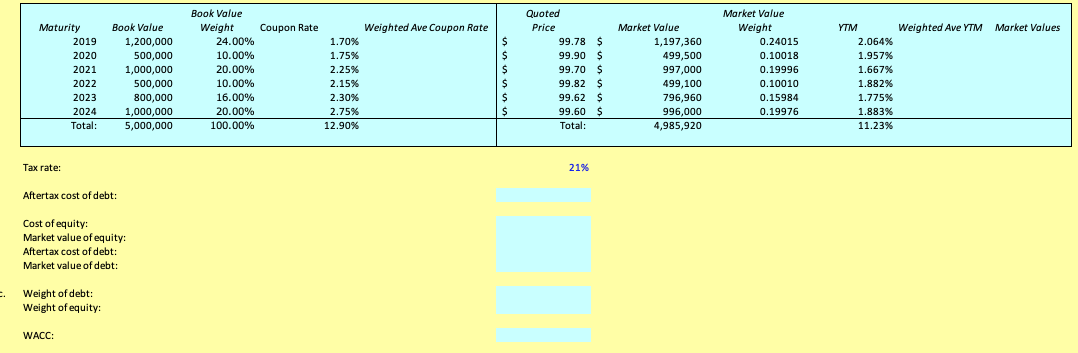

Question: Find the weighted average for the missing data in the table, then fill in the rest of the data. Please explain how to get weighted

Find the weighted average for the missing data in the table, then fill in the rest of the data.

Please explain how to get weighted average.

Coupon Rate Weighted Ave Coupon Rate YTM Weighted Ave YTM Market Values Maturity 2019 2020 2021 2022 2023 2024 Total: Book Value 1,200,000 500,000 1,000,000 500,000 800,000 1,000,000 5,000,000 Book Value Weight 24.00% 10.00% 20.00% 10.00% 16.00% 20.00% 100.00% 1.70% 1.75% 2.25% 2.15% 2.30% 2.75% 12.90% Quoted Price 99.78 $ 99.90 $ 99.70 $ 99.82 $ 99.62 $ 99.60 $ Total: Market Value 1,197,360 499,500 997,000 499, 100 796,960 996,000 4,985,920 Market Value Weight 0.24015 0.10018 0.19996 0.10010 0.15984 0.19976 2.064% 1.957% 1.667% 1.882% 1.775% 1.883% 11.23% Tax rate: 219 Aftertax cost of debt: Cost of equity: Market value of equity: Aftertax cost of debt: Market value of debt: Weight of debt: Weight of equity: WACC: Coupon Rate Weighted Ave Coupon Rate YTM Weighted Ave YTM Market Values Maturity 2019 2020 2021 2022 2023 2024 Total: Book Value 1,200,000 500,000 1,000,000 500,000 800,000 1,000,000 5,000,000 Book Value Weight 24.00% 10.00% 20.00% 10.00% 16.00% 20.00% 100.00% 1.70% 1.75% 2.25% 2.15% 2.30% 2.75% 12.90% Quoted Price 99.78 $ 99.90 $ 99.70 $ 99.82 $ 99.62 $ 99.60 $ Total: Market Value 1,197,360 499,500 997,000 499, 100 796,960 996,000 4,985,920 Market Value Weight 0.24015 0.10018 0.19996 0.10010 0.15984 0.19976 2.064% 1.957% 1.667% 1.882% 1.775% 1.883% 11.23% Tax rate: 219 Aftertax cost of debt: Cost of equity: Market value of equity: Aftertax cost of debt: Market value of debt: Weight of debt: Weight of equity: WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts