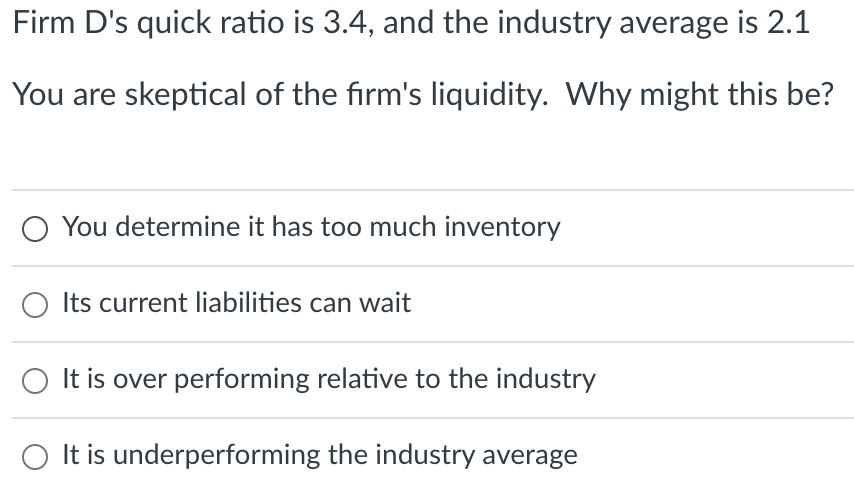

Question: Firm D's quick ratio is 3.4, and the industry average is 2.1 You are skeptical of the firm's liquidity. Why might this be? You determine

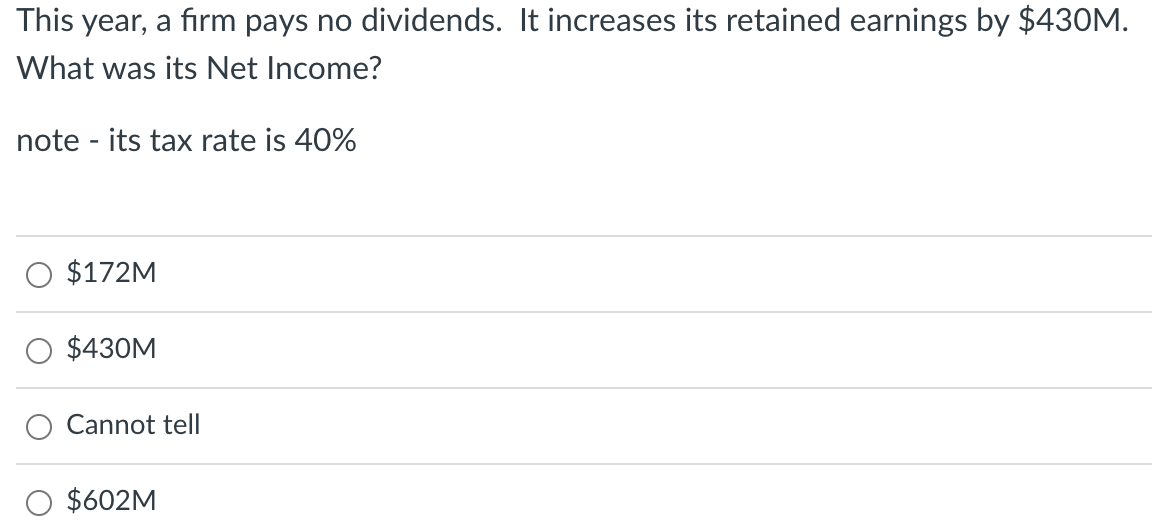

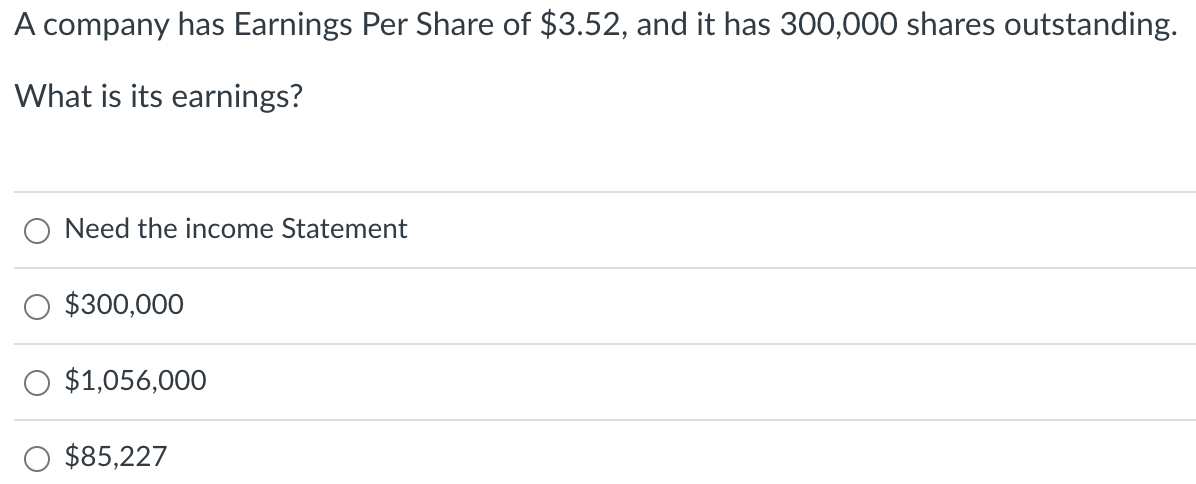

Firm D's quick ratio is 3.4, and the industry average is 2.1 You are skeptical of the firm's liquidity. Why might this be? You determine it has too much inventory Its current liabilities can wait It is over performing relative to the industry It is underperforming the industry average This year, a firm pays no dividends. It increases its retained earnings by $430M. What was its Net Income? note - its tax rate is 40% $172M $430M Cannot tell $602M A company has Earnings Per Share of $3.52, and it has 300,000 shares outstanding. What is its earnings? Need the income Statement $300,000 $1,056,000 $85,227 Firm D's quick ratio is 3.4, and the industry average is 2.1 You are skeptical of the firm's liquidity. Why might this be? You determine it has too much inventory Its current liabilities can wait It is over performing relative to the industry It is underperforming the industry average This year, a firm pays no dividends. It increases its retained earnings by $430M. What was its Net Income? note - its tax rate is 40% $172M $430M Cannot tell $602M A company has Earnings Per Share of $3.52, and it has 300,000 shares outstanding. What is its earnings? Need the income Statement $300,000 $1,056,000 $85,227

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts