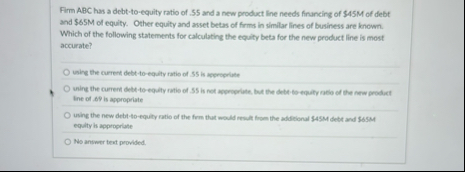

Question: Firm ABC has a debt - to - equity ratio of . 5 5 and a new product line needs financing of $ 4 5

Firm ABC has a debttoequity ratio of and a new product line needs financing of $ of debt and $ of equity. Other equity and asset betas of firms in wimilar lines of bersineses ane bnown. Which of the following statements for calculating the equity beta for the new product line is most accurate?

using the current debttoequity ratio of is meveopilate

Ine of is appropiate

using the new debttoequity ratio of the from thut mould resalt from the addilional M debt and M equity is appropriate

No answer text provided.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock