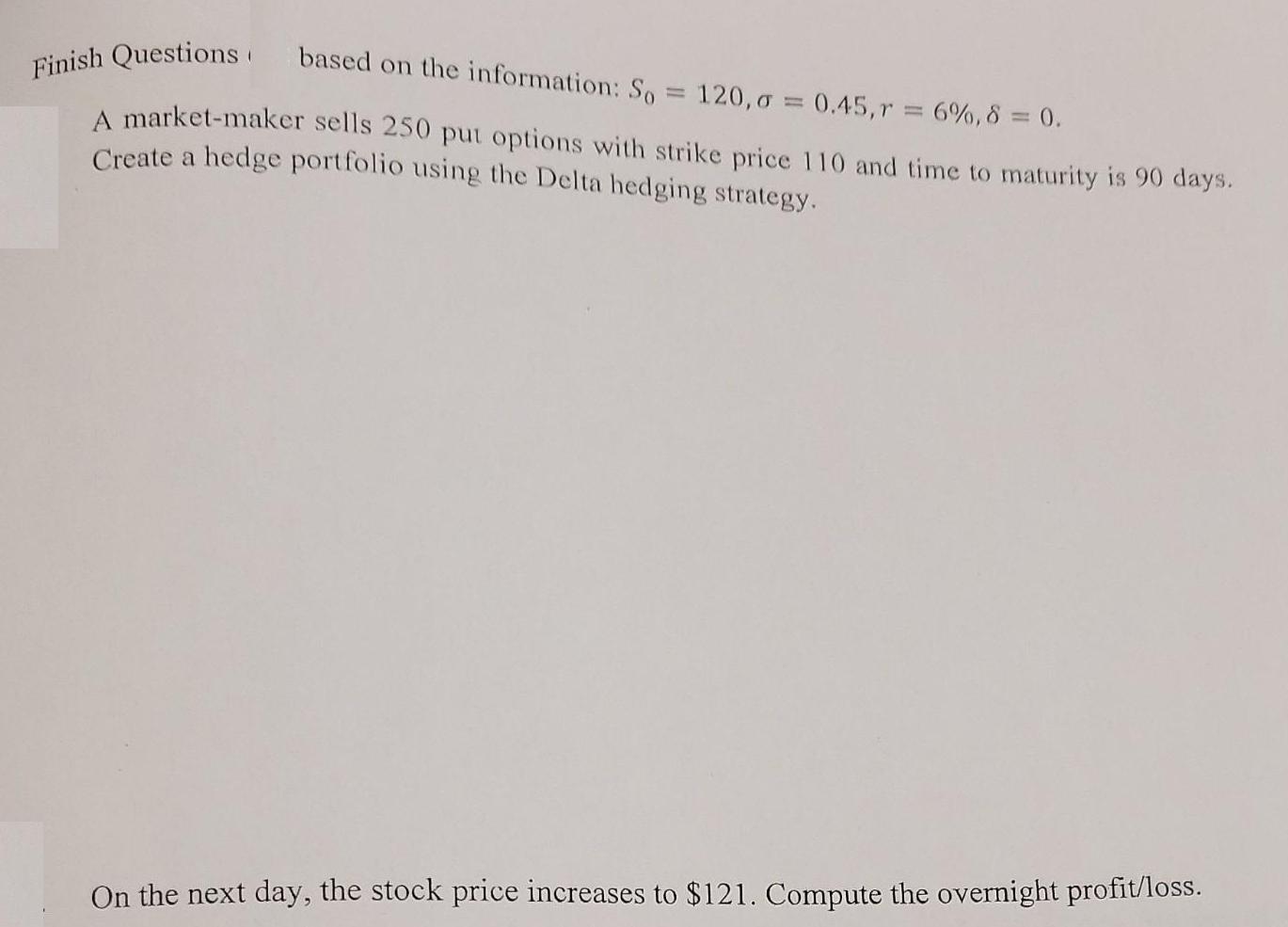

Question: Finish Questions based on the information: So = 120,0 = 0.45, r = 6%,8 = 0. A market-maker sells 250 put options with strike

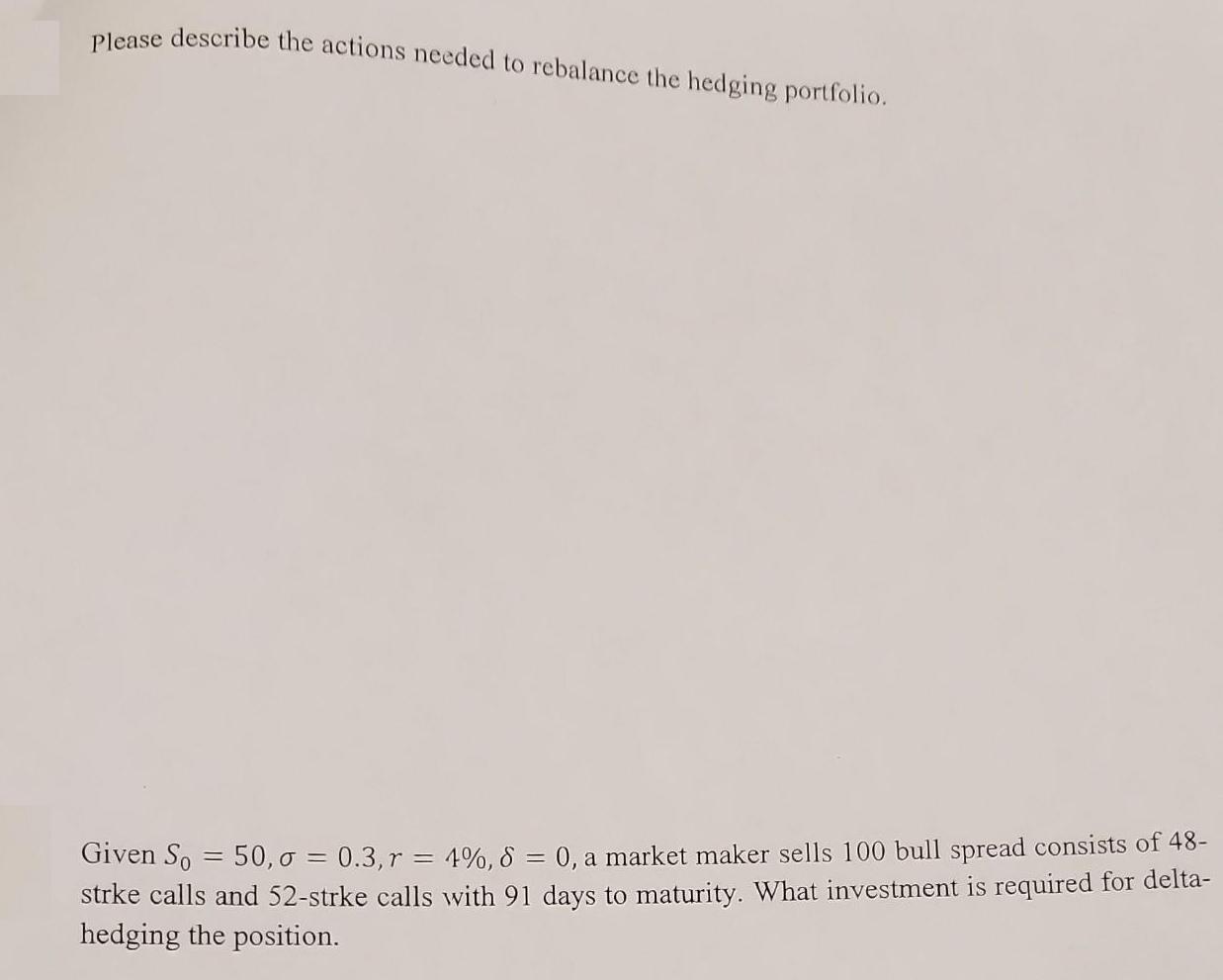

Finish Questions based on the information: So = 120,0 = 0.45, r = 6%,8 = 0. A market-maker sells 250 put options with strike price 110 and time to maturity is 90 days. Create a hedge portfolio using the Delta hedging strategy. On the next day, the stock price increases to $121. Compute the overnight profit/loss. Please describe the actions needed to rebalance the hedging portfolio. Given So = 50, o = 0.3, r = 4%, 8 = 0, a market maker sells 100 bull spread consists of 48- strke calls and 52-strke calls with 91 days to maturity. What investment is required for delta- hedging the position.

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Create a hedge portfolio using the Delta hedging strategy ANSWER The delta of the put option is 8 so the marketmaker needs to sell 8250 2000 shares of ... View full answer

Get step-by-step solutions from verified subject matter experts