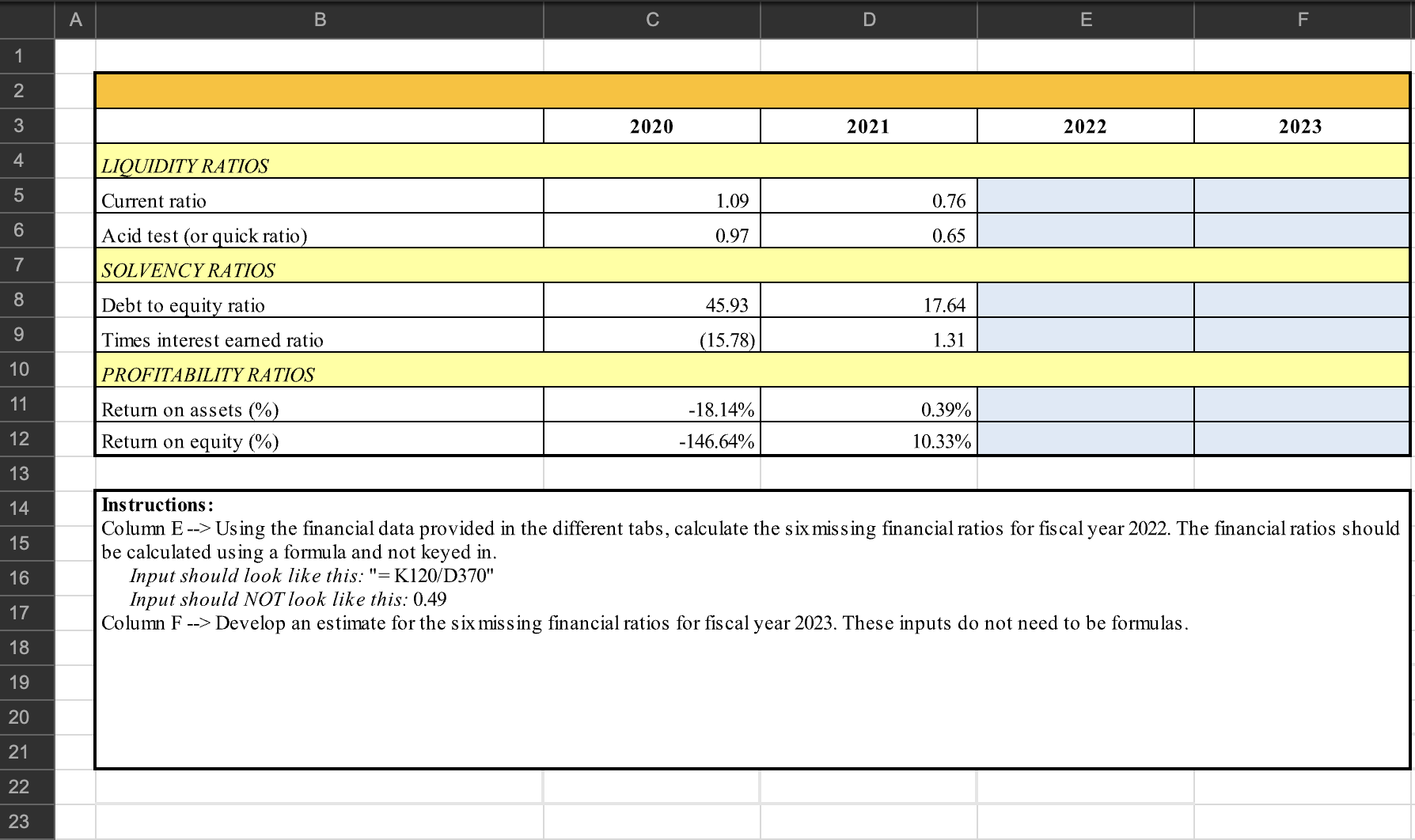

Question: Find the Solvency Ratios using the instructions below and the data. Please show all steps and work. Column E --> Using the financial data provided

Find the Solvency Ratios using the instructions below and the data. Please show all steps and work.

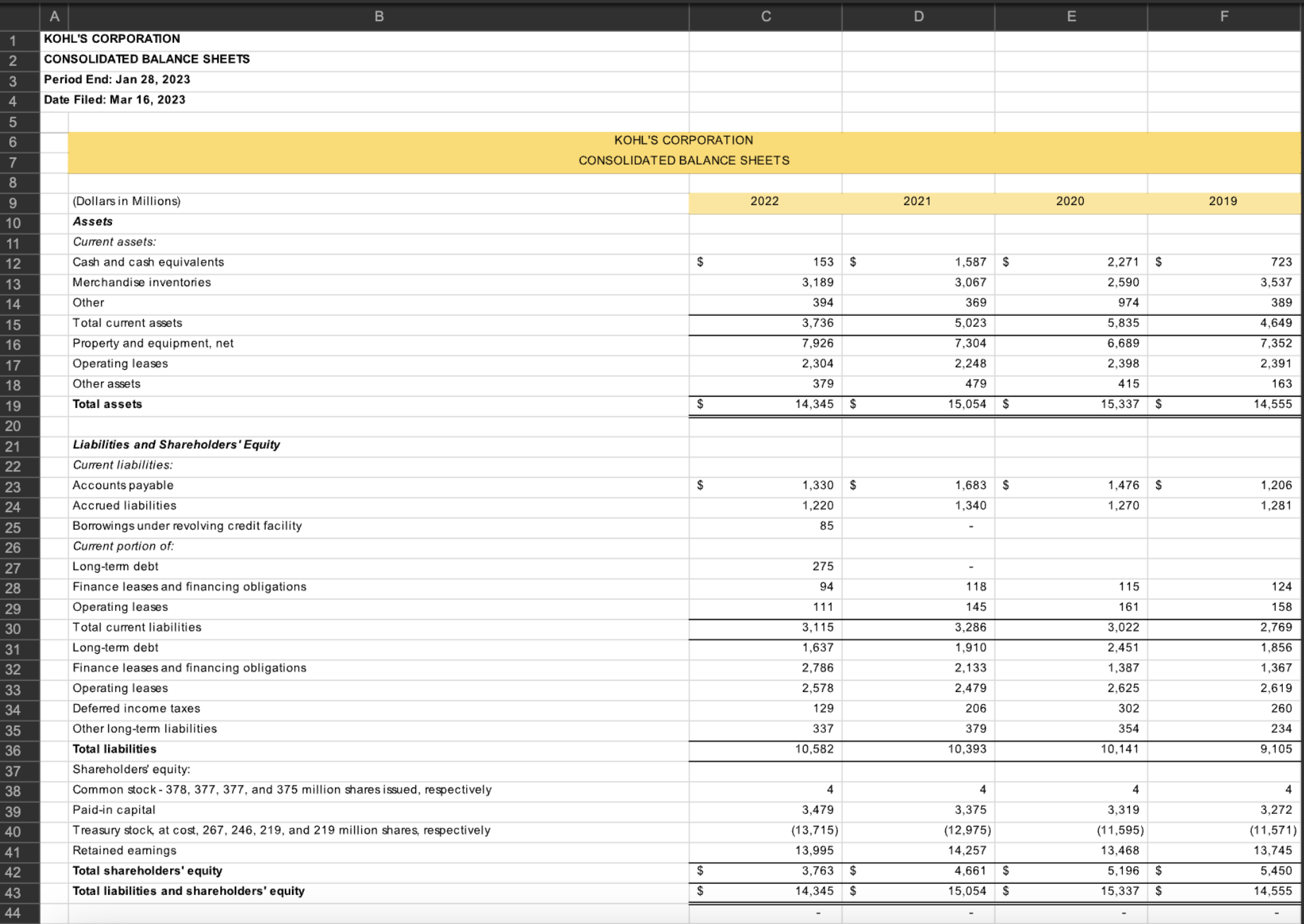

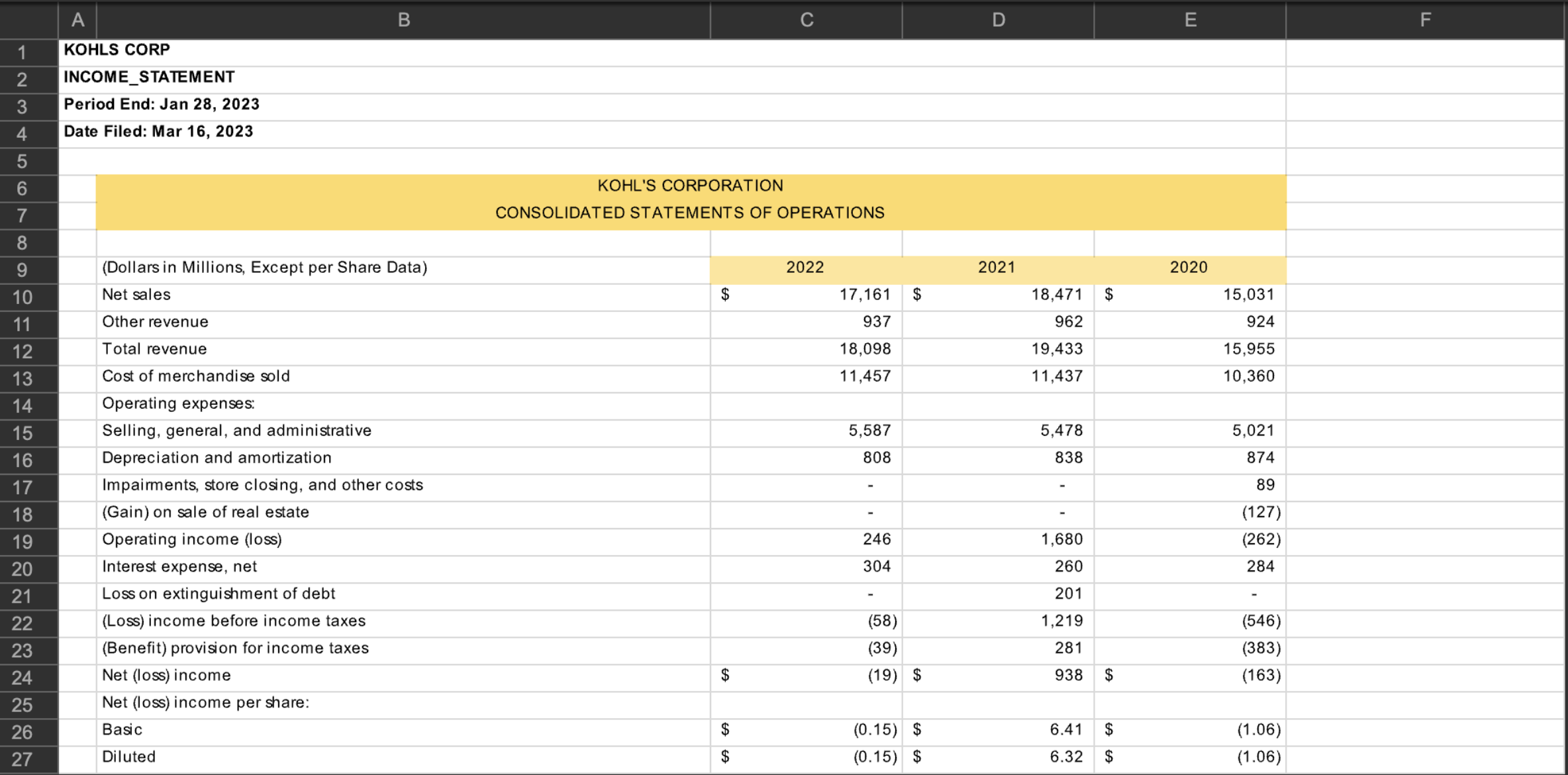

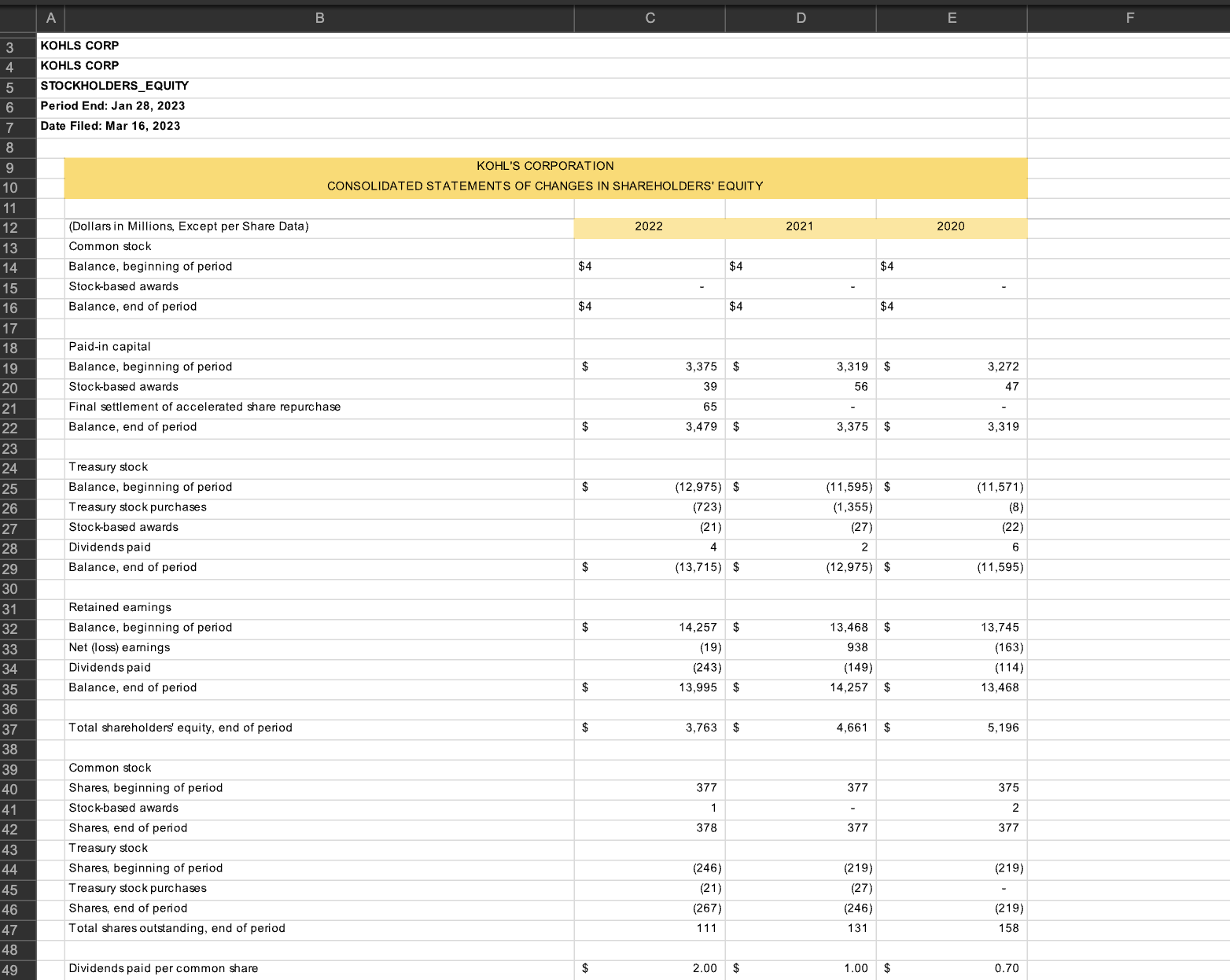

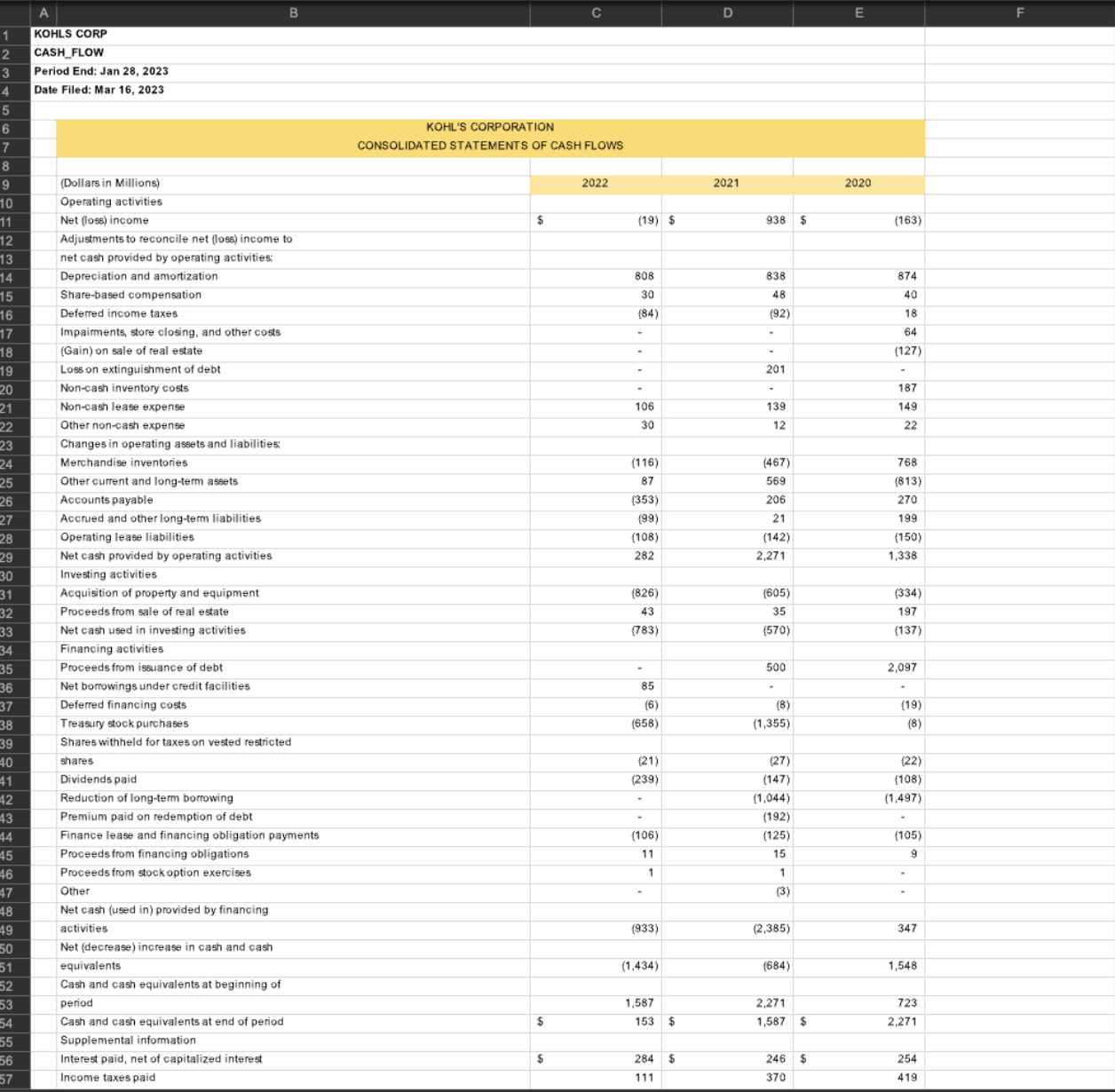

Column E --> Using the financial data provided in the different tabs, calculate the six missing financial ratios for fiscal year 2022 . The financial ratios should be calculated using a formula and not keyed in. Input should look like this: "= K120/D370" Input should NOT look like this: 0.49 Column F --> Develop an estimate for the six missing financial ratios for fiscal year 2023. These inputs do not need to be formulas. A B C D E F KOHL'S CORPORATION CONSOLIDATED BALANCE SHEETS Period End: Jan 28, 2023 Date Filed: Mar 16, 2023 KOHL'S CORPORATION CONSOLIDATED BALANCE SHEETS (Dollars in Millions) Assets Current assets: Cash and cash equivalents Merchandise inventories Other Total current assets Property and equipment, net Operating leases Other assets Total assets Liabilities and Shareholders 'Equity Current liabilities: Accounts payable Accrued liabilities Borrowings under revolving credit facility Current portion of: Long-term debt Finance leases and financing obligations Operating leases Total current liabilities Long-term debt Finance leases and financing obligations Operating leases Deferred income taxes Other long-term liabilities Total liabilities Shareholders' equity: Common stock - 378,377,377, and 375 million shares issued, respectively Paid-in capital Treasury stock, at cost, 267, 246, 219, and 219 million shares, respectively Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2022 2021 \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline$ & 153 & $ & 1,587 & $ & 2,271 & $ & 723 \\ \hline & 3,189 & & 3,067 & & 2,590 & & 3,537 \\ \hline & 394 & & 369 & & 974 & & 389 \\ \hline & 3,736 & & 5,023 & & 5,835 & & 4,649 \\ \hline & 7,926 & & 7,304 & & 6,689 & & 7,352 \\ \hline & 2,304 & & 2,248 & & 2,398 & & 2,391 \\ \hline & 379 & & 479 & & 415 & & 163 \\ \hline$ & 14,345 & $ & 15,054 & $ & 15,337 & $ & 14,555 \\ \hline \end{tabular} A B C D F KOHLS CORP INCOME_STATEMENT Period End: Jan 28, 2023 Date Filed: Mar 16, 2023 KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in Millions, Except per Share Data) Net sales Other revenue Total revenue Cost of merchandise sold Operating expenses: Selling, general, and administrative Depreciation and amortization Impairments, store closing, and other costs (Gain) on sale of real estate Operating income (loss) Interest expense, net Loss on extinguishment of debt (Loss) income before income taxes (Benefit) provision for income taxes Net (loss) income Net (loss) income per share: Basic Diluted 2022 $ $ 17,161 937 18,098 11,457 5,587 808 246 304 (58) (39) $ $ $ 2021 $ (19) $ (0.15) (0.15)$ 2020 18,471 $ 962 19,433 11,437 5,478 838 5,021 874 89 (127) (262) 284 (546) (383) (163) (1.06) (1.06) A B C D E F KOHLS CORP KOHLS CORP STOCKHOLDERS_EQUITY Period End: Jan 28, 2023 Date Filed: Mar 16, 2023 KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (Dollars in Millions, Except per Share Data) Common stock Balance, beginning of period Stock-based awards Balance, end of period Paid-in capital Balance, beginning of period Stock-based awards Final settlement of accelerated share repurchase Balance, end of period Treasury stock Balance, beginning of period Treasury stock purchases Stock-based awards Dividends paid Balance, end of period Retained earnings Balance, beginning of period Net (loss) earnings Dividends paid Balance, end of period Total shareholders' equity, end of period Common stock Shares, beginning of period Stock-based awards Shares, end of period Treasury stock Shares, beginning of period Treasury stock purchases Shares, end of period Total shares outstanding, end of period Dividends paid per common share 2022 2021 $4 $4 $ $ $ (12,975) (723) (21) $4 $4 $ 39 65 3,479 $ $ 4 $ $ $ $ (13,715)$ 14,257 $ (19) (243) 13,995 $ 3,763 $ 377 1 378 378 (246) (21) (267) 111 $ 2.00 (11,595)$ (1,355) (27) (12,975)$ 13,468$ 938 (149) 14,257$ 4,661$ 377 377 (219) (27) (246) 131 $ 2020 $4 $4 $ 3,272 47 3,319 (11,571) (8) (22) 6 (11,595) 13,745 (163) (114) 13,468 5,196 375 2 377 (219) (219) 158 158 1.00 1.00 $ 0.70 A B C D E F KOHLS CORP CASH_FLOW Period End: Jan 28, 2023 Date Filed: Mar 16, 2023 KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF CASHFLOWS (Dollars in Millions) 2022 2021 2020 Operating activities Net (loss) income $ (19) $ 938 $ (163) Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization Share-based compensation Deferred income taxes Impairments, store closing, and other costs (Gain) on sale of real estate Loss on extinguishment of debt Non-cash inventory costs Non-cash lease expense Other non-cash expense Changes in operating assets and liabilities: Merchandise inventories Other current and long-term assets Accounts payable Accrued and other long-term liabilities Operating lease liabilities Net cash provided by operating activities Investing activities Acquisition of property and equipment Proceeds from sale of real estate Net cash used in investing activities Financing activities Proceeds from iseuance of debt Net borrowings under credit facilities Deferred financing costs Treasury stock purchases Shares withheld for taxes on vested restricted shares Dividends paid Reduction of long-term borrowing Premium paid on redemption of debt Finance lease and financing obligation payments Proceeds from financing obligations Proceeds from stock option exercises Other Net cash (used in) provided by financing activities Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental information Interest paid, net of capitalized interest Income taxes paid Income taxes paid 808 30 (84) \begin{tabular}{l} - \\ - \\ - \\ - \\ 106 \\ 30 \\ \hline(116) \\ 87 \end{tabular} (353) (99) (108) 282 (826) 43 (783) 85 (6) (658) (21) (239) - (106) 11 1 + (933) (1,434) 1,587 $ 153 $ $ 284 111 838 48 (92) 201 139 12 (467) 569 206 21 (142) 2,271 (605) 35 (570) 500 (8) (1,355) (27) (147) (1,044) (192) (125) 15 1 (3) (2,385) (684) 2,271 1,587 1,587$ 246 370 874 40 18 64 (127) 187 149 22 768 (813) 270 199 (150) 1,338 (334) 197 (137) 2,097 (19) (8) (22) (108) (1,497) (105) 9 347 1,548 723 2,271 2,271 $ 254 419 419 Column E --> Using the financial data provided in the different tabs, calculate the six missing financial ratios for fiscal year 2022 . The financial ratios should be calculated using a formula and not keyed in. Input should look like this: "= K120/D370" Input should NOT look like this: 0.49 Column F --> Develop an estimate for the six missing financial ratios for fiscal year 2023. These inputs do not need to be formulas. A B C D E F KOHL'S CORPORATION CONSOLIDATED BALANCE SHEETS Period End: Jan 28, 2023 Date Filed: Mar 16, 2023 KOHL'S CORPORATION CONSOLIDATED BALANCE SHEETS (Dollars in Millions) Assets Current assets: Cash and cash equivalents Merchandise inventories Other Total current assets Property and equipment, net Operating leases Other assets Total assets Liabilities and Shareholders 'Equity Current liabilities: Accounts payable Accrued liabilities Borrowings under revolving credit facility Current portion of: Long-term debt Finance leases and financing obligations Operating leases Total current liabilities Long-term debt Finance leases and financing obligations Operating leases Deferred income taxes Other long-term liabilities Total liabilities Shareholders' equity: Common stock - 378,377,377, and 375 million shares issued, respectively Paid-in capital Treasury stock, at cost, 267, 246, 219, and 219 million shares, respectively Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2022 2021 \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline$ & 153 & $ & 1,587 & $ & 2,271 & $ & 723 \\ \hline & 3,189 & & 3,067 & & 2,590 & & 3,537 \\ \hline & 394 & & 369 & & 974 & & 389 \\ \hline & 3,736 & & 5,023 & & 5,835 & & 4,649 \\ \hline & 7,926 & & 7,304 & & 6,689 & & 7,352 \\ \hline & 2,304 & & 2,248 & & 2,398 & & 2,391 \\ \hline & 379 & & 479 & & 415 & & 163 \\ \hline$ & 14,345 & $ & 15,054 & $ & 15,337 & $ & 14,555 \\ \hline \end{tabular} A B C D F KOHLS CORP INCOME_STATEMENT Period End: Jan 28, 2023 Date Filed: Mar 16, 2023 KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in Millions, Except per Share Data) Net sales Other revenue Total revenue Cost of merchandise sold Operating expenses: Selling, general, and administrative Depreciation and amortization Impairments, store closing, and other costs (Gain) on sale of real estate Operating income (loss) Interest expense, net Loss on extinguishment of debt (Loss) income before income taxes (Benefit) provision for income taxes Net (loss) income Net (loss) income per share: Basic Diluted 2022 $ $ 17,161 937 18,098 11,457 5,587 808 246 304 (58) (39) $ $ $ 2021 $ (19) $ (0.15) (0.15)$ 2020 18,471 $ 962 19,433 11,437 5,478 838 5,021 874 89 (127) (262) 284 (546) (383) (163) (1.06) (1.06) A B C D E F KOHLS CORP KOHLS CORP STOCKHOLDERS_EQUITY Period End: Jan 28, 2023 Date Filed: Mar 16, 2023 KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (Dollars in Millions, Except per Share Data) Common stock Balance, beginning of period Stock-based awards Balance, end of period Paid-in capital Balance, beginning of period Stock-based awards Final settlement of accelerated share repurchase Balance, end of period Treasury stock Balance, beginning of period Treasury stock purchases Stock-based awards Dividends paid Balance, end of period Retained earnings Balance, beginning of period Net (loss) earnings Dividends paid Balance, end of period Total shareholders' equity, end of period Common stock Shares, beginning of period Stock-based awards Shares, end of period Treasury stock Shares, beginning of period Treasury stock purchases Shares, end of period Total shares outstanding, end of period Dividends paid per common share 2022 2021 $4 $4 $ $ $ (12,975) (723) (21) $4 $4 $ 39 65 3,479 $ $ 4 $ $ $ $ (13,715)$ 14,257 $ (19) (243) 13,995 $ 3,763 $ 377 1 378 378 (246) (21) (267) 111 $ 2.00 (11,595)$ (1,355) (27) (12,975)$ 13,468$ 938 (149) 14,257$ 4,661$ 377 377 (219) (27) (246) 131 $ 2020 $4 $4 $ 3,272 47 3,319 (11,571) (8) (22) 6 (11,595) 13,745 (163) (114) 13,468 5,196 375 2 377 (219) (219) 158 158 1.00 1.00 $ 0.70 A B C D E F KOHLS CORP CASH_FLOW Period End: Jan 28, 2023 Date Filed: Mar 16, 2023 KOHL'S CORPORATION CONSOLIDATED STATEMENTS OF CASHFLOWS (Dollars in Millions) 2022 2021 2020 Operating activities Net (loss) income $ (19) $ 938 $ (163) Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization Share-based compensation Deferred income taxes Impairments, store closing, and other costs (Gain) on sale of real estate Loss on extinguishment of debt Non-cash inventory costs Non-cash lease expense Other non-cash expense Changes in operating assets and liabilities: Merchandise inventories Other current and long-term assets Accounts payable Accrued and other long-term liabilities Operating lease liabilities Net cash provided by operating activities Investing activities Acquisition of property and equipment Proceeds from sale of real estate Net cash used in investing activities Financing activities Proceeds from iseuance of debt Net borrowings under credit facilities Deferred financing costs Treasury stock purchases Shares withheld for taxes on vested restricted shares Dividends paid Reduction of long-term borrowing Premium paid on redemption of debt Finance lease and financing obligation payments Proceeds from financing obligations Proceeds from stock option exercises Other Net cash (used in) provided by financing activities Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental information Interest paid, net of capitalized interest Income taxes paid Income taxes paid 808 30 (84) \begin{tabular}{l} - \\ - \\ - \\ - \\ 106 \\ 30 \\ \hline(116) \\ 87 \end{tabular} (353) (99) (108) 282 (826) 43 (783) 85 (6) (658) (21) (239) - (106) 11 1 + (933) (1,434) 1,587 $ 153 $ $ 284 111 838 48 (92) 201 139 12 (467) 569 206 21 (142) 2,271 (605) 35 (570) 500 (8) (1,355) (27) (147) (1,044) (192) (125) 15 1 (3) (2,385) (684) 2,271 1,587 1,587$ 246 370 874 40 18 64 (127) 187 149 22 768 (813) 270 199 (150) 1,338 (334) 197 (137) 2,097 (19) (8) (22) (108) (1,497) (105) 9 347 1,548 723 2,271 2,271 $ 254 419 419

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts