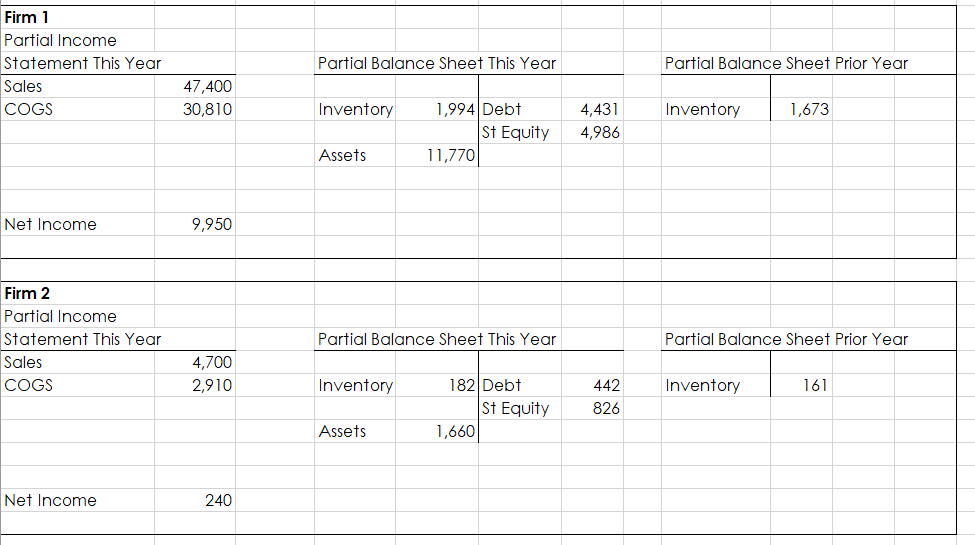

Question: Firm 1 Partial Income Statement This Year Sales COGS Partial Balance Sheet This Year Partial Balance Sheet Prior Year 47,400 30,810 Inventory Inventory 1,673 1,994

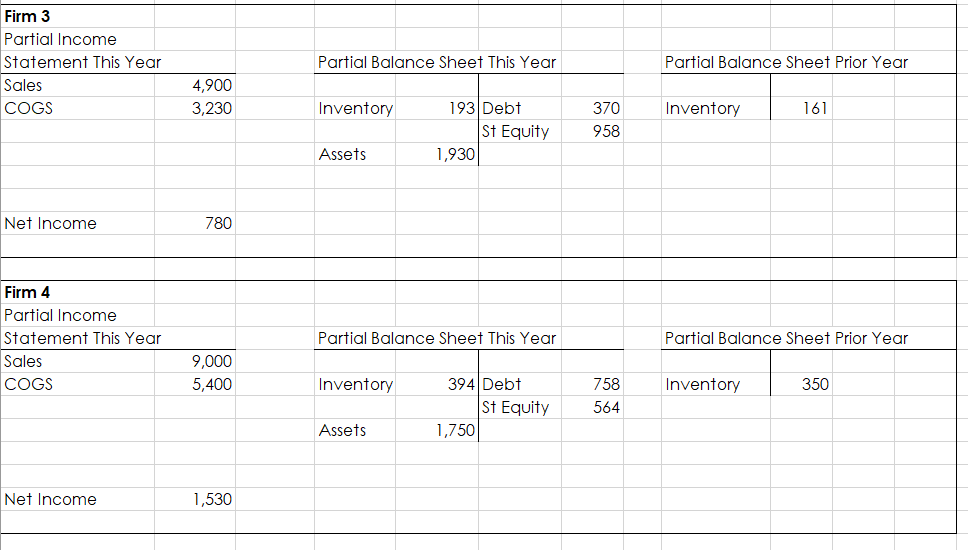

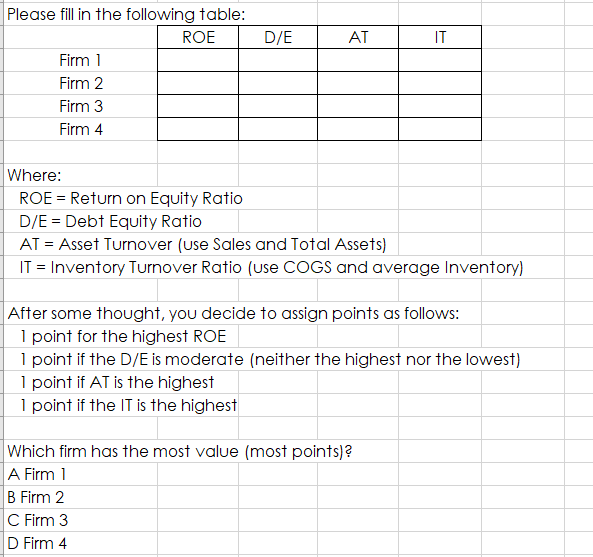

Firm 1 Partial Income Statement This Year Sales COGS Partial Balance Sheet This Year Partial Balance Sheet Prior Year 47,400 30,810 Inventory Inventory 1,673 1,994 Debt St Equity 11,7701 4,431 4,986 Assets Net Income 9,950 Firm 2 Partial Income Statement This Year Sales COGS Partial Balance Sheet This Year Partial Balance Sheet Prior Year 4,700 2,910 Inventory Inventory 161 182 Debt St Equity 1,660 442 826 Assets Net Income 240 Firm 3 Partial Income Statement This Year Sales COGS Partial Balance Sheet This Year Partial Balance Sheet Prior Year 4,900 3,230 Inventory Inventory 161 193 Debt St Equity 1,930 370 958 Assets Net Income 780 Firm 4 Partial Income Statement This Year Sales COGS Partial Balance Sheet This Year Partial Balance Sheet Prior Year 9,000 5,400 Inventory Inventory 350 394 Debt St Equity 1,750 758 564 Assets Net Income 1,530 D/E AT IT Please fill in the following table: ROE Firm 1 Firm 2 Firm 3 Firm 4 Where: ROE = Return on Equity Ratio D/E = Debt Equity Ratio AT = Asset Turnover (use Sales and Total Assets) IT = Inventory Turnover Ratio (use COGS and average Inventory) After some thought, you decide to assign points as follows: 1 point for the highest ROE 1 point if the D/E is moderate (neither the highest nor the lowest) 1 point if AT is the highest 1 point if the IT is the highest Which firm has the most value (most points)? A Firm 1 B Firm 2 C Firm 3 D Firm 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts