Question: Find the expected rate of return and return standard deviation for the portfolio with 50% HT and 50% in Coll. Assume a two-stock portfolio is

Find the expected rate of return and return standard deviation for the portfolio with 50% HT and 50% in Coll.

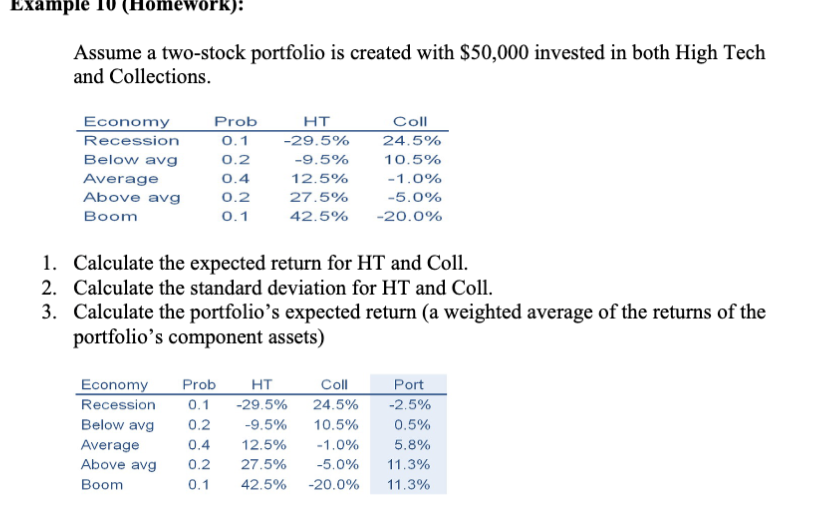

Assume a two-stock portfolio is created with $50,000 invested in both High Tech and Collections. 1. Calculate the expected return for HT and Coll. 2. Calculate the standard deviation for HT and Coll. 3. Calculate the portfolio's expected return (a weighted average of the returns of the portfolio's component assets)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts