Question: FIRST 3 PAGES IS THE PROBLEM. AND 4TH PAGE PLEASE ANSWER 1,2,&3. Your company, Deep Rock Mining LLC, is considering an expansion of operations into

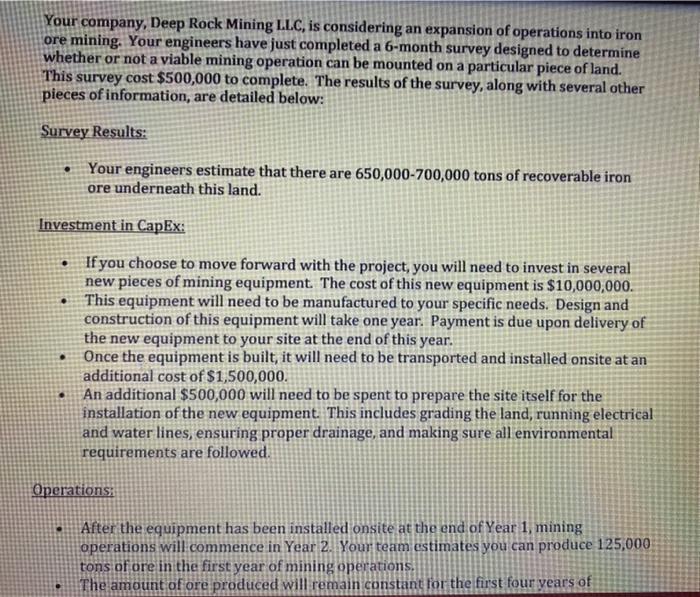

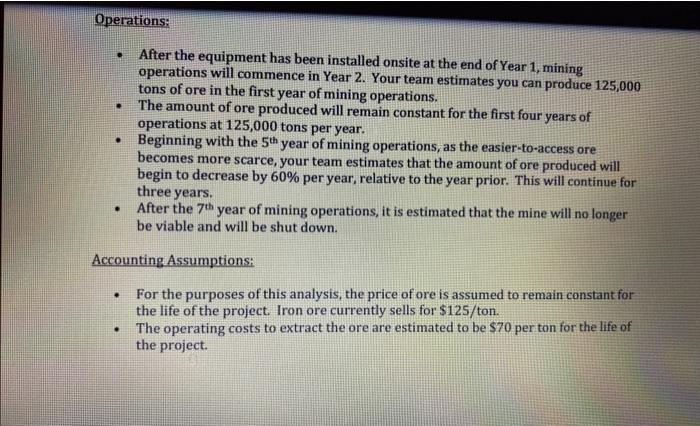

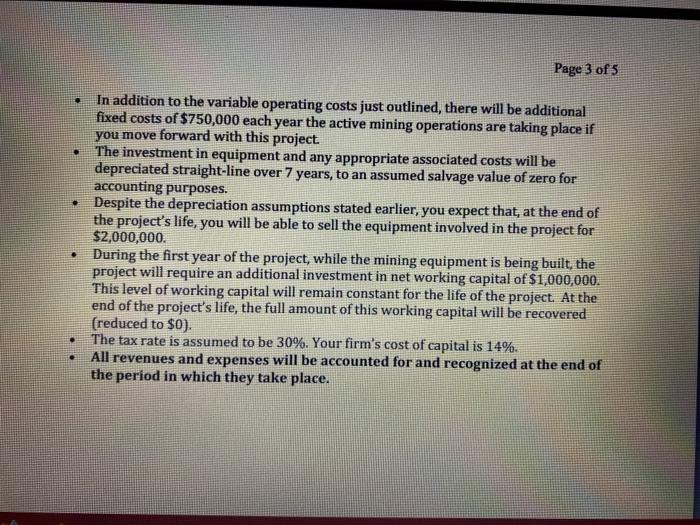

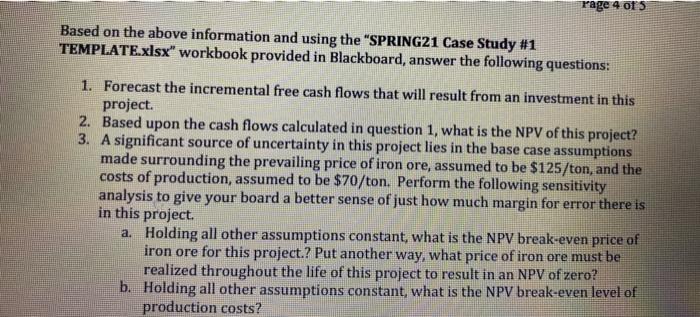

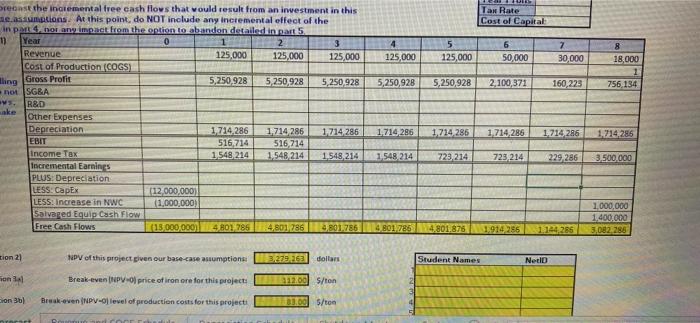

Your company, Deep Rock Mining LLC, is considering an expansion of operations into iron ore mining. Your engineers have just completed a 6-month survey designed to determine whether or not a viable mining operation can be mounted on a particular piece of land. This survey cost $500,000 to complete. The results of the survey, along with several other pieces of information, are detailed below: Survey Results: Your engineers estimate that there are 650,000-700,000 tons of recoverable iron ore underneath this land. Investment in CapEx: If you choose to move forward with the project, you will need to invest in several new pieces of mining equipment. The cost of this new equipment is $10,000,000. This equipment will need to be manufactured to your specific needs. Design and construction of this equipment will take one year. Payment is due upon delivery of the new equipment to your site at the end of this year. Once the equipment is built, it will need to be transported and installed onsite at an additional cost of $1,500,000. An additional $500,000 will need to be spent to prepare the site itself for the installation of the new equipment. This includes grading the land, running electrical and water lines, ensuring proper drainage, and making sure all environmental requirements are followed. . Operations: After the equipment has been installed onsite at the end of Year 1, mining operations will commence in Year 2. Your team estimates you can produce 125,000 tons of ore in the first year of mining operations, The amount of ore produced will remain constant for the first four years of Operations: . After the equipment has been installed onsite at the end of Year 1, mining operations will commence in Year 2. Your team estimates you can produce 125,000 tons of ore in the first year of mining operations. The amount of ore produced will remain constant for the first four years of operations at 125,000 tons per year. Beginning with the 5th year of mining operations, as the easier-to-access ore becomes more scarce, your team estimates that the amount of ore produced will begin to decrease by 60% per year, relative to the year prior. This will continue for three years, After the 7th year of mining operations, it is estimated that the mine will no longer be viable and will be shut down. . . Accounting Assumptions: . For the purposes of this analysis, the price of ore is assumed to remain constant for the life of the project. Iron ore currently sells for $125/ton. The operating costs to extract the ore are estimated to be $70 per ton for the life of the project. . Page 3 of 5 In addition to the variable operating costs just outlined, there will be additional fixed costs of $750,000 each year the active mining operations are taking place if you move forward with this project . The investment in equipment and any appropriate associated costs will be depreciated straight-line over 7 years, to an assumed salvage value of zero for accounting purposes. Despite the depreciation assumptions stated earlier, you expect that, at the end of the project's life, you will be able to sell the equipment involved in the project for $2,000,000 During the first year of the project, while the mining equipment is being built, the project will require an additional investment in net working capital of $1,000,000. This level of working capital will remain constant for the life of the project. At the end of the project's life, the full amount of this working capital will be recovered (reduced to $0). The tax rate is assumed to be 30%. Your firm's cost of capital is 14%. All revenues and expenses will be accounted for and recognized at the end of the period in which they take place. rage 4 of 5 Based on the above information and using the "SPRING21 Case Study #1 TEMPLATE.xlsx"workbook provided in Blackboard, answer the following questions: 1. Forecast the incremental free cash flows that will result from an investment in this project. 2. Based upon the cash flows calculated in question 1, what is the NPV of this project? 3. A significant source of uncertainty in this project lies in the base case assumptions made surrounding the prevailing price of iron ore, assumed to be $125/ton, and the costs of production, assumed to be $70/ton. Perform the following sensitivity analysis to give your board a better sense of just how much margin for error there is in this project. a. Holding all other assumptions constant, what is the NPV break-even price of iron ore for this project.? Put another way, what price of iron ore must be realized throughout the life of this project to result in an NPV of zero? b. Holding all other assumptions constant, what is the NPV break-even level of production costs? Tax Rate Cost of Capital 4 125,000 5 125,000 6 50,000 7 30,000 8 18,000 5,250,928 5,250,928 2,100,371 160, 225 756.134 oreanse the incremental free cash flows that would result from an investment in this easiumpsions. At this point, do NOT include any incremental effect of the in panorama from the option to abandon detailed in part 5 n Year 0 2 3 Revenue 125,000 125,000 125,000 Cost of Production (COGS lling Gross Profit 5,250,928 5,250,928 5,250 928 not SGBA vs. RBD ske Other Expenses Depreciation 1714,286 1,714286 1714,286 EBIT 516,714 516 714 income Tax 1,548, 214 1.548 214 1.548, 214 Incremental Earnings PLUS: Depreciation LESS: Capex (12,000,000) LESS: Increase in NWC (1,000,000) Salvaged Equip Cash Flow Free Cash Flows (15 000 000) 480! 285 4,801 7864801.786 1714 286 1.714,286 1.714,286 1.214 286 1.214,285 1.548 214 723214 723214 229 286 3.500.000 1,000,000 1.400.000 3,082,285 4 801 785 4.801.875 1,914 256 1144,285 tion 21 NPV of this project given our base-case assumptions 3.2796 dollars Student Names Netlo Fional Break-even (PVol price of iron ore for this project: 12.00 s/ton con 36 Bruskoven (NPV-level of production costs for this project 0.005/ton Denture con Your company, Deep Rock Mining LLC, is considering an expansion of operations into iron ore mining. Your engineers have just completed a 6-month survey designed to determine whether or not a viable mining operation can be mounted on a particular piece of land. This survey cost $500,000 to complete. The results of the survey, along with several other pieces of information, are detailed below: Survey Results: Your engineers estimate that there are 650,000-700,000 tons of recoverable iron ore underneath this land. Investment in CapEx: If you choose to move forward with the project, you will need to invest in several new pieces of mining equipment. The cost of this new equipment is $10,000,000. This equipment will need to be manufactured to your specific needs. Design and construction of this equipment will take one year. Payment is due upon delivery of the new equipment to your site at the end of this year. Once the equipment is built, it will need to be transported and installed onsite at an additional cost of $1,500,000. An additional $500,000 will need to be spent to prepare the site itself for the installation of the new equipment. This includes grading the land, running electrical and water lines, ensuring proper drainage, and making sure all environmental requirements are followed. . Operations: After the equipment has been installed onsite at the end of Year 1, mining operations will commence in Year 2. Your team estimates you can produce 125,000 tons of ore in the first year of mining operations, The amount of ore produced will remain constant for the first four years of Operations: . After the equipment has been installed onsite at the end of Year 1, mining operations will commence in Year 2. Your team estimates you can produce 125,000 tons of ore in the first year of mining operations. The amount of ore produced will remain constant for the first four years of operations at 125,000 tons per year. Beginning with the 5th year of mining operations, as the easier-to-access ore becomes more scarce, your team estimates that the amount of ore produced will begin to decrease by 60% per year, relative to the year prior. This will continue for three years, After the 7th year of mining operations, it is estimated that the mine will no longer be viable and will be shut down. . . Accounting Assumptions: . For the purposes of this analysis, the price of ore is assumed to remain constant for the life of the project. Iron ore currently sells for $125/ton. The operating costs to extract the ore are estimated to be $70 per ton for the life of the project. . Page 3 of 5 In addition to the variable operating costs just outlined, there will be additional fixed costs of $750,000 each year the active mining operations are taking place if you move forward with this project . The investment in equipment and any appropriate associated costs will be depreciated straight-line over 7 years, to an assumed salvage value of zero for accounting purposes. Despite the depreciation assumptions stated earlier, you expect that, at the end of the project's life, you will be able to sell the equipment involved in the project for $2,000,000 During the first year of the project, while the mining equipment is being built, the project will require an additional investment in net working capital of $1,000,000. This level of working capital will remain constant for the life of the project. At the end of the project's life, the full amount of this working capital will be recovered (reduced to $0). The tax rate is assumed to be 30%. Your firm's cost of capital is 14%. All revenues and expenses will be accounted for and recognized at the end of the period in which they take place. rage 4 of 5 Based on the above information and using the "SPRING21 Case Study #1 TEMPLATE.xlsx"workbook provided in Blackboard, answer the following questions: 1. Forecast the incremental free cash flows that will result from an investment in this project. 2. Based upon the cash flows calculated in question 1, what is the NPV of this project? 3. A significant source of uncertainty in this project lies in the base case assumptions made surrounding the prevailing price of iron ore, assumed to be $125/ton, and the costs of production, assumed to be $70/ton. Perform the following sensitivity analysis to give your board a better sense of just how much margin for error there is in this project. a. Holding all other assumptions constant, what is the NPV break-even price of iron ore for this project.? Put another way, what price of iron ore must be realized throughout the life of this project to result in an NPV of zero? b. Holding all other assumptions constant, what is the NPV break-even level of production costs? Tax Rate Cost of Capital 4 125,000 5 125,000 6 50,000 7 30,000 8 18,000 5,250,928 5,250,928 2,100,371 160, 225 756.134 oreanse the incremental free cash flows that would result from an investment in this easiumpsions. At this point, do NOT include any incremental effect of the in panorama from the option to abandon detailed in part 5 n Year 0 2 3 Revenue 125,000 125,000 125,000 Cost of Production (COGS lling Gross Profit 5,250,928 5,250,928 5,250 928 not SGBA vs. RBD ske Other Expenses Depreciation 1714,286 1,714286 1714,286 EBIT 516,714 516 714 income Tax 1,548, 214 1.548 214 1.548, 214 Incremental Earnings PLUS: Depreciation LESS: Capex (12,000,000) LESS: Increase in NWC (1,000,000) Salvaged Equip Cash Flow Free Cash Flows (15 000 000) 480! 285 4,801 7864801.786 1714 286 1.714,286 1.714,286 1.214 286 1.214,285 1.548 214 723214 723214 229 286 3.500.000 1,000,000 1.400.000 3,082,285 4 801 785 4.801.875 1,914 256 1144,285 tion 21 NPV of this project given our base-case assumptions 3.2796 dollars Student Names Netlo Fional Break-even (PVol price of iron ore for this project: 12.00 s/ton con 36 Bruskoven (NPV-level of production costs for this project 0.005/ton Denture con

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts