Question: Firm ( W ) , which has a 3 4 percent marginal tax rate, plans to operate a new business that should generate

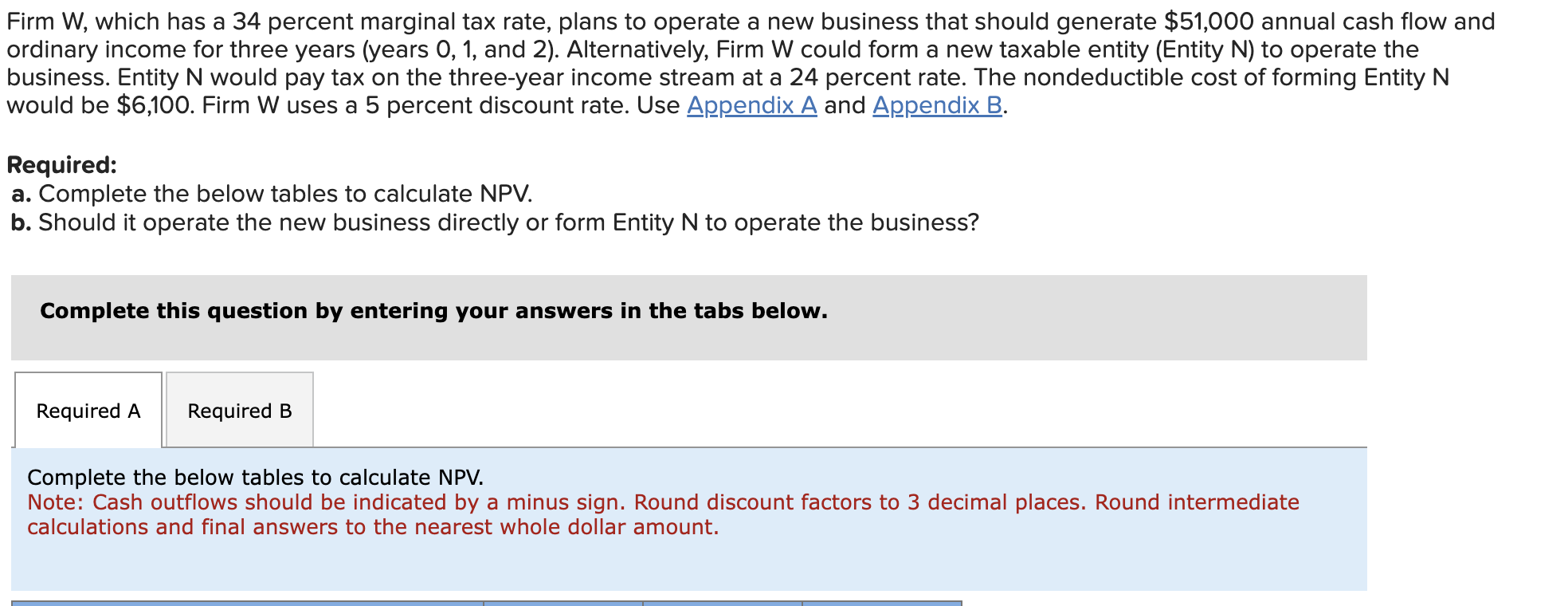

Firm W which has a percent marginal tax rate, plans to operate a new business that should generate $ annual cash flow and ordinary income for three years years and Alternatively, Firm W could form a new taxable entity Entity N to operate the business. Entity N would pay tax on the threeyear income stream at a percent rate. The nondeductible cost of forming Entity N would be $ Firm W uses a percent discount rate. Use Appendix A and Appendix B Required: a Complete the below tables to calculate NPV b Should it operate the new business directly or form Entity N to operate the business? Complete this question by entering your answers in the tabs below. Required B Complete the below tables to calculate NPV Note: Cash outflows should be indicated by a minus sign. Round discount factors to decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount. Complete the below tables to calculate NPV

Note: Cash outflows should be indicated by a minus sign. Round discount factors to decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount.

begintabularllll

hline & Year & Year & Year

hline Business operated by Firm W: & & &

hline Aftertax cash flow at tax rate & & &

hline Discount factor & & &

hline Present value & $ & $ & $

hline NPV & & &

hline Business operated by Entity N: & & &

hline Aftertax cash flow at tax rate & & &

hline Cost of forming Entity N & & &

hline Net cash flow & $ & $ & $

hline Discount factor & & &

hline Present value & $ & &

hline NPV & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock