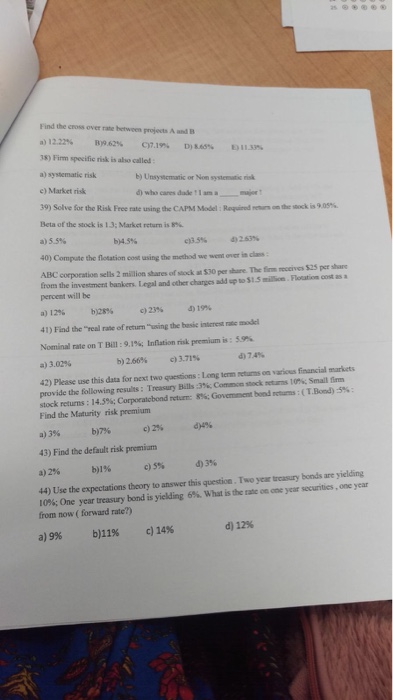

Question: Find the cross over rate between projects A and B 38) Firm specific risk is also called a) sysiematic risk e) Market ristk 39) Solve

Find the cross over rate between projects A and B 38) Firm specific risk is also called a) sysiematic risk e) Market ristk 39) Solve for the Risk Free rate uning the CAPM Model :Reqaied nehurs on the ssock is 9.05% Beta ofthe stock is 1.3; Market return is 8%. a)55% b) Unsystematic or Non systemutic risk d) who cares dade 1 1 am a b)4.5 40) Compute the flotation cost using the method we sent over is clas ABC corporation sells 2 million shares of sock at $30 per share. The fim eceives $25 per share from the investment bankers. Legal and other charges add up to $1 5 million Flosation cost as percent will be a)12% b)28% c)23% dio% 41) Find the "real rate of return "using the hesic interest rate mmodel Nominal rate on T Bill : 9.1%; Inflation risk premium is : 59% a) 3.02% b)2.66% c) 3.71% d) 74% 42) Please use this data for next two qaestions: Long term returns on various financial markets provide the following results : Treasury Bills :3%; Catssnstock setns lon, small firm stock returns : 14.5%; Corporatebond returm: 8%; Goverment bond mm : (TBend) SS: Find the Maturity risk premium a)3% b)7% c)2% 43) Find the default risk premium d)4% a) 2% b)196 c)5% d)3% 44) Use the expectations theory to answer this question. Two yer treasury bonds are yielding 10%; One year treasury bond is yielding 6% what is rate on one year securities, one year from now ( forward rate?) a)9% b)11% c)14% d) 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts