Question: FiredUp Ltd Val and Stevie have been doing some thinking since lockdown. They aren't enjoying their jobs and would like to make a go of

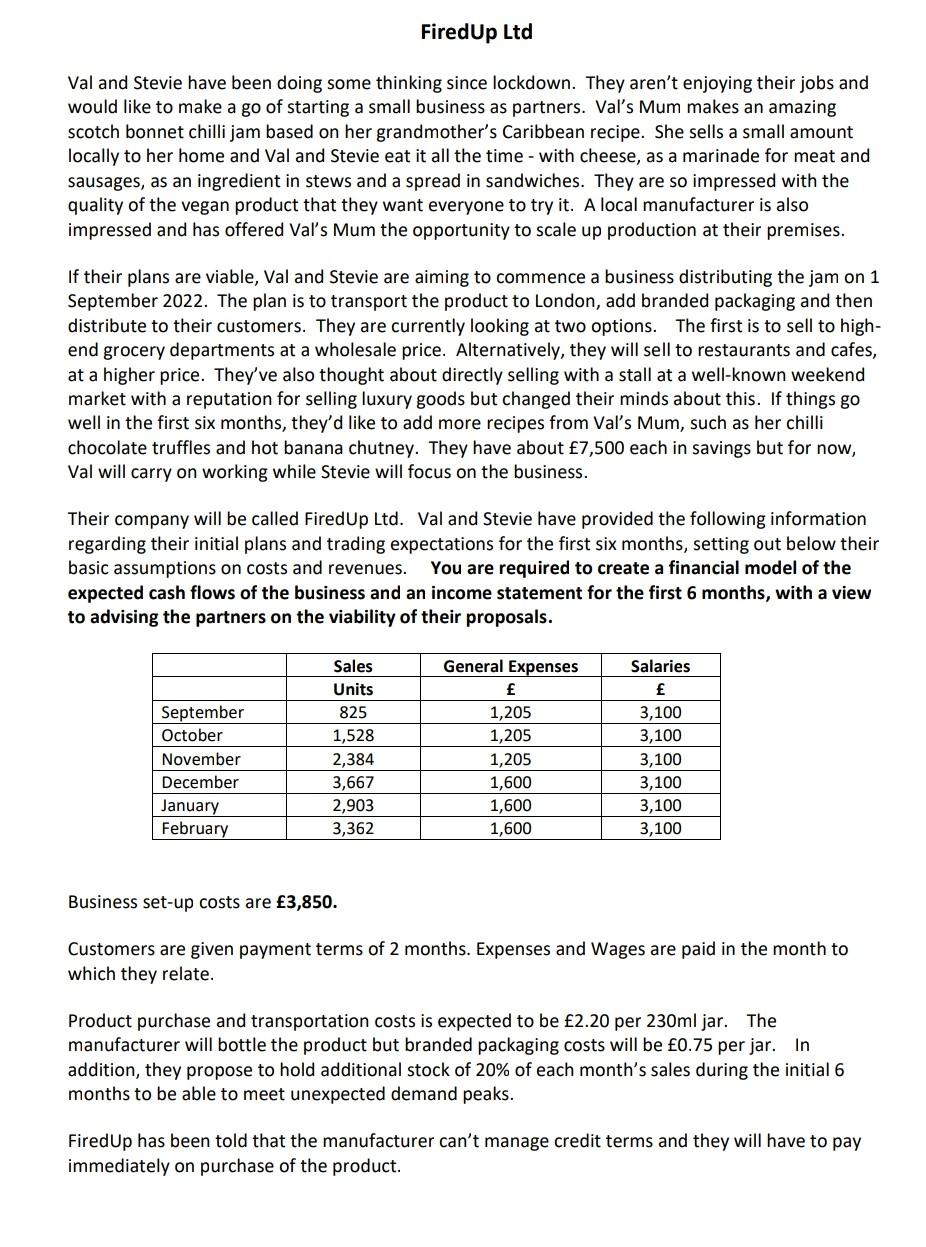

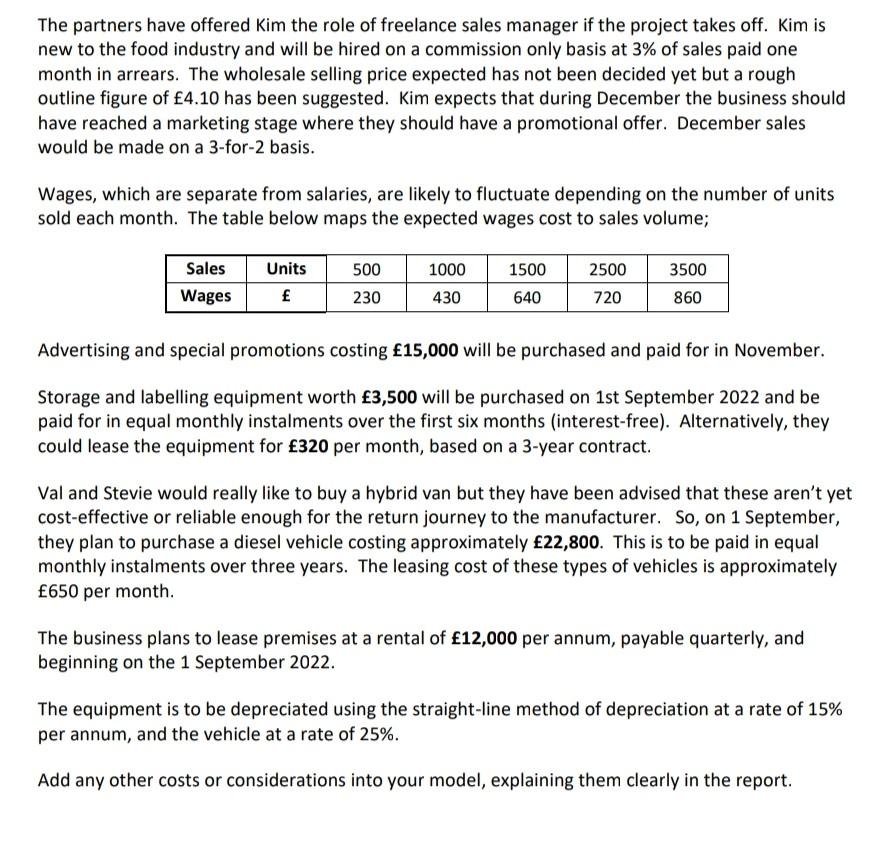

FiredUp Ltd Val and Stevie have been doing some thinking since lockdown. They aren't enjoying their jobs and would like to make a go of starting a small business as partners. Val's Mum makes an amazing scotch bonnet chilli jam based on her grandmother's Caribbean recipe. She sells a small amount locally to her home and Val and Stevie eat it all the time - with cheese, as a marinade for meat and sausages, as an ingredient in stews and a spread in sandwiches. They are so impressed with the quality of the vegan product that they want everyone to try it. A local manufacturer is also impressed and has offered Val's Mum the opportunity to scale up production at their premises. If their plans are viable, Val and Stevie are aiming to commence a business distributing the jam on 1 September 2022. The plan is to transport the product to London, add branded packaging and then distribute to their customers. They are currently looking at two options. The first is to sell to high- end grocery departments at a wholesale price. Alternatively, they will sell to restaurants and cafes, at a higher price. They've also thought about directly selling with a stall at a well-known weekend market with a reputation for selling luxury goods but changed their minds about this. If things go well in the first six months, they'd like to add more recipes from Val's Mum, such as her chilli chocolate truffles and hot banana chutney. They have about 7,500 each in savings but for now, Val will carry on working while Stevie will focus on the business. Their company will be called FiredUp Ltd. Val and Stevie have provided the following information regarding their initial plans and trading expectations for the first six months, setting out below their basic assumptions on costs and revenues. You are required to create a financial model of the expected cash flows of the business and an income statement for the first 6 months, with a view to advising the partners on the viability of their proposals. September October November December January February Sales Units 825 1,528 2,384 3,667 2,903 3,362 General Expenses f 1,205 1,205 1,205 1,600 1,600 1,600 Salaries 3,100 3,100 3,100 3,100 3,100 3,100 Business set-up costs are 3,850. Customers are given payment terms of 2 months. Expenses and Wages are paid in the month to which they relate. Product purchase and transportation costs is expected to be 2.20 per 230ml jar. The manufacturer will bottle the product but branded packaging costs will be 0.75 per jar. In addition, they propose to hold additional stock of 20% of each month's sales during the initial 6 months to be able to meet unexpected demand peaks. FiredUp has been told that the manufacturer can't manage credit terms and they will have to pay immediately on purchase of the product. The partners have offered Kim the role of freelance sales manager if the project takes off. Kim is new to the food industry and will be hired on a commission only basis at 3% of sales paid one month in arrears. The wholesale selling price expected has not been decided yet but a rough outline figure of 4.10 has been suggested. Kim expects that during December the business should have reached a marketing stage where they should have a promotional offer. December sales would be made on a 3-for-2 basis. Wages, which are separate from salaries, are likely to fluctuate depending on the number of units sold each month. The table below maps the expected wages cost to sales volume; Sales Wages Units 500 230 1000 430 1500 640 2500 720 3500 860 Advertising and special promotions costing 15,000 will be purchased and paid for in November. Storage and labelling equipment worth 3,500 will be purchased on 1st September 2022 and be paid for in equal monthly instalments over the first six months (interest-free). Alternatively, they could lease the equipment for 320 per month, based on a 3-year contract. Val and Stevie would really like to buy a hybrid van but they have been advised that these aren't yet cost-effective or reliable enough for the return journey to the manufacturer. So, on 1 September, they plan to purchase a diesel vehicle costing approximately 22,800. This is to be paid in equal monthly instalments over three years. The leasing cost of these types of vehicles is approximately 650 per month. The business plans to lease premises at a rental of 12,000 per annum, payable quarterly, and beginning on the 1 September 2022. The equipment is to be depreciated using the straight-line method of depreciation at a rate of 15% per annum, and the vehicle at a rate of 25%. Add any other costs or considerations into your model, explaining them clearly in the report. Val and Stevie would like you to: i. develop a cash budget model which they can use to assess the projected cashflows for Fired Up Ltd. The model should show opening balance, cash inflows, cash outflows and closing balances for each month. ii. produce an expected Income Statement model for the period to the end of February 2023. The model should show revenues, costs and profit using the methods and structure you have learnt in ITFA. FiredUp Ltd Val and Stevie have been doing some thinking since lockdown. They aren't enjoying their jobs and would like to make a go of starting a small business as partners. Val's Mum makes an amazing scotch bonnet chilli jam based on her grandmother's Caribbean recipe. She sells a small amount locally to her home and Val and Stevie eat it all the time - with cheese, as a marinade for meat and sausages, as an ingredient in stews and a spread in sandwiches. They are so impressed with the quality of the vegan product that they want everyone to try it. A local manufacturer is also impressed and has offered Val's Mum the opportunity to scale up production at their premises. If their plans are viable, Val and Stevie are aiming to commence a business distributing the jam on 1 September 2022. The plan is to transport the product to London, add branded packaging and then distribute to their customers. They are currently looking at two options. The first is to sell to high- end grocery departments at a wholesale price. Alternatively, they will sell to restaurants and cafes, at a higher price. They've also thought about directly selling with a stall at a well-known weekend market with a reputation for selling luxury goods but changed their minds about this. If things go well in the first six months, they'd like to add more recipes from Val's Mum, such as her chilli chocolate truffles and hot banana chutney. They have about 7,500 each in savings but for now, Val will carry on working while Stevie will focus on the business. Their company will be called FiredUp Ltd. Val and Stevie have provided the following information regarding their initial plans and trading expectations for the first six months, setting out below their basic assumptions on costs and revenues. You are required to create a financial model of the expected cash flows of the business and an income statement for the first 6 months, with a view to advising the partners on the viability of their proposals. September October November December January February Sales Units 825 1,528 2,384 3,667 2,903 3,362 General Expenses f 1,205 1,205 1,205 1,600 1,600 1,600 Salaries 3,100 3,100 3,100 3,100 3,100 3,100 Business set-up costs are 3,850. Customers are given payment terms of 2 months. Expenses and Wages are paid in the month to which they relate. Product purchase and transportation costs is expected to be 2.20 per 230ml jar. The manufacturer will bottle the product but branded packaging costs will be 0.75 per jar. In addition, they propose to hold additional stock of 20% of each month's sales during the initial 6 months to be able to meet unexpected demand peaks. FiredUp has been told that the manufacturer can't manage credit terms and they will have to pay immediately on purchase of the product. The partners have offered Kim the role of freelance sales manager if the project takes off. Kim is new to the food industry and will be hired on a commission only basis at 3% of sales paid one month in arrears. The wholesale selling price expected has not been decided yet but a rough outline figure of 4.10 has been suggested. Kim expects that during December the business should have reached a marketing stage where they should have a promotional offer. December sales would be made on a 3-for-2 basis. Wages, which are separate from salaries, are likely to fluctuate depending on the number of units sold each month. The table below maps the expected wages cost to sales volume; Sales Wages Units 500 230 1000 430 1500 640 2500 720 3500 860 Advertising and special promotions costing 15,000 will be purchased and paid for in November. Storage and labelling equipment worth 3,500 will be purchased on 1st September 2022 and be paid for in equal monthly instalments over the first six months (interest-free). Alternatively, they could lease the equipment for 320 per month, based on a 3-year contract. Val and Stevie would really like to buy a hybrid van but they have been advised that these aren't yet cost-effective or reliable enough for the return journey to the manufacturer. So, on 1 September, they plan to purchase a diesel vehicle costing approximately 22,800. This is to be paid in equal monthly instalments over three years. The leasing cost of these types of vehicles is approximately 650 per month. The business plans to lease premises at a rental of 12,000 per annum, payable quarterly, and beginning on the 1 September 2022. The equipment is to be depreciated using the straight-line method of depreciation at a rate of 15% per annum, and the vehicle at a rate of 25%. Add any other costs or considerations into your model, explaining them clearly in the report. Val and Stevie would like you to: i. develop a cash budget model which they can use to assess the projected cashflows for Fired Up Ltd. The model should show opening balance, cash inflows, cash outflows and closing balances for each month. ii. produce an expected Income Statement model for the period to the end of February 2023. The model should show revenues, costs and profit using the methods and structure you have learnt in ITFA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts