Question: Find the answer to the questions below Consider two stocks for two companies ABC and XYZ companies. The relevant data for each ABC XYZ 467

Find the answer to the questions below

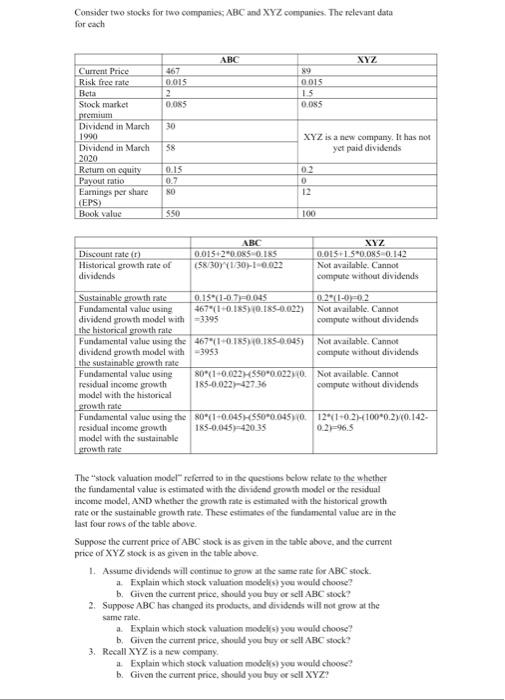

Find the answer to the questions belowConsider two stocks for two companies ABC and XYZ companies. The relevant data for each ABC XYZ 467 0.015 2 0.085 9 0015 1.5 0.085 30 Current Price Risk free rate Beta Stock market premium Dividend in March 1990 Dividend in March 2020 Return on equity Payout ratio Earnings per share (EPS) Book value XYZ is a new company. It has not yet paid dividends 0.13 0.7 NO 02 0 12 550 100 Discount rated) Historical growth rate of dividends ABC 0.015420.085 0.185 (58/3071:30-1-0.022 XYZ 0.015*1.5*0.085-0.142 Not available. Cannot compute without dividends Sustainable growth rate 0.15*(1-0.7=0.045 0.21-002 Fundamental value using 467"10.185) 10.185-0.022) Not available. Cannot dividend growth model with =3395 compute without dividends the historical growth rate Fundamental value using the 467"140.185)(0.385-0.045) Not available. Cannot dividend growth model with =3953 compute without dividends the sustainable growth rate Fundamental value using 801-0.002550'00022NO. Not available. Cannot residual income growth 185-0.0222736 compute without dividends model with the historical growth rate Fundamental value using the 80(1-0,045 550*0.04570121-0.2H-100*0.27(0.142- residual income growth 185-0,045-420.35 0.2=96.5 model with the sustainable growth rate The "stock valuation model referred to in the questions below relate to the whether the fundamental value is estimated with the dividend growth model or the residual income model, AND whether the growth rate is estimated with the historical growth rate or the sustainable growth rate. These estimates of the fundamental value are in the last four rows of the table above. Suppose the current price of ABC stock is as given in the table above, and the current price of XYZ stock is as given in the table above 1. Assume dividends will continue to grow at the same rate for ABC stock a. Explain which stock valuation modelis) you would choose? b. Given the current price should you buy or sell ABC stock? 2. Suppose ABC has changed its products, and dividends will not grow at the same rate a Explain which stock valuation models) you would choose? b. Given the current price, should you bey or sell ABC stock 3. Recall XYZ is a new company a Explain which stock valuation models) you would choose? b. Given the current price, should you buy or sell XYZ! Consider two stocks for two companies ABC and XYZ companies. The relevant data for each ABC XYZ 467 0.015 2 0.085 9 0015 1.5 0.085 30 Current Price Risk free rate Beta Stock market premium Dividend in March 1990 Dividend in March 2020 Return on equity Payout ratio Earnings per share (EPS) Book value XYZ is a new company. It has not yet paid dividends 0.13 0.7 NO 02 0 12 550 100 Discount rated) Historical growth rate of dividends ABC 0.015420.085 0.185 (58/3071:30-1-0.022 XYZ 0.015*1.5*0.085-0.142 Not available. Cannot compute without dividends Sustainable growth rate 0.15*(1-0.7=0.045 0.21-002 Fundamental value using 467"10.185) 10.185-0.022) Not available. Cannot dividend growth model with =3395 compute without dividends the historical growth rate Fundamental value using the 467"140.185)(0.385-0.045) Not available. Cannot dividend growth model with =3953 compute without dividends the sustainable growth rate Fundamental value using 801-0.002550'00022NO. Not available. Cannot residual income growth 185-0.0222736 compute without dividends model with the historical growth rate Fundamental value using the 80(1-0,045 550*0.04570121-0.2H-100*0.27(0.142- residual income growth 185-0,045-420.35 0.2=96.5 model with the sustainable growth rate The "stock valuation model referred to in the questions below relate to the whether the fundamental value is estimated with the dividend growth model or the residual income model, AND whether the growth rate is estimated with the historical growth rate or the sustainable growth rate. These estimates of the fundamental value are in the last four rows of the table above. Suppose the current price of ABC stock is as given in the table above, and the current price of XYZ stock is as given in the table above 1. Assume dividends will continue to grow at the same rate for ABC stock a. Explain which stock valuation modelis) you would choose? b. Given the current price should you buy or sell ABC stock? 2. Suppose ABC has changed its products, and dividends will not grow at the same rate a Explain which stock valuation models) you would choose? b. Given the current price, should you bey or sell ABC stock 3. Recall XYZ is a new company a Explain which stock valuation models) you would choose? b. Given the current price, should you buy or sell XYZ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts