Question: First drop down- is/is not Second drop down- should not change the capital structure/should substitute some debt for equity/ should substitute some equity for debt.

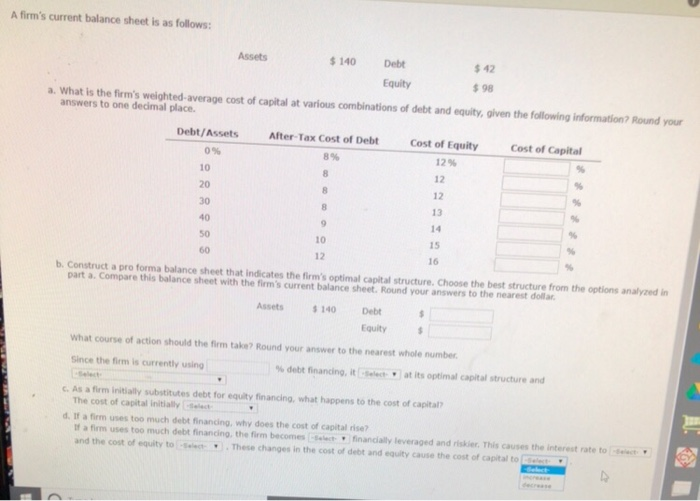

A firm's current balance sheet is as follows Assets $140 Debt $ 42 s 98 Equity a. What is the firm's weighted-average cost of capital at various combinations of debt and equity, given the following information? Round your answers to one decimal place. Debt/Assets After-Tax Cost of Debt Cost of EquityCost of Capital 0% 10 20 30 40 50 60 8% 12% 12 12 13 14 15 16 10 12 b. Construct a pro forma balance sheet that indicates the firm's optimal capital structure. Choose the best structure from the options analyzed in part a. Compare this balance sheet with the firm's current balance sheet. Round your answers to the nearest dollar Assets $140Debt Equity What course of action should the firm take? Round your answer to the nearest whole number Since the firm is currently using % debt financing, it Ehler, at its optimal capital structure and c. As a firm initially substitutes debt for equity financing, what happens to the cost of capital The cost of capital initially Slc d. If a firm uses too much debt financing, why does the cost of capital rise? a firm uses too much debt financing, the firm becomes -select. financially leveraged and riskier. This causes the interest rate to 4-ie , and the cost of equity toSelec These changes in the cost of debt and equity cause the cost of capital to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts