Question: Firms A and B have the same return on assets, but firm A has a higher return on equity. What must be true about the

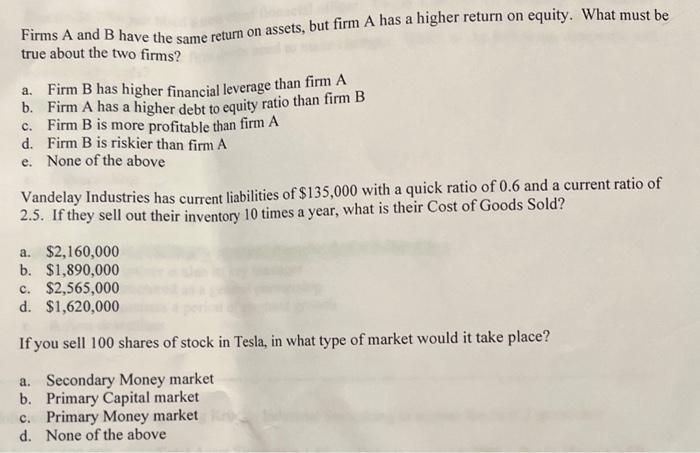

Firms A and B have the same return on assets, but firm A has a higher return on equity. What must be true about the two firms? a. Firm B has higher financial leverage than firm A b. Firm A has a higher debt to equity ratio than firm B Firm B is more profitable than firm A c. d. Firm B is riskier than firm A e. None of the above Vandelay Industries has current liabilities of $135,000 with a quick ratio of 0.6 and a current ratio of 2.5. If they sell out their inventory 10 times a year, what is their Cost of Goods Sold? a. $2,160,000 b. $1,890,000 c. $2,565,000 d. $1,620,000 If you sell 100 shares of stock in Tesla, in what type of market would it take place? a. Secondary Money market b. Primary Capital market c. Primary Money market d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts