Question: Find the comparative income statement. Profitability Measures Match each computation to one of the profitability measures in the table. Profitability Measures Asset turnover Return on

Find the comparative income statement.

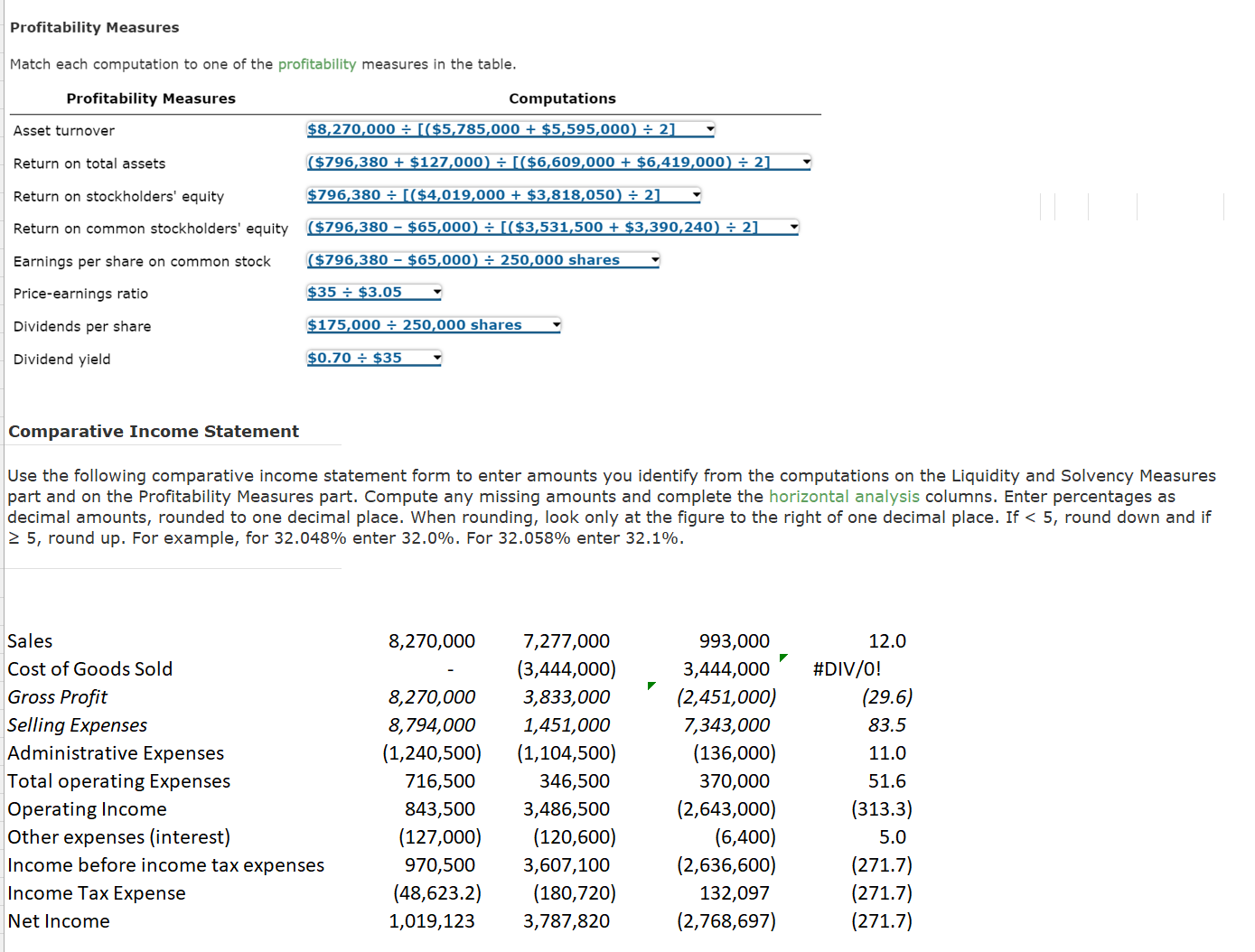

Profitability Measures Match each computation to one of the profitability measures in the table. Profitability Measures Asset turnover Return on total assets Return on stockholders' equity Return on common stockholders' equity Earnings per share on common stock Price-earnings ratio Dividends per share Dividend yield Computations $8,270,000 [($5,785,000 + $5,595,000) 2] ($796,380 + $127,000) [($6,609,000 + $6,419,000) 2] $796,380 [($4,019,000 + $3,818,050) 2] ($796,380 $65,000) [($3,531,500 + $3,390,240) 2] ($796,380 $65,000) 250,000 shares $35 $3.05 $175,000 250,000 shares $0.70 + $35 Comparative Income Statement Use the following comparative income statement form to enter amounts you identify from the computations on the Liquidity and Solvency Measures part and on the Profitability Measures part. Compute any missing amounts and complete the horizontal analysis columns. Enter percentages as decimal amounts, rounded to one decimal place. When rounding, look only at the figure to the right of one decimal place. If < 5, round down and if 5, round up. For example, for 32.048% enter 32.0%. For 32.058% enter 32.1%. Sales 8,270,000 Cost of Goods Sold Gross Profit 8,270,000 7,277,000 (3,444,000) 3,833,000 993,000 3,444,000 (2,451,000) 12.0 #DIV/O! (29.6) Selling Expenses 8,794,000 1,451,000 7,343,000 83.5 Administrative Expenses (1,240,500) (1,104,500) (136,000) 11.0 Total operating Expenses 716,500 346,500 370,000 51.6 Operating Income 843,500 3,486,500 (2,643,000) (313.3) Other expenses (interest) (127,000) (120,600) (6,400) 5.0 Income before income tax expenses 970,500 3,607,100 (2,636,600) (271.7) Income Tax Expense (48,623.2) (180,720) 132,097 (271.7) Net Income 1,019,123 3,787,820 (2,768,697) (271.7)

Step by Step Solution

There are 3 Steps involved in it

Answer Answer Lets match each computation to the corresponding profitability measure Return on total assets Computation 8270000 5785000 5595000 2 Resu... View full answer

Get step-by-step solutions from verified subject matter experts