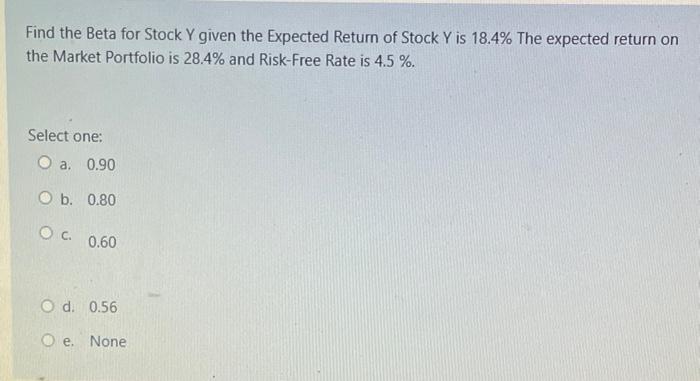

Question: Find the Beta for Stock Y given the Expected Return of Stock Y is 18.4% The expected return on the Market Portfolio is 28.4% and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock