Question: First Blank - options are Accelerated or Straight-Line Second Blank - options are 35,945, 44,931, 46,729, 34,148 Now determine what the project's NPV would be

First Blank - options are Accelerated or Straight-Line

Second Blank - options are 35,945, 44,931, 46,729, 34,148

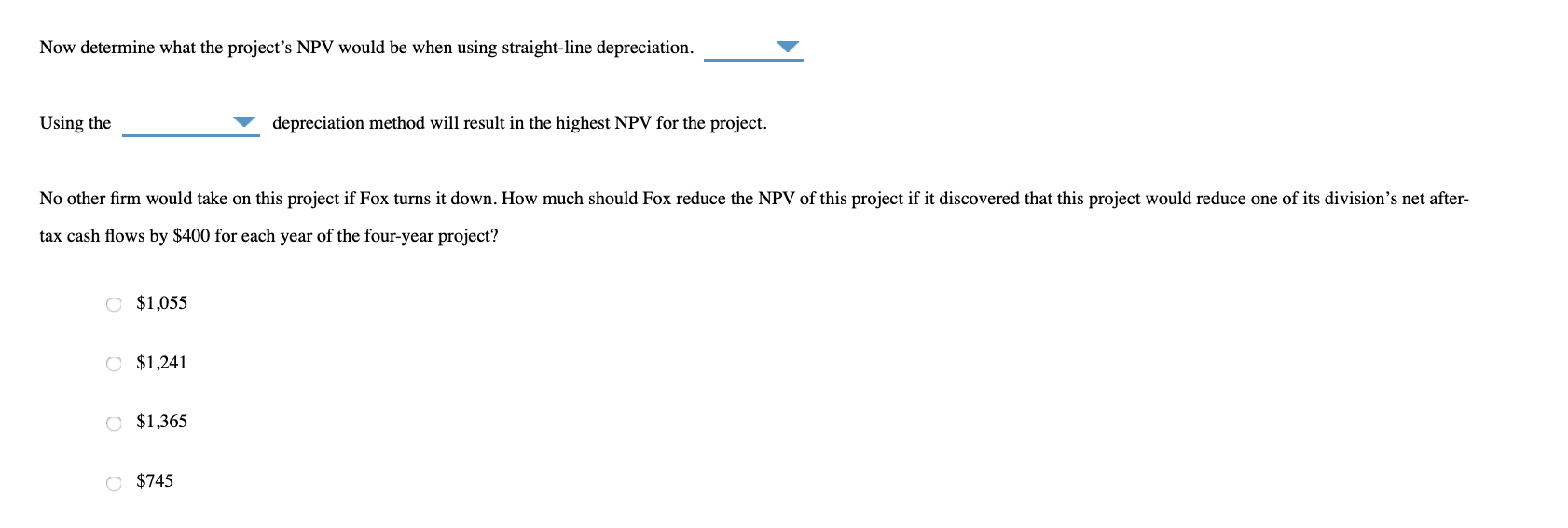

Now determine what the project's NPV would be when using straight-line depreciation. Using the depreciation method will result in the highest NPV for the project. No other firm would take on this project if Fox turns it down. How much should Fox reduce the NPV of this project if it discovered that this project would reduce one of its division's net after- tax cash flows by $400 for each year of the four-year project? o $1,055 o $1,241 o $1,365 O $745 Now determine what the project's NPV would be when using straight-line depreciation. Using the depreciation method will result in the highest NPV for the project. No other firm would take on this project if Fox turns it down. How much should Fox reduce the NPV of this project if it discovered that this project would reduce one of its division's net after- tax cash flows by $400 for each year of the four-year project? o $1,055 o $1,241 o $1,365 O $745

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts