Question: FIRST FILL OUT THE INPUT SECTION: NEXT FILL OUT THE OUTPUT SECTION: Houston Electronics is a midsized electronics manufacturer located in Houston, Texas. The company

FIRST FILL OUT THE INPUT SECTION:

NEXT FILL OUT THE OUTPUT SECTION:

NEXT FILL OUT THE OUTPUT SECTION:

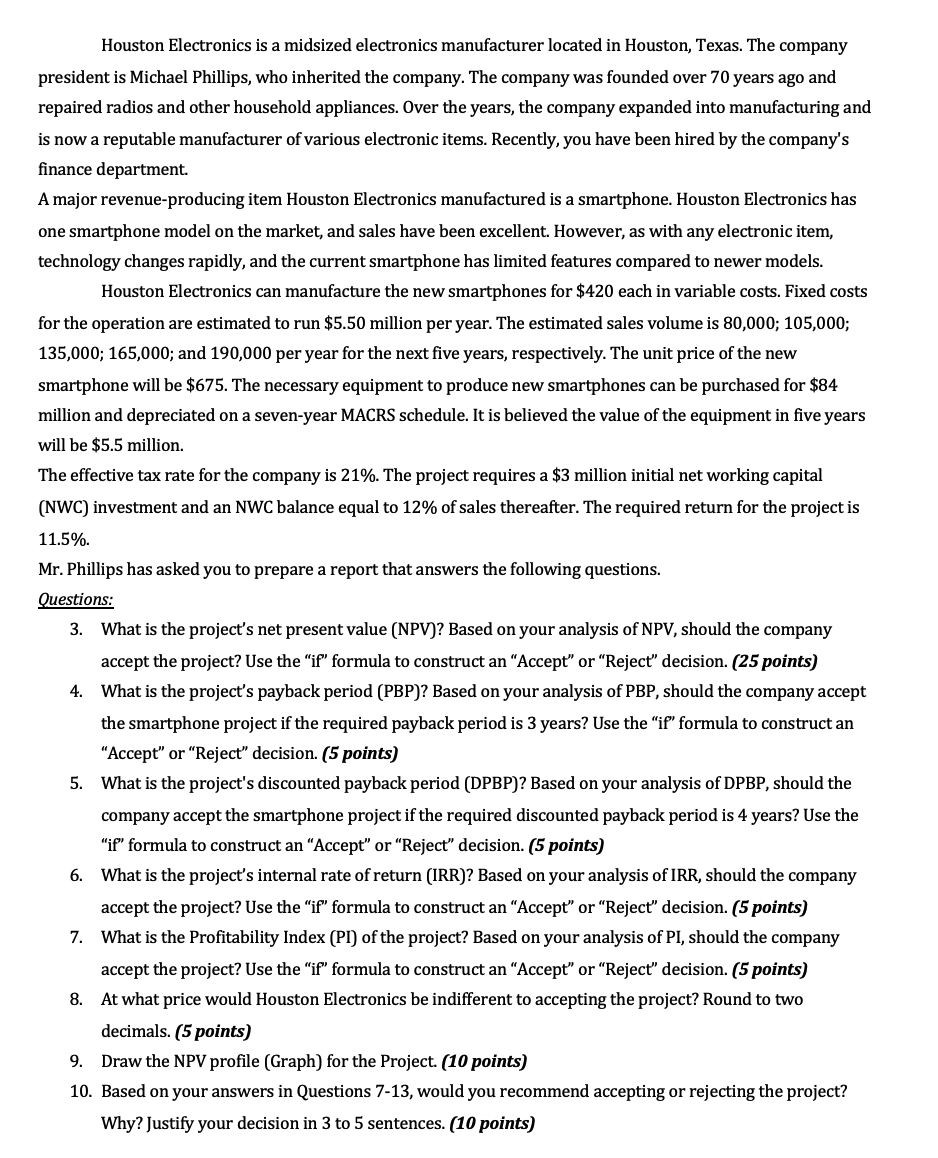

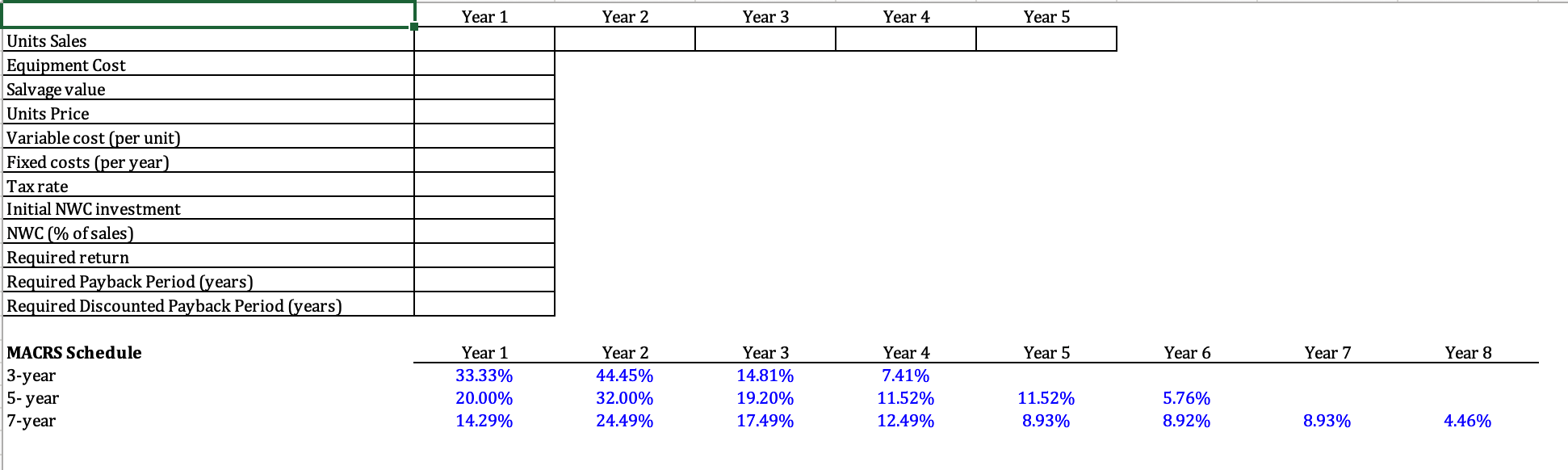

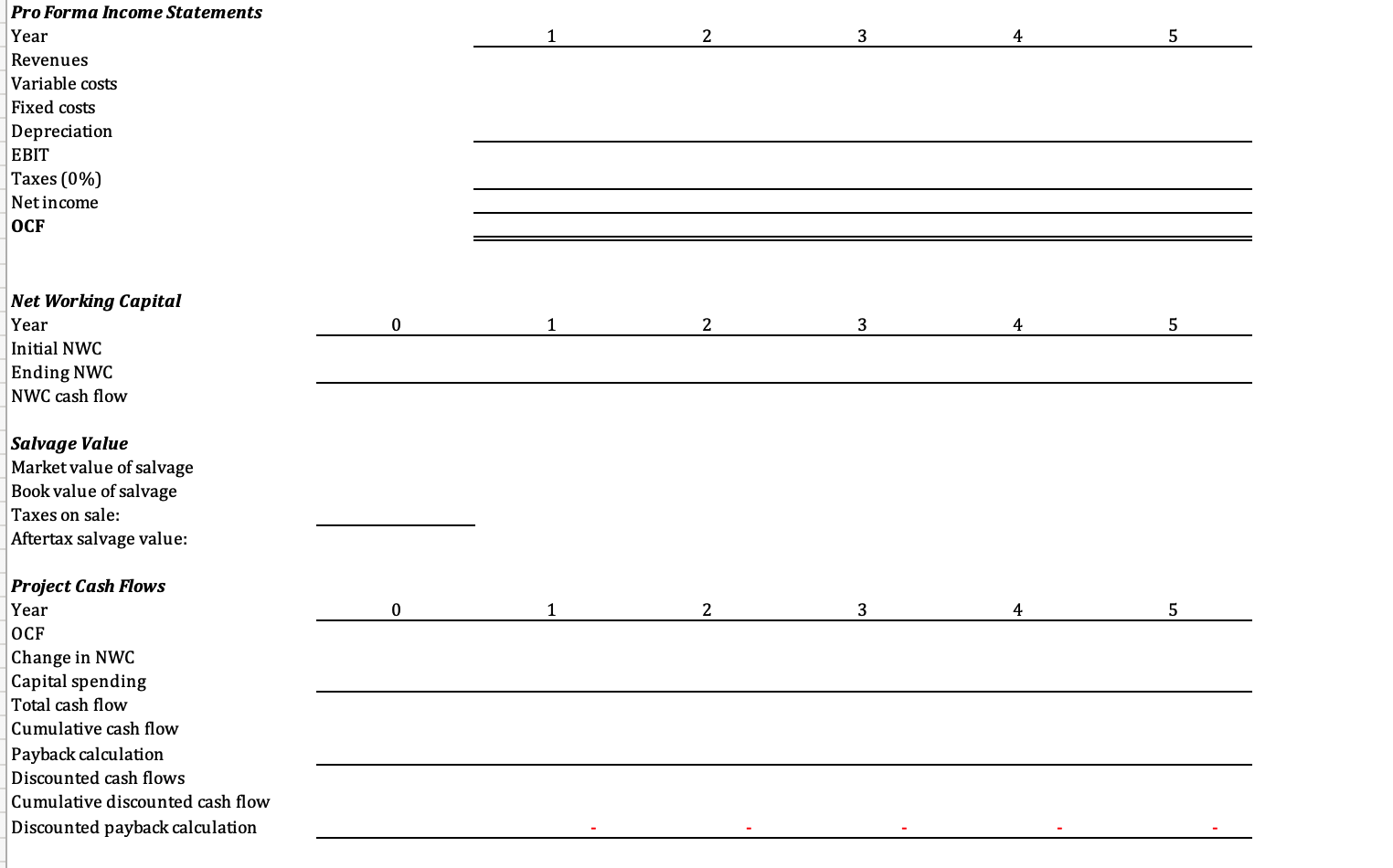

Houston Electronics is a midsized electronics manufacturer located in Houston, Texas. The company president is Michael Phillips, who inherited the company. The company was founded over 70 years ago and repaired radios and other household appliances. Over the years, the company expanded into manufacturing and is now a reputable manufacturer of various electronic items. Recently, you have been hired by the company's finance department. A major revenue-producing item Houston Electronics manufactured is a smartphone. Houston Electronics has one smartphone model on the market, and sales have been excellent. However, as with any electronic item, technology changes rapidly, and the current smartphone has limited features compared to newer models. Houston Electronics can manufacture the new smartphones for $420 each in variable costs. Fixed costs for the operation are estimated to run $5.50 million per year. The estimated sales volume is 80,000;105,000; 135,000;165,000; and 190,000 per year for the next five years, respectively. The unit price of the new smartphone will be $675. The necessary equipment to produce new smartphones can be purchased for $84 million and depreciated on a seven-year MACRS schedule. It is believed the value of the equipment in five years will be $5.5 million. The effective tax rate for the company is 21%. The project requires a $3 million initial net working capital (NWC) investment and an NWC balance equal to 12% of sales thereafter. The required return for the project is 11.5% Mr. Phillips has asked you to prepare a report that answers the following questions. Questions: 3. What is the project's net present value (NPV)? Based on your analysis of NPV, should the company accept the project? Use the "if" formula to construct an "Accept" or "Reject" decision. (25 points) 4. What is the project's payback period (PBP)? Based on your analysis of PBP, should the company accept the smartphone project if the required payback period is 3 years? Use the "if" formula to construct an "Accept" or "Reject" decision. (5 points) 5. What is the project's discounted payback period (DPBP)? Based on your analysis of DPBP, should the company accept the smartphone project if the required discounted payback period is 4 years? Use the "if" formula to construct an "Accept" or "Reject" decision. (5 points) 6. What is the project's internal rate of return (IRR)? Based on your analysis of IRR, should the company accept the project? Use the "if" formula to construct an "Accept" or "Reject" decision. (5 points) 7. What is the Profitability Index (PI) of the project? Based on your analysis of PI, should the company accept the project? Use the "if" formula to construct an "Accept" or "Reject" decision. (5 points) 8. At what price would Houston Electronics be indifferent to accepting the project? Round to two decimals. ( 5 points) 9. Draw the NPV profile (Graph) for the Project. (10 points) 10. Based on your answers in Questions 7-13, would you recommend accepting or rejecting the project? Why? Justify your decision in 3 to 5 sentences. (10 points) MACRS Schedule 3-year 5- year \begin{tabular}{rrcccccc} Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 & Year 8 \\ \hline 33.33% & 44.45% & 14.81% & 7.41% & & & & \\ 20.00% & 32.00% & 19.20% & 11.52% & 11.52% & 5.76% & \\ 14.29% & 24.49% & 17.49% & 12.49% & 8.93% & 8.92% & 8.93% & 4.46% \end{tabular} Pro Forma Income Statements Year \begin{tabular}{lllll} 1 & 2 & 4 & 5 \\ \hline \end{tabular} Revenues Variable costs Fixed costs Depreciation EBIT Taxes (0%) Net income OCF Net Working Capital Year 0 0 2 3 5 Initial NWC Ending NWC NWC cash flow Salvage Value Market value of salvage Book value of salvage Taxes on sale: Aftertax salvage value: Project Cash Flows Year 0 1 2 OCF Change in NWC Capital spending Total cash flow Cumulative cash flow Payback calculation Discounted cash flows Cumulative discounted cash flow Discounted payback calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts