Question: Find the present value (one period before the first payment) of an annuity-immediate that lasts five years and pays $2,000 at the end of each

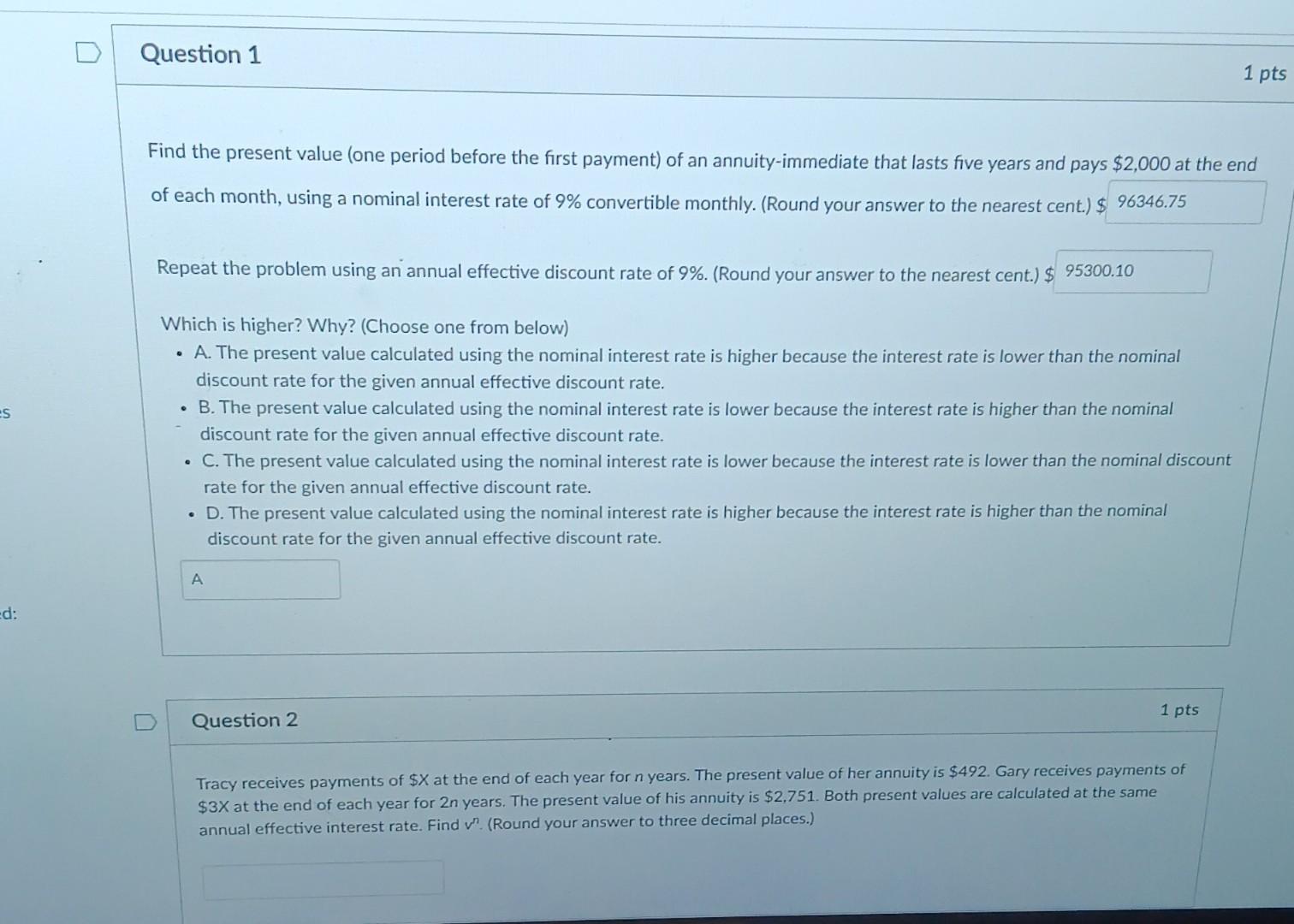

Find the present value (one period before the first payment) of an annuity-immediate that lasts five years and pays $2,000 at the end of each month, using a nominal interest rate of 9% convertible monthly. (Round your answer to the nearest cent.) $ Repeat the problem using an annual effective discount rate of 9%. (Round your answer to the nearest cent.) $ Which is higher? Why? (Choose one from below) - A. The present value calculated using the nominal interest rate is higher because the interest rate is lower than the nominal discount rate for the given annual effective discount rate. - B. The present value calculated using the nominal interest rate is lower because the interest rate is higher than the nominal discount rate for the given annual effective discount rate. - C. The present value calculated using the nominal interest rate is lower because the interest rate is lower than the nominal discount rate for the given annual effective discount rate. - D. The present value calculated using the nominal interest rate is higher because the interest rate is higher than the nominal discount rate for the given annual effective discount rate. Question 2 1 pts Tracy receives payments of $X at the end of each year for n years. The present value of her annuity is $492. Gary receives payments of $3X at the end of each year for 2n years. The present value of his annuity is $2,751. Both present values are calculated at the same annual effective interest rate. Find vn. (Round your answer to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts