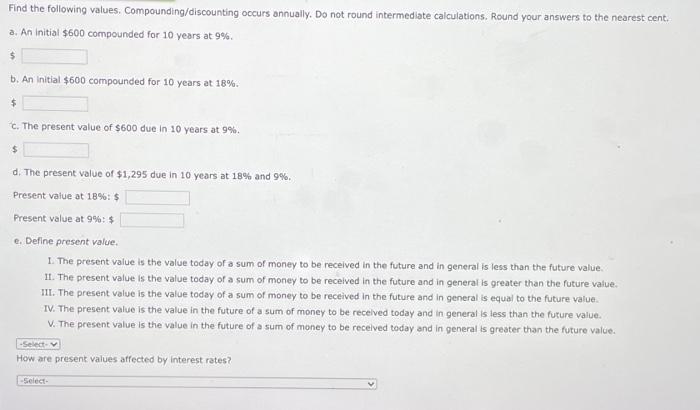

Question: Find the following values. Compounding/discounting occurs annually. Do not round intermediate calculations. Round your answers to the nearest cent. a. An initial $600 compounded for

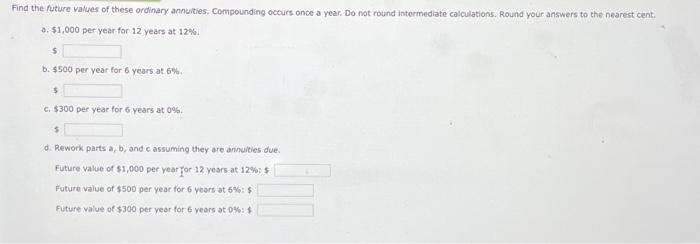

Find the following values. Compounding/discounting occurs annually. Do not round intermediate calculations. Round your answers to the nearest cent. a. An initial $600 compounded for 10 years at 9% $ b. An initial $600 compounded for 10 years at 18% $ c. The present value of $600 due in 10 years at 9% $ d. The present value of $1,295 due in 10 years at 18% and 9%. Present value at 18%: $ Present value at 9%:$ e. Define present value. I. The present value is the value today of a sum of money to be received in the future and in general is less than the future value II. The present value is the value today of a sum of money to be received in the future and in general is greater than the future value. III. The present value is the value today of a sum of money to be received in the future and in general is equal to the future value IV. The present value is the value in the future of a sum of money to be received today and in general is less than the future value. V. The present value is the value in the future of a sum of money to be received today and in general is greater than the future value. -Select- How are present values affected by interest rates? -Select Find the future values of these ordinary annuities. Compounding occurs once a year. Do not round Intermediate calculations. Round your answers to the nearest cent. 2. $1,000 per year for 12 years at 12% $ b. $500 per year for 6 years at 6% $ C. $300 per year for 6 years at 0%. 5 d. Rework parts a, b, and c assuming they are annuities dues Future value of $1,000 per year for 12 years at 12%:$ Future value of $500 per year for 6 years at 6%:$ Future value of $300 per year for 6 years at 0%:$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts