Question: finding initial cash flow and payback period etc (Click on the icon here in order to copy the contents of the data table below into

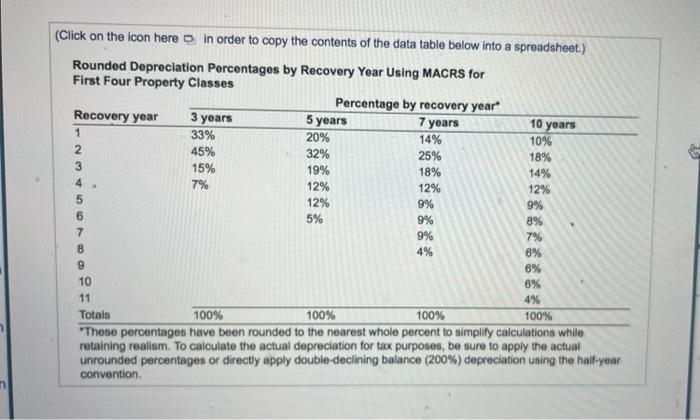

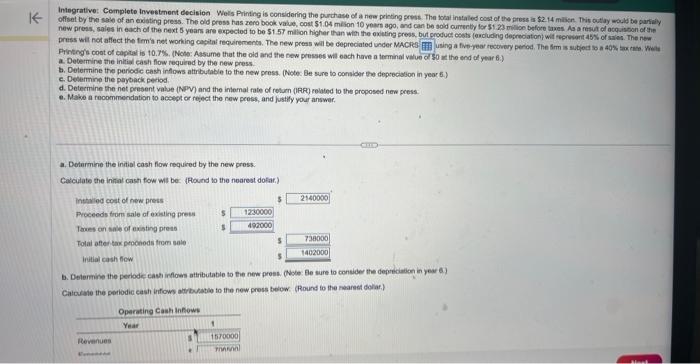

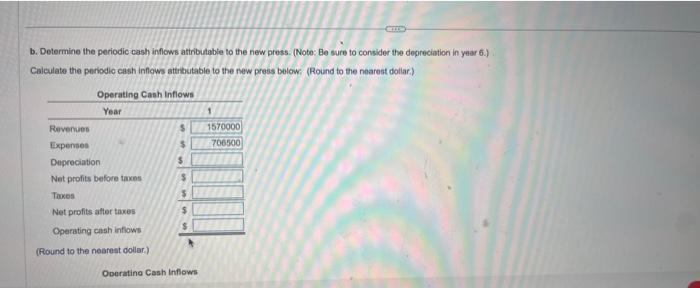

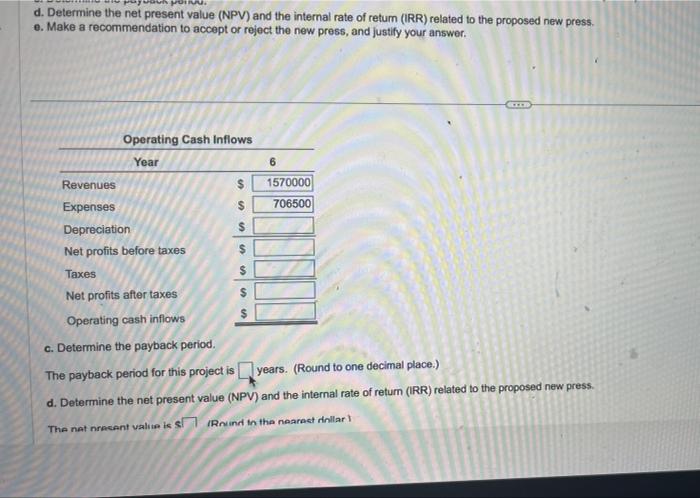

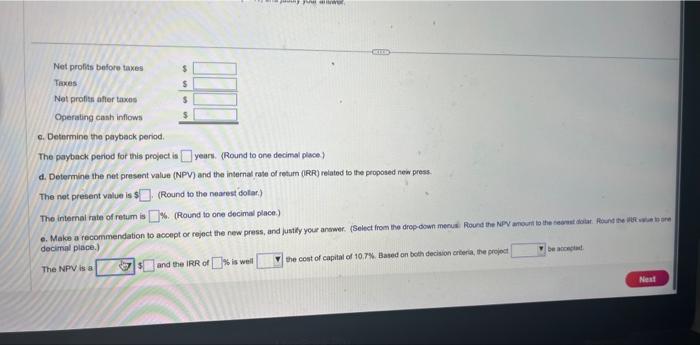

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes retaining realism. To caiculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200\%) depreciation using the haif-year convention. Integrative: Cemplete lovestment decision Weis Printng is considering the purchase of a nee printing grvis. The total instaled oost of twe press a s $2.14 misen. Dris outay mould te partily Printerg's coat of captai is 10.7\%. (Note: Assume that the old and the new presses wit oach have a terminal value of 50 at the and of year 6 ) a. Debermine the initid cash flow requeded by the new press: b. Delermine the periode cash inflows atrhbutable te the new press. (Note Be sure to consider the deptecision in yeor 5 .) c. Deternine the payback petiod. d. Determine the net present value (NPV) and the inlemal rate of retum (URF) rolated to the proposed new press. e. Make a reoommendation to aceset or repect the new press, and justly your answer. a. Dotarmine the initial cash flow required by the new press. Calculate the ininal casti fow wt be: (Found to the nearest dofar.) b. Delermine the periode cast inflows atributable to the new prose. (oble Be sure to consider the depteciaion in year 6.) Calculale the periodic cash infows attrbusatio to the new press below. (Round to the narest dolar.) b. Determine the periodic cash inflows aftributable to the new press. (Note: Be sure to consider the depreciation in year 6.) Calculate the periodic cash inflows attroutable to the new press bolow: (Round to the nearent dollar.) Operatino Cash Infowr d. Determine the net present value (NPV) and the internal rate of return (IRR) related to the proposed new press. e. Make a recommendation to accept or reject the new press, and justify your answer. c. Determine the payback period. The payback period for this project is years. (Round to one decimal place.) d. Determine the net present value (NPV) and the internal rate of return (IRR) related to the proposed new press. The nat nresent valio is S IRnuind in the nearest dillar) The payback period for this peoject is years. (Round to one decimal place) d. Determine the net present value (NPV) and the internat rate of return (RRR) reiatod to the proposed nein press. The net present value is 5 (Round to the nearest dotar.) The internal rate of retum is W. (Round to one decimal place.) decimal place.) The NPN is a 5. and the IRR of \%o weil we cost of capital of 10.7%. Based on both decision cribera, the projosi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts