Question: Finding operating and free cash flows Consider the balance sheets and selected data from the Income statement of Kaits Corporation that follow it a. Calculate

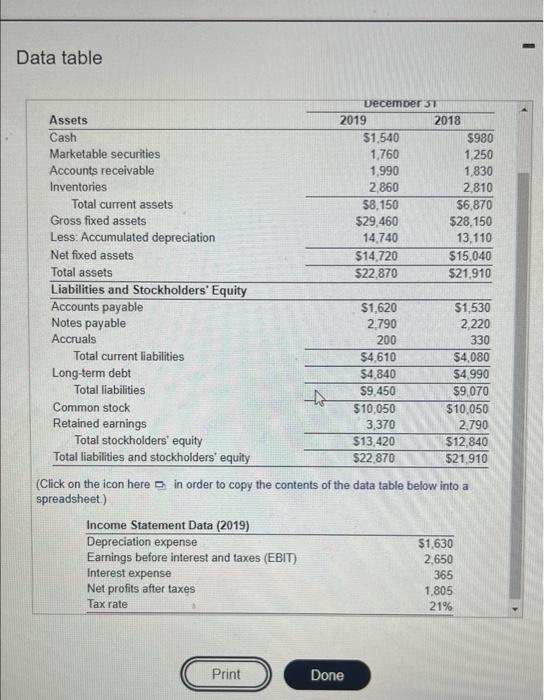

Finding operating and free cash flows Consider the balance sheets and selected data from the Income statement of Kaits Corporation that follow it a. Calculate the firm's net operating profil after taxes (NOPAT) for the year ended December 31, 2019 b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2019 c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2019 d. Interpret, compare and contrast your cash fow estimate in parts ib) and (c) GE 6. The net operating profit after taxes is $(Round to the noarent color) Data table December ST Assets 2019 2018 Cash $1,540 $980 Marketable securities 1,760 1,250 Accounts receivable 1,990 1,830 Inventories 2,860 2,810 Total current assets 58,150 $6,870 Gross fixed assets $29,460 $28.150 Less: Accumulated depreciation 14.740 13.110 Net fixed assets $14,720 $15,040 Total assets $22.870 $21.910 Liabilities and Stockholders' Equity Accounts payable $1,620 $1,530 Notes payable 2.790 2,220 Accruals 200 330 Total current liabilities $4,610 $4,080 Long-term debt $4,840 $4.990 Total liabilities $9.450 $9,070 Common stock $10,050 $10,050 Retained earnings 3,370 2,790 Total stockholders' equity $13,420 $12.840 Total liabilities and stockholders' equity $22.870 521,910 (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Income Statement Data (2019) Depreciation expense $1,630 Earnings before interest and taxes (EBIT) 2,650 Interest expense 365 Net profits after taxes 1.805 Tax rate 21% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts