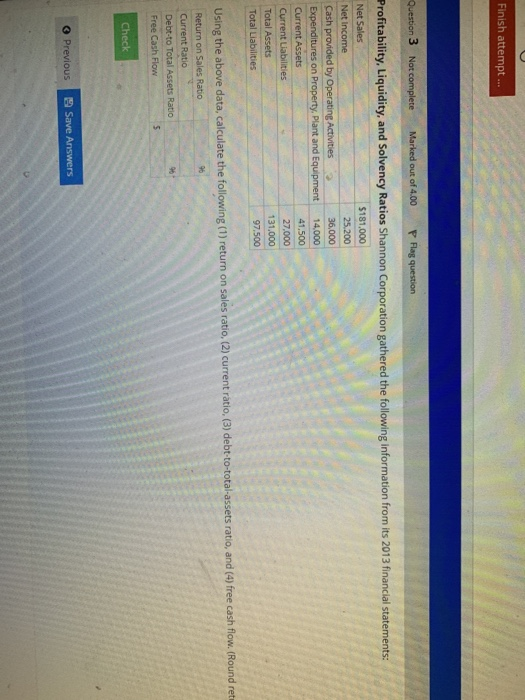

Question: Finish attempt... Question 3 Not complete P Rag question Marked out of 4.00 Profitability, Liquidity, and Solvency Ratios Shannon Corporation gathered the following information from

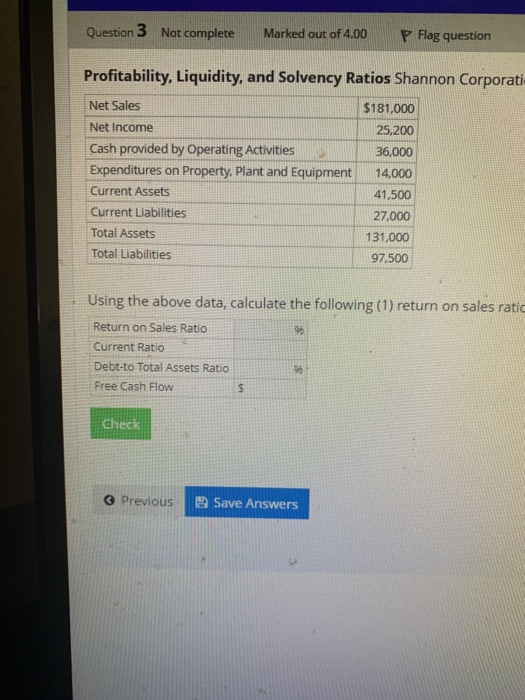

Finish attempt... Question 3 Not complete P Rag question Marked out of 4.00 Profitability, Liquidity, and Solvency Ratios Shannon Corporation gathered the following information from its 2013 financial statements: Net Sales $181,000 Net Income 25,200 Cash provided by Operating Activities 36,000 Expenditures on Property, Plant and Equipment 14,000 Current Assets 41,500 Current Liabilities 27,000 Total Assets 131.000 Total Liabilities 97,500 Using the above data, calculate the following (1) return on sales ratio, (2) current ratio, (3) debt-to-total-assets ratio, and (4) free cash flow. (Round ret Return on Sales Ratio 96 Current Ratio Debt-to Total Assets Ratio Free Cash Flow Check O Previous Save Answers Using the above data, calculate the following (1) return on sales ratio, (2) current ratio, (3) debt- to-total-assets ratio, and (4) free cash flow. (Round return on sales and debt-to-total assets ratios to one decimal point and round current ratio to two decimal points.) Question 3 Not complete Marked out of 4.00 P Flag question Profitability, Liquidity, and Solvency Ratios Shannon Corporati Net Sales $181,000 Net Income 25,200 Cash provided by Operating Activities 36,000 Expenditures on Property. Plant and Equipment 14,000 Current Assets 41,500 Current Liabilities 27,000 Total Assets 131,000 Total Liabilities 97,500 Using the above data, calculate the following (1) return on sales ratic Return on Sales Ratio 96 Current Ratio Debt-to Total Assets Ratio Free Cash Flow Check O Previous Save Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts