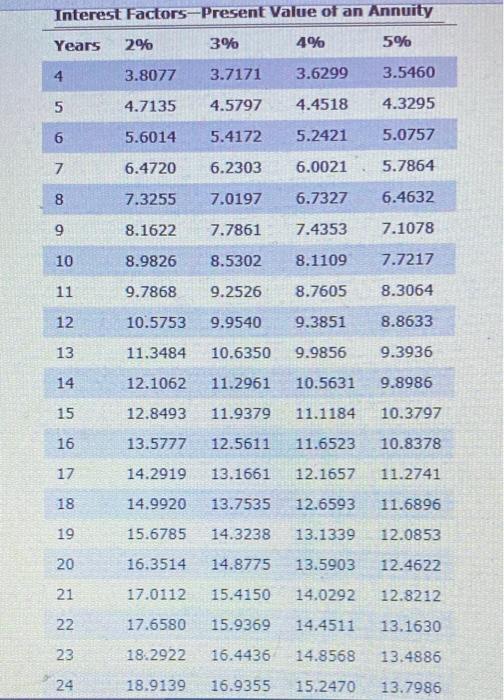

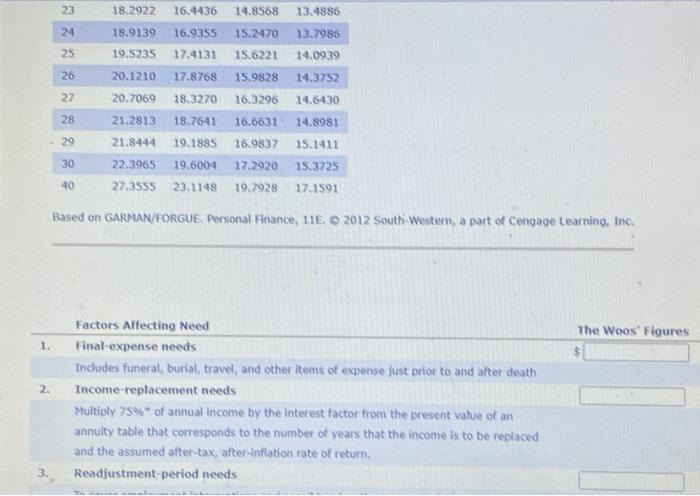

Question: first blank options: 60, 62, or 65. second blank options: 3, 5, or 2. third blank options: 21, 26, or 18. Kathy and Kevin Woo

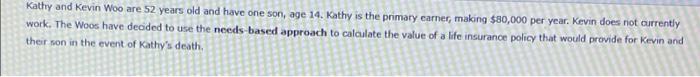

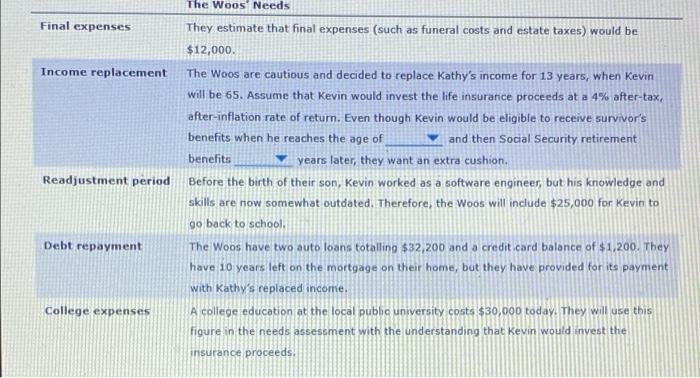

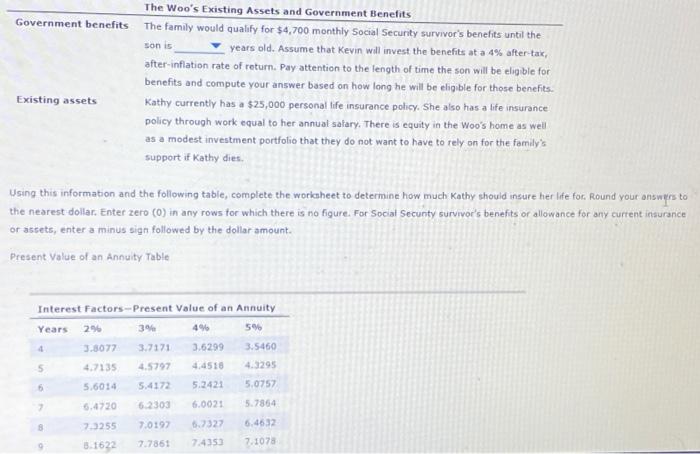

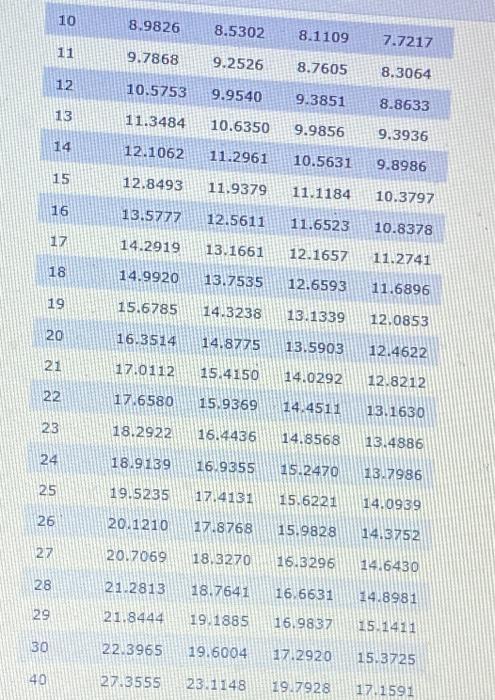

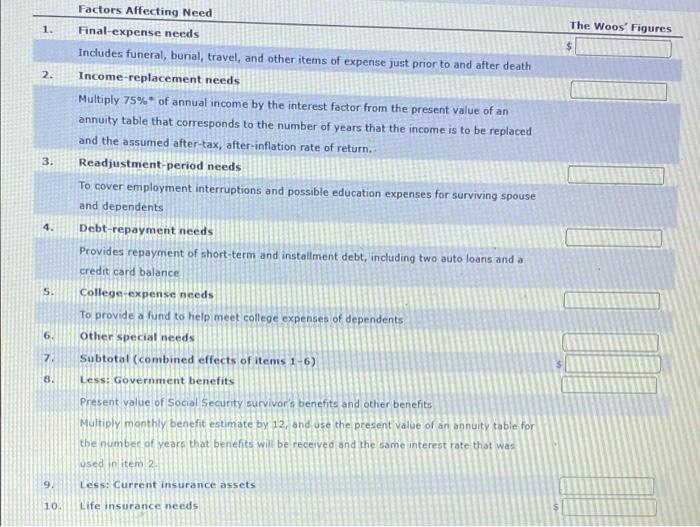

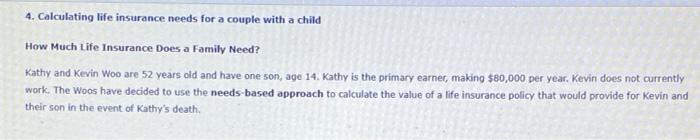

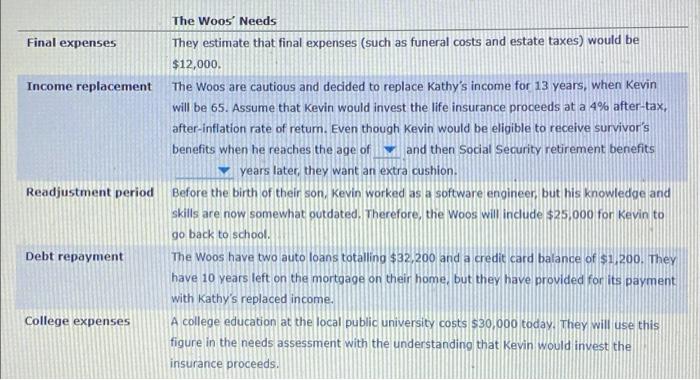

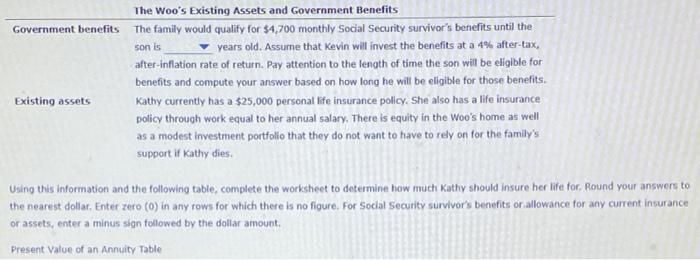

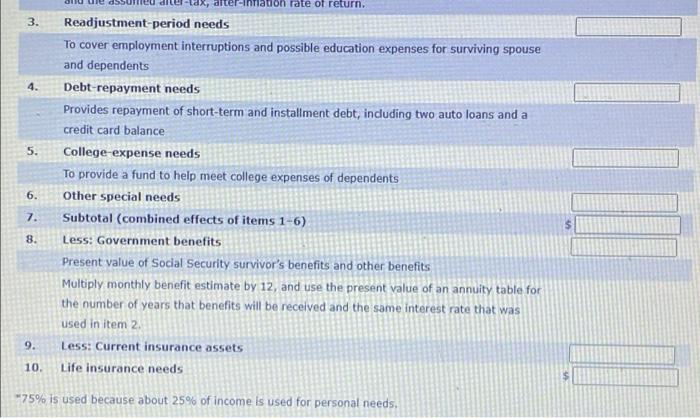

Kathy and Kevin Woo are 52 years old and have one son, age 14. Kathy is the primary carer, making $30,000 per year. Kevin does riot currently work. The Woos have decided to use the needs-based approach to calculate the value of a life insurance policy that would provide for Kevin and their son in the event of Kathy's death, o Final expenses Income replacement Readjustment period The Woos Needs They estimate that final expenses (such as funeral costs and estate taxes) would be $12,000 The Woos are cautious and decided to replace Kathy's income for 13 years, when Kevin will be 65. Assume that Kevin would invest the life insurance proceeds at a 4% after-tax, after-inflation rate of return. Even though Kevin would be eligible to receive survivor's benefits when he reaches the age of and then Social Security retirement benefits years later, they want an extra cushion. Before the birth of their son, Kevin worked as a software engineer, but his knowledge and skills are now somewhat outdated. Therefore, the Woos will include $25,000 for Kevin to go back to school, The Woos have two auto loans totalling $32,200 and a credit card balance of $1,200. They have 10 years left on the mortgage on their home, but they have provided for its payment With Kathy's replaced income. A college education at the local public university costs $30,000 today. They will use this figure in the needs assessment with the understanding that Kevin would invest the insurance proceeds. Debt repayment College expenses Government benefits son is The Woo's Existing Assets and Government Benefits The family would qualify for $4,700 monthly Social Security survivor's benefits until the years old. Assume that Kevin will invest the benefits ata 4% after-tax, after-inflation rate of return. Pay attention to the length of time the son will be eligible for benefits and compute your answer based on how long he will be eligible for those benefits. Kathy currently has a $25,000 personal life insurance policy. She also has a life insurance policy through work equal to her annual salary. There is equity in the Woo's home as well as a modest investment portfolio that they do not want to have to rely on for the family's support if Kathy dies Existing assets Using this information and the following table, complete the woricheet to determine how much Kathy should insure her life for. Round your answers to the nearest dollar. Enter zero (0) in any rows for which there is no figure. For Social Secunty survivor's benefits or allowance for any current insurance or assets, enter a minus sign followed by the dollar amount. Present Value of an Annuity Table Interest Factors-Present Value of an Annuity Years 29 39 4% 59 3.8077 3.6299 3.5460 3.7171 4.5797 5 44510 4.3295 4.7135 5.6014 5 5.4172 5.2421 5.0757 6.4720 62303 6.0021 5.7864 8 723255 7.0192 6.2327 5.4632 7.1078 3.1622 7.7861 7.4353 10 8.9826 8.5302 8.1109 7.7217 11 9.7868 9.2526 8.7605 8.3064 12 10.5753 9.9540 9.3851 8.8633 13 11.3484 10.6350 9.9856 9.3936 14 12.1062 11.2961 10.5631 9.8986 15 12.8493 11.9379 11.1184 10.3797 16 13.5777 12.5611 11.6523 10.8378 17 14.2919 13.1661 12.1657 11.2741 18 14.9920 13.7535 12.6593 11.6896 19 15.6785 14.3238 13.1339 12,0853 20 16.3514 14.8775 13.5903 12.4622 21 17.0112 15.4150 14.0292 12.8212 22 17.6580 15.9369 14.4511 13.1630 23 18.2922 16.4436 14.8568 13.4886 24 18.9139 16.9355 15.2470 13.7986 25 19.5235 17.4131 15.6221 14.0939 26 20.1210 17.8768 15.9828 14.3752 27 20.7069 18.3270 16.3296 14.6430 28 21.2813 18.7641 16.6631 14.8981 29 21.8444 19.1885 16.9837 15.1411 30 2213965 19.6004 1712920 15.3725 40 27.3555 23.1148 19.7928 17.1591 1 The Woos' Figures 2. 3. Factors Affecting Need Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and after death Income replacement needs Multiply 75% of annual income by the interest factor from the present value of an annuity table that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return.. Readjustment period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents Debt-repayme ds Provides repayment of short-term and installment debt, including two auto loans and a credit card balance College-expense needs To provide a fund to help meet college expenses of dependents other special needs Subtotal (combined effects of items 1-6) 4. 5. 6 7. 8 Less: Government benefits Present value of Social Security survivor's benefits and other benefits Multiply monthly benefit estimate by 12, and use the present value of an annuity table for the number of years that benefits will be received and the same interest rate that was used in item 2 9. Less: Current insurance assets 10. Life insurance needs 4. Calculating life insurance needs for a couple with a child How Much Life Insurance Does a Family Need? Kathy and Kevin Woo are 52 years old and have one son, age 14. Kathy is the primary earner, making $80,000 per year. Kevin does not currently work. The Woos have decided to use the needs based approach to calculate the value of a life insurance policy that would provide for Kevin and their son in the event of Kathy's death, Final expenses Income replacement The Woos Needs They estimate that final expenses (such as funeral costs and estate taxes) would be $12,000, The Woos are cautious and decided to replace Kathy's income for 13 years, when Kevin will be 65. Assume that Kevin would invest the life insurance proceeds at a 4% after-tax, after-inflation rate of return. Even though Kevin would be eligible to receive survivor's benefits when he reaches the age of and then Social Security retirement benefits w years later they want an extra cushion. Before the birth of their son, Kevin worked as a software engineer, but his knowledge and skills are now somewhat outdated. Therefore, the Woos will include $25,000 for Kevin to go back to school Readjustment period Debt repayment The Woos have two auto loans totalling $32,200 and a credit card balance of $1200. They have 10 years left on the mortgage on their home, but they have provided for its payment with Kathy's replaced income. A college education at the local public university costs $30,000 today. They will use this figure in the needs assessment with the understanding that Kevin would invest the insurance proceeds. College expenses Government benefits The Woo's Existing Assets and Government Benefits The family would qualify for $4,700 monthly Social Security survivor's benefits until the son is years old. Assume that Kevin will invest the benefits at a 4% after-tax, after-inflation rate of return. Pay attention to the length of time the son will be eligible for benefits and compute your answer based on how long he will be eligible for those benefits. Kathy currently has a $25,000 personal life insurance policy. She also has a life insurance policy through work equal to her annual salary. There is equity in the Woo's home as well as a modest investment portfolio that they do not want to have to rely on for the family's support if Kathy dies. Existing assets Using this information and the following table, complete the worksheet to determine how much Kathy should insure her life for Round your answers to the nearest dollar, Enter zero (0) in any rows for which there is no figure For Social Security survivor's benefits or allowance for any current insurance or assets, enter a minus sign followed by the dollar amount Present Value of an Annuity Table Interest Factors-Present Value of an Annuity Years 2% 3% 4% 5% 4 3.8077 3.7171 3.6299 3.5460 5 4.7135 4.5797 4.4518 4.3295 6 5.6014 5.4172 5.2421 5.0757 7 6.4720 6.2303 6.0021 5.7864 8 7.3255 7.0197 6.7327 6.4632 9 8.1622 7.7861 7.4353 7.1078 10 8.9826 8.5302 8.1109 7.7217 11 9.7868 9.2526 8.7605 8.3064 12 10.5753 9.9540 9.3851 8.8633 13 11.3484 10.6350 9.9856 9.3936 14 12.1062 11.2961 10.5631 9.8986 15 12.8493 11.9379 11.1184 10.3797 16 13.5777 12.5611 11.6523 10.8378 17 14.2919 13.1661 12.1657 11.2741 18 14.9920 13.7535 12.6593 11.6896 19 15.6785 14.3238 13.1339 12.0853 20 16.3514 14.8775 13.5903 12.4622 21 17.0112 15.4150 14.0292 12.8212 22 17.6580 15.9369 14.4511 13.1630 23 18.2922 16.4436 14.8568 13.4886 24 18.9139 16.9355 15.2470 13.7986 23 18.2922 16.4436 14.8568 13.4886 24 18.9139 16.9355 15.2470 13.7986 25 19.5235 17.4131 15.6221 14.0939 26 20.1210 17.8768 15.9828 14.3752 27 20.7069 18.3270 16.3296 14.6430 28 21.2813 18.7641 16.6631 14.8981 29 21.8444 19.1885 16.9837 15.1411 30 22.3965 19.6004 17.2920 15.3725 17.1591 40 273555 23.1148 19.7928 Based on GARMAN/FORGUE. Personal Finance, 116, 2012 South Wester, a part of Cengage Learning, Inc. The Woos Figures 1. 2 Factors Affecting Need Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and after death Income-replacement needs Multiply 75% of annual income by the interest factor from the present value of an annulty table that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after inflation rate of return Readjustment period needs 3. On 3. 4. 5. intiation rate of return. Readjustment period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents Debt-repayment needs Provides repayment of short-term and installment debt, including two auto loans and a credit card balance College-expense needs To provide a fund to help meet college expenses of dependents Other special needs Subtotal (combined effects of items 1-6) Less: Government benefits Present value of Social Security survivor's benefits and other benefits Multiply monthly benefit estimate by 12, and use the present value of an annuity table for the number of years that benefits will be received and the same interest rate that was used in item 2 Less: Current insurance assets Life insurance needs 6. 7. 8. 9. 10. "75% is used because about 25% of income is used for personal needs. Kathy and Kevin Woo are 52 years old and have one son, age 14. Kathy is the primary carer, making $30,000 per year. Kevin does riot currently work. The Woos have decided to use the needs-based approach to calculate the value of a life insurance policy that would provide for Kevin and their son in the event of Kathy's death, o Final expenses Income replacement Readjustment period The Woos Needs They estimate that final expenses (such as funeral costs and estate taxes) would be $12,000 The Woos are cautious and decided to replace Kathy's income for 13 years, when Kevin will be 65. Assume that Kevin would invest the life insurance proceeds at a 4% after-tax, after-inflation rate of return. Even though Kevin would be eligible to receive survivor's benefits when he reaches the age of and then Social Security retirement benefits years later, they want an extra cushion. Before the birth of their son, Kevin worked as a software engineer, but his knowledge and skills are now somewhat outdated. Therefore, the Woos will include $25,000 for Kevin to go back to school, The Woos have two auto loans totalling $32,200 and a credit card balance of $1,200. They have 10 years left on the mortgage on their home, but they have provided for its payment With Kathy's replaced income. A college education at the local public university costs $30,000 today. They will use this figure in the needs assessment with the understanding that Kevin would invest the insurance proceeds. Debt repayment College expenses Government benefits son is The Woo's Existing Assets and Government Benefits The family would qualify for $4,700 monthly Social Security survivor's benefits until the years old. Assume that Kevin will invest the benefits ata 4% after-tax, after-inflation rate of return. Pay attention to the length of time the son will be eligible for benefits and compute your answer based on how long he will be eligible for those benefits. Kathy currently has a $25,000 personal life insurance policy. She also has a life insurance policy through work equal to her annual salary. There is equity in the Woo's home as well as a modest investment portfolio that they do not want to have to rely on for the family's support if Kathy dies Existing assets Using this information and the following table, complete the woricheet to determine how much Kathy should insure her life for. Round your answers to the nearest dollar. Enter zero (0) in any rows for which there is no figure. For Social Secunty survivor's benefits or allowance for any current insurance or assets, enter a minus sign followed by the dollar amount. Present Value of an Annuity Table Interest Factors-Present Value of an Annuity Years 29 39 4% 59 3.8077 3.6299 3.5460 3.7171 4.5797 5 44510 4.3295 4.7135 5.6014 5 5.4172 5.2421 5.0757 6.4720 62303 6.0021 5.7864 8 723255 7.0192 6.2327 5.4632 7.1078 3.1622 7.7861 7.4353 10 8.9826 8.5302 8.1109 7.7217 11 9.7868 9.2526 8.7605 8.3064 12 10.5753 9.9540 9.3851 8.8633 13 11.3484 10.6350 9.9856 9.3936 14 12.1062 11.2961 10.5631 9.8986 15 12.8493 11.9379 11.1184 10.3797 16 13.5777 12.5611 11.6523 10.8378 17 14.2919 13.1661 12.1657 11.2741 18 14.9920 13.7535 12.6593 11.6896 19 15.6785 14.3238 13.1339 12,0853 20 16.3514 14.8775 13.5903 12.4622 21 17.0112 15.4150 14.0292 12.8212 22 17.6580 15.9369 14.4511 13.1630 23 18.2922 16.4436 14.8568 13.4886 24 18.9139 16.9355 15.2470 13.7986 25 19.5235 17.4131 15.6221 14.0939 26 20.1210 17.8768 15.9828 14.3752 27 20.7069 18.3270 16.3296 14.6430 28 21.2813 18.7641 16.6631 14.8981 29 21.8444 19.1885 16.9837 15.1411 30 2213965 19.6004 1712920 15.3725 40 27.3555 23.1148 19.7928 17.1591 1 The Woos' Figures 2. 3. Factors Affecting Need Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and after death Income replacement needs Multiply 75% of annual income by the interest factor from the present value of an annuity table that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return.. Readjustment period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents Debt-repayme ds Provides repayment of short-term and installment debt, including two auto loans and a credit card balance College-expense needs To provide a fund to help meet college expenses of dependents other special needs Subtotal (combined effects of items 1-6) 4. 5. 6 7. 8 Less: Government benefits Present value of Social Security survivor's benefits and other benefits Multiply monthly benefit estimate by 12, and use the present value of an annuity table for the number of years that benefits will be received and the same interest rate that was used in item 2 9. Less: Current insurance assets 10. Life insurance needs 4. Calculating life insurance needs for a couple with a child How Much Life Insurance Does a Family Need? Kathy and Kevin Woo are 52 years old and have one son, age 14. Kathy is the primary earner, making $80,000 per year. Kevin does not currently work. The Woos have decided to use the needs based approach to calculate the value of a life insurance policy that would provide for Kevin and their son in the event of Kathy's death, Final expenses Income replacement The Woos Needs They estimate that final expenses (such as funeral costs and estate taxes) would be $12,000, The Woos are cautious and decided to replace Kathy's income for 13 years, when Kevin will be 65. Assume that Kevin would invest the life insurance proceeds at a 4% after-tax, after-inflation rate of return. Even though Kevin would be eligible to receive survivor's benefits when he reaches the age of and then Social Security retirement benefits w years later they want an extra cushion. Before the birth of their son, Kevin worked as a software engineer, but his knowledge and skills are now somewhat outdated. Therefore, the Woos will include $25,000 for Kevin to go back to school Readjustment period Debt repayment The Woos have two auto loans totalling $32,200 and a credit card balance of $1200. They have 10 years left on the mortgage on their home, but they have provided for its payment with Kathy's replaced income. A college education at the local public university costs $30,000 today. They will use this figure in the needs assessment with the understanding that Kevin would invest the insurance proceeds. College expenses Government benefits The Woo's Existing Assets and Government Benefits The family would qualify for $4,700 monthly Social Security survivor's benefits until the son is years old. Assume that Kevin will invest the benefits at a 4% after-tax, after-inflation rate of return. Pay attention to the length of time the son will be eligible for benefits and compute your answer based on how long he will be eligible for those benefits. Kathy currently has a $25,000 personal life insurance policy. She also has a life insurance policy through work equal to her annual salary. There is equity in the Woo's home as well as a modest investment portfolio that they do not want to have to rely on for the family's support if Kathy dies. Existing assets Using this information and the following table, complete the worksheet to determine how much Kathy should insure her life for Round your answers to the nearest dollar, Enter zero (0) in any rows for which there is no figure For Social Security survivor's benefits or allowance for any current insurance or assets, enter a minus sign followed by the dollar amount Present Value of an Annuity Table Interest Factors-Present Value of an Annuity Years 2% 3% 4% 5% 4 3.8077 3.7171 3.6299 3.5460 5 4.7135 4.5797 4.4518 4.3295 6 5.6014 5.4172 5.2421 5.0757 7 6.4720 6.2303 6.0021 5.7864 8 7.3255 7.0197 6.7327 6.4632 9 8.1622 7.7861 7.4353 7.1078 10 8.9826 8.5302 8.1109 7.7217 11 9.7868 9.2526 8.7605 8.3064 12 10.5753 9.9540 9.3851 8.8633 13 11.3484 10.6350 9.9856 9.3936 14 12.1062 11.2961 10.5631 9.8986 15 12.8493 11.9379 11.1184 10.3797 16 13.5777 12.5611 11.6523 10.8378 17 14.2919 13.1661 12.1657 11.2741 18 14.9920 13.7535 12.6593 11.6896 19 15.6785 14.3238 13.1339 12.0853 20 16.3514 14.8775 13.5903 12.4622 21 17.0112 15.4150 14.0292 12.8212 22 17.6580 15.9369 14.4511 13.1630 23 18.2922 16.4436 14.8568 13.4886 24 18.9139 16.9355 15.2470 13.7986 23 18.2922 16.4436 14.8568 13.4886 24 18.9139 16.9355 15.2470 13.7986 25 19.5235 17.4131 15.6221 14.0939 26 20.1210 17.8768 15.9828 14.3752 27 20.7069 18.3270 16.3296 14.6430 28 21.2813 18.7641 16.6631 14.8981 29 21.8444 19.1885 16.9837 15.1411 30 22.3965 19.6004 17.2920 15.3725 17.1591 40 273555 23.1148 19.7928 Based on GARMAN/FORGUE. Personal Finance, 116, 2012 South Wester, a part of Cengage Learning, Inc. The Woos Figures 1. 2 Factors Affecting Need Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and after death Income-replacement needs Multiply 75% of annual income by the interest factor from the present value of an annulty table that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after inflation rate of return Readjustment period needs 3. On 3. 4. 5. intiation rate of return. Readjustment period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents Debt-repayment needs Provides repayment of short-term and installment debt, including two auto loans and a credit card balance College-expense needs To provide a fund to help meet college expenses of dependents Other special needs Subtotal (combined effects of items 1-6) Less: Government benefits Present value of Social Security survivor's benefits and other benefits Multiply monthly benefit estimate by 12, and use the present value of an annuity table for the number of years that benefits will be received and the same interest rate that was used in item 2 Less: Current insurance assets Life insurance needs 6. 7. 8. 9. 10. "75% is used because about 25% of income is used for personal needs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts