Question: Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow a. Calculate the

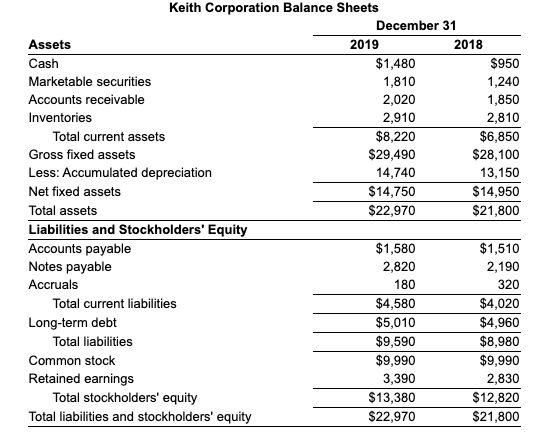

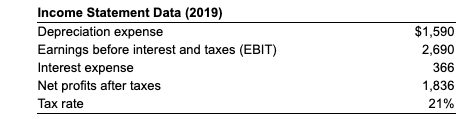

Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2019. b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2019. c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2019. d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c). Keith Corporation Balance Sheets December 31 Assets 2019 2018 Cash $1,480 $950 Marketable securities 1,810 1,240 Accounts receivable 2,020 1,850 Inventories 2,910 2,810 Total current assets $8,220 $6,850 Gross fixed assets $29,490 $28,100 Less: Accumulated depreciation 14,740 13,150 Net fixed assets $14,750 $14,950 Total assets $22,970 $21,800 Liabilities and Stockholders' Equity Accounts payable $1,580 $1,510 Notes payable 2,820 2,190 Accruals 180 320 Total current liabilities $4,580 $4,020 Long-term debt $5,010 $4,960 Total liabilities $9,590 $8,980 Common stock $9,990 $9,990 Retained earnings 3,390 2,830 Total stockholders' equity $13,380 $12,820 Total liabilities and stockholders' equity $22,970 $21,800 Income Statement Data (2019) Depreciation expense Earnings before interest and taxes (EBIT) Interest expense Net profits after taxes Tax rate $1,590 2,690 366 1,836 21%

Step by Step Solution

There are 3 Steps involved in it

To answer the given questions we need to follow these steps a Calculate the firms Net Operating Profit After Taxes NOPAT for the year ended December 31 2019 Formula for NOPAT textNOPAT textEBIT times ... View full answer

Get step-by-step solutions from verified subject matter experts