Question: Find the result and please explain step by step how to find depreciation mt cx '(llll|1|(|GE|G|G'lGi GllGllGllallsllellellelle' G'lMllallQllNewl llNelell + ( 9 C' i eztolmheducation.com/ext/map/index.html?_con=con&externa|_browser=0&launchUr|=https%253A%252F%252Fmdc.blackboard.com%252F..4

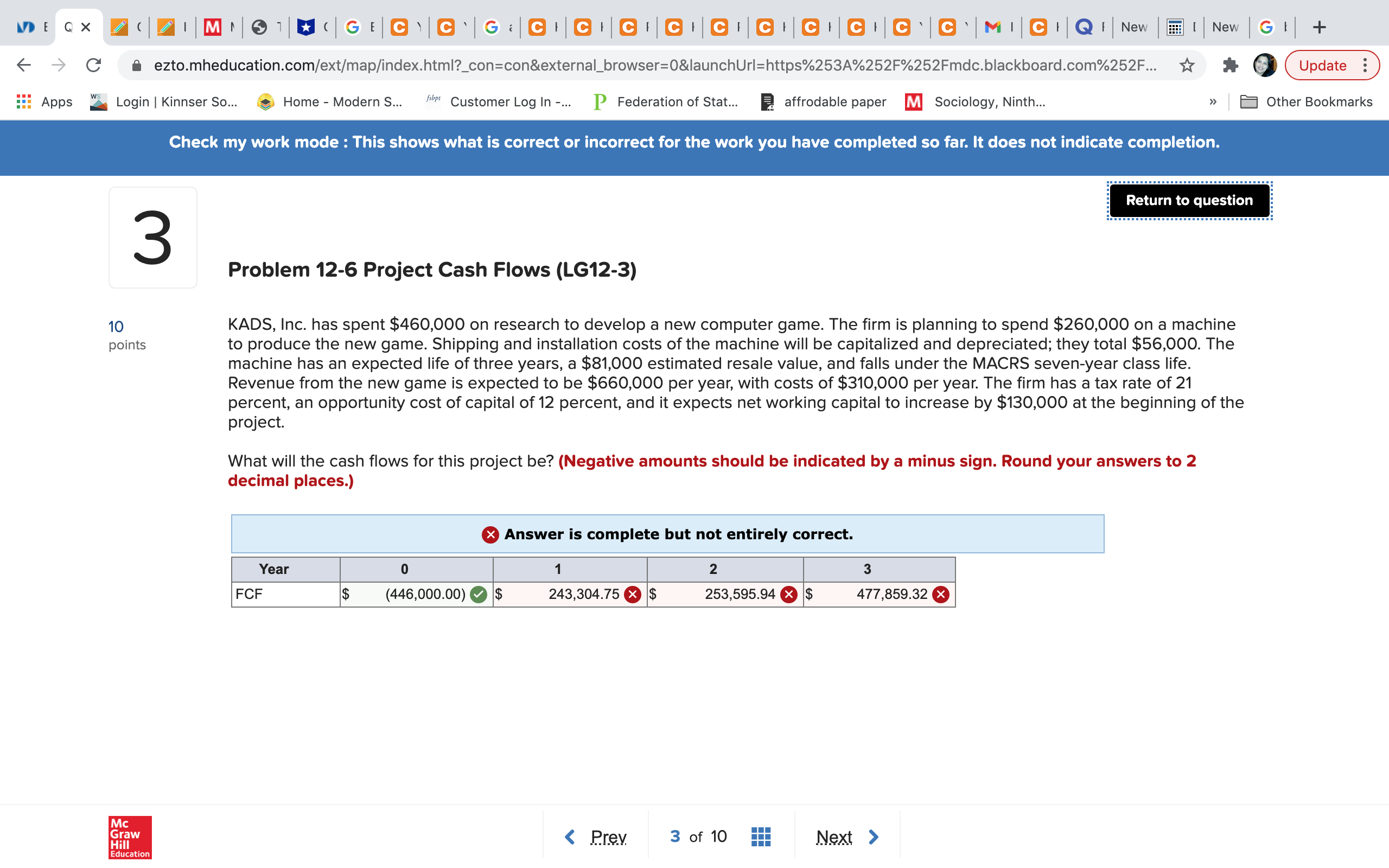

Find the result and please explain step by step how to find depreciation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock