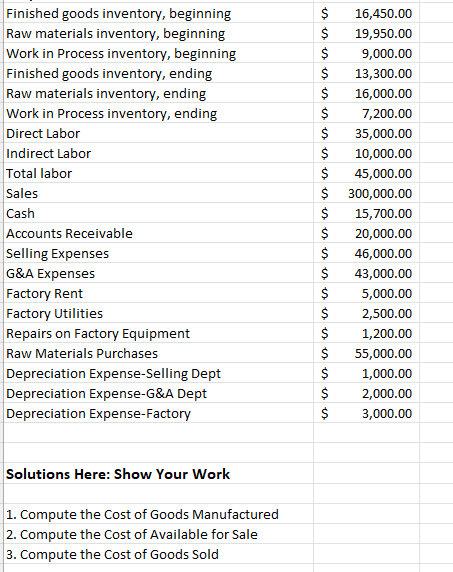

Question: Finished goods inventory, beginning Raw materials inventory, beginning Work in Process inventory, beginning Finished goods inventory, ending Raw materials inventory, ending $ 16,450.00 $

Finished goods inventory, beginning Raw materials inventory, beginning Work in Process inventory, beginning Finished goods inventory, ending Raw materials inventory, ending $ 16,450.00 $ 19,950.00 es es es es $ 9,000.00 $ 13,300.00 Work in Process inventory, ending Direct Labor Indirect Labor Total labor Sales Cash Accounts Receivable Selling Expenses G&A Expenses $ eseseses es es es $ 16,000.00 $ 7,200.00 $ 35,000.00 $ 10,000.00 $ 45,000.00 $ 300,000.00 15,700.00 - $ 20,000.00 Factory Rent $ Factory Utilities $ eseses es $ 46,000.00 $ 43,000.00 5,000.00 2,500.00 Repairs on Factory Equipment Raw Materials Purchases Depreciation Expense-Selling Dept $ Depreciation Expense-G&A Dept $ eseses es $ 1,200.00 $ 55,000.00 1,000.00 2,000.00 Depreciation Expense-Factory $ 3,000.00 Solutions Here: Show Your Work 1. Compute the Cost of Goods Manufactured 2. Compute the Cost of Available for Sale 3. Compute the Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts