Question: Finding a present value is the reverse of finding a future value. is the process of calculating the present value of a cash flow or

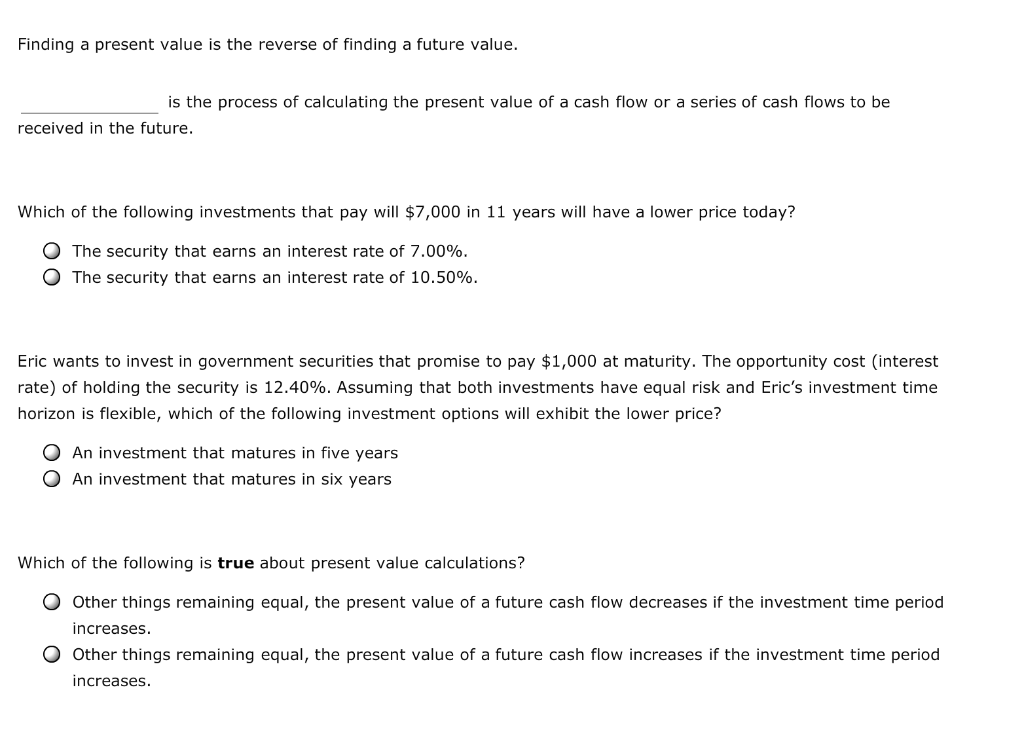

Finding a present value is the reverse of finding a future value. is the process of calculating the present value of a cash flow or a series of cash flows to be received in the future. Which of the following investments that pay will $7,000 in 11 years will have a lower price today? O The security that earns an interest rate of 7.00%. The security that earns an interest rate of 10.50%. Eric wants to invest in government securities that promise to pay $1,000 at maturity. The opportunity cost (interest rate) of holding the security is 12.40%. Assuming that both investments have equal risk and Eric's investment time horizon is flexible, which of the following investment options will exhibit the lower price? O An investment that matures in five years O An investment that matures in six years Which of the following is true about present value calculations? Other things remaining equal, the present value of a future cash flow decreases if the investment time period increases Other things remaining equal, the present value of a future cash flow increases if the investment time period increases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts