Question: Firm A from the table below is considering a merger with a competitor in its industry. However, the firm wishes to avoid proposing a merger

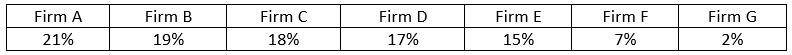

Firm A from the table below is considering a merger with a competitor in its industry. However, the firm wishes to avoid proposing a merger with the competitor if it's likely to be challenged by the Department of Justice (DOJ) on the grounds that it exceeds guidelines for acceptable changes.  Given this, which of firm A's competitors has the largest percentage market share it could merge with while staying within DOJ guidelines? Given this, which of firm A's competitors has the largest percentage market share it could merge with while staying within DOJ guidelines? | ||||||||||||||||||||||||||||||||||||||||||||||

|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts