Question: Firm specific risk is also called and systematic risk, diversifiable risk systematic risk, non - diverslfiabte risk unique risk, non - diversifiable risk unlque risk,

Firm specific risk is also called and

systematic risk, diversifiable risk

systematic risk, nondiverslfiabte risk

unique risk, nondiversifiable risk

unlque risk, diversifiatie risk

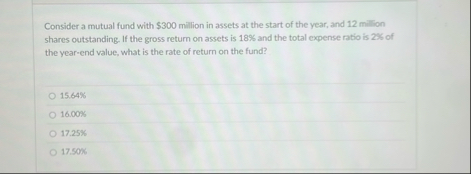

Consider a mutual fund with $ million in assets at the start of the year, and million shares outstanding. If the gross return on assets is and the total expense ratio is of the yearend value, what is the rate of return on the fund?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock