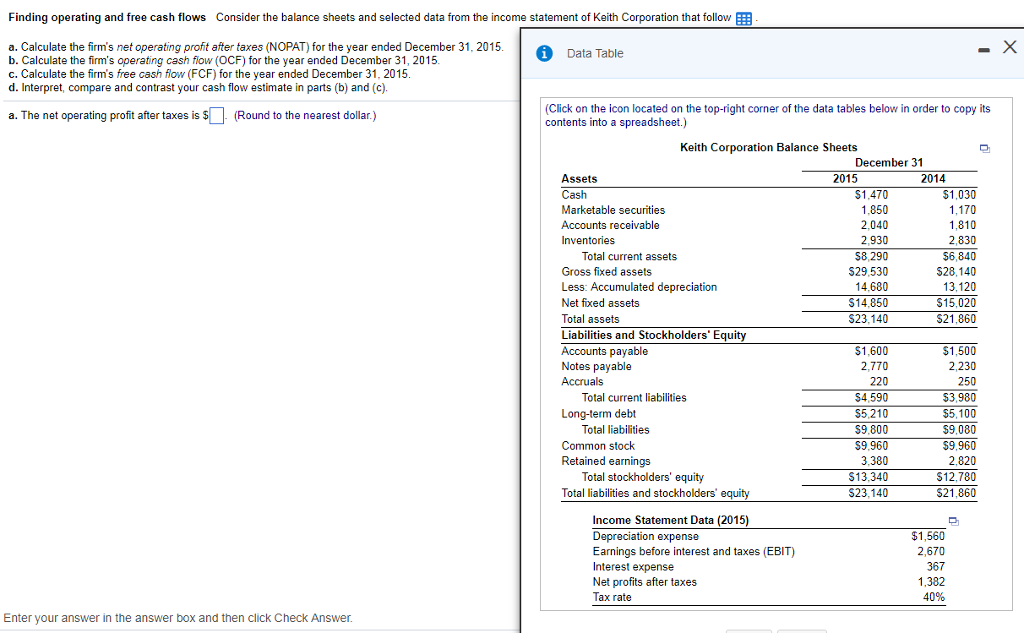

Question: Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow a. Calculate the

Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2015 b. Calculate the firm's operating cash fiow (OCF) for the yearended December 31, 2015 c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2015 d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c) Data Table (Click on the icon located on the top-right corner of the data tables below in order to copy its contents into a spreadsheet.) a. The net operating profit after taxes is S(Round to the nearest dollar.) Keith Corporation Balance Sheets December 31 2014 Assets Cash Marketable securities Accounts receivable Inventories 2015 $1.470 1,850 2,040 2,930 58,290 S29,530 14.680 S14,850 S23.140 1,030 1,170 1,810 2,830 56,840 28,140 13,120 $15,020 S21,860 Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable Accruals S1,600 2,770 220 $4,590 S5,210 S9,800 $9,960 3.380 $13.340 S23,140 $1,500 2,230 250 53,980 $5,100 9,080 9,960 2.820 $12,780 21,860 Total current liabilities Long-term debt Total liabilities Common stock Retained earninas Total stockholders' equity Total liabilities and stockholders Income Statement Data (2015) Depreciation expense Earnings before interest and taxes (EBIT) Interest expense Net profits after taxes Tax rate $1,560 2,670 367 1,382 40% Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts