Question: First, calculate your TAKE HOME/NEI PAY . Firstly, you will deduct your 401K contributions. You must contribute 3%. Next, you will calculate your FICA andfederal

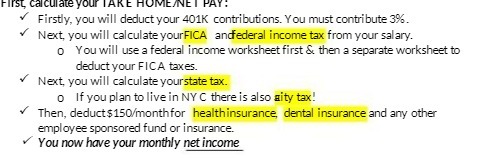

First, calculate your TAKE HOME/NEI PAY . Firstly, you will deduct your 401K contributions. You must contribute 3%. Next, you will calculate your FICA andfederal income tax from your salary. o You will use a federal income worksheet first & then a separate worksheet to deduct your FICA taxes. Next, you will calculate yourstate tax. o If you plan to live in NY C there is also aity tax! Then, deduct$150/monthfor healthinsurance, dental insurance and any other employee sponsored fund or insurance. You now have your monthly net income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock