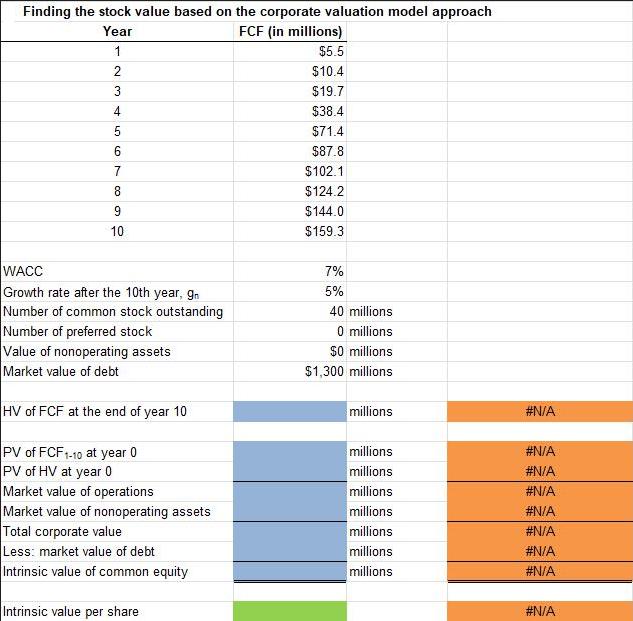

Question: Finding the stock value based on the corporate valuation model approach Year FCF (in millions) 1 2 3 4 5 6 7 8 9

Finding the stock value based on the corporate valuation model approach Year FCF (in millions) 1 2 3 4 5 6 7 8 9 10 WACC Growth rate after the 10th year, gr Number of common stock outstanding Number of preferred stock Value of nonoperating assets Market value of debt HV of FCF at the end of year 10 PV of FCF 1-10 at year 0 PV of HV at year 0 Market value of operations Market value of nonoperating assets Total corporate value Less: market value of debt Intrinsic value of common equity Intrinsic value per share $5.5 $10.4 $19.7 $38.4 $71.4 $87.8 $102.1 $124.2 $144.0 $159 7% 5% 40 millions 0 millions $0 millions $1,300 millions millions millions millions millions millions millions millions millions #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

1 Calculate PV of FCF for years 110 at year 0 PV551071104107219710733841074714107587810761021... View full answer

Get step-by-step solutions from verified subject matter experts