Question: First Duration, a securities dealer, has a leverage-adjusted duration gap of 1.7 years, $52 million in assets, 7 percent equity to assets ratio, and

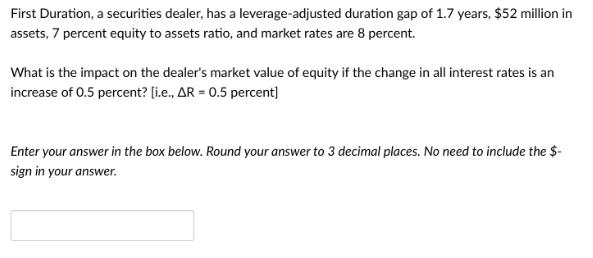

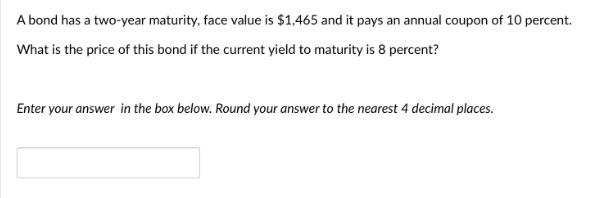

First Duration, a securities dealer, has a leverage-adjusted duration gap of 1.7 years, $52 million in assets, 7 percent equity to assets ratio, and market rates are 8 percent. What is the impact on the dealer's market value of equity if the change in all interest rates is an increase of 0.5 percent? [i.e., AR = 0.5 percent] Enter your answer in the box below. Round your answer to 3 decimal places. No need to include the $- sign in your answer. A bond has a two-year maturity, face value is $1,465 and it pays an annual coupon of 10 percent. What is the price of this bond if the current yield to maturity is 8 percent? Enter your answer in the box below. Round your answer to the nearest 4 decimal places.

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below 1 The impact on the dealers market valu... View full answer

Get step-by-step solutions from verified subject matter experts