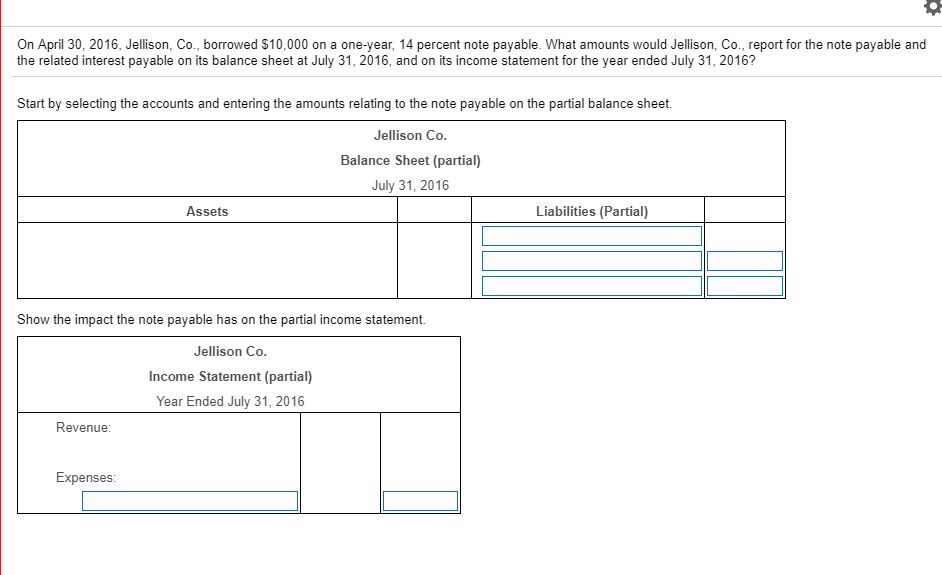

Question: First column options are: Current Liabilities & Long Term Liabilities Second & Third column: Interest Expense, Interest payable, Note Payable ( Long term), Note payable

First column options are: Current Liabilities & Long Term Liabilities

Second & Third column: Interest Expense, Interest payable, Note Payable ( Long term), Note payable (short term)

Income Statement (Partial) Columns

Only column: Interest expense, interest payable, Note payable (short term)

On April 30, 2016, Jellison, Co., borrowed $10,000 on a one-year, 14 percent note payable. What amounts would Jellison, Co., report for the note payable and the related interest payable on its balance sheet at July 31, 2016, and on its income statement for the year ended July 31, 2016? Start by selecting the accounts and entering the amounts relating to the note payable on the partial balance sheet. Jellison Co. Balance Sheet (partial) July 31, 2016 Assets Liabilities (Partial) Show the impact the note payable has on the partial income statement. Jellison Co. Income Statement (partial) Year Ended July 31, 2016 Revenue Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts