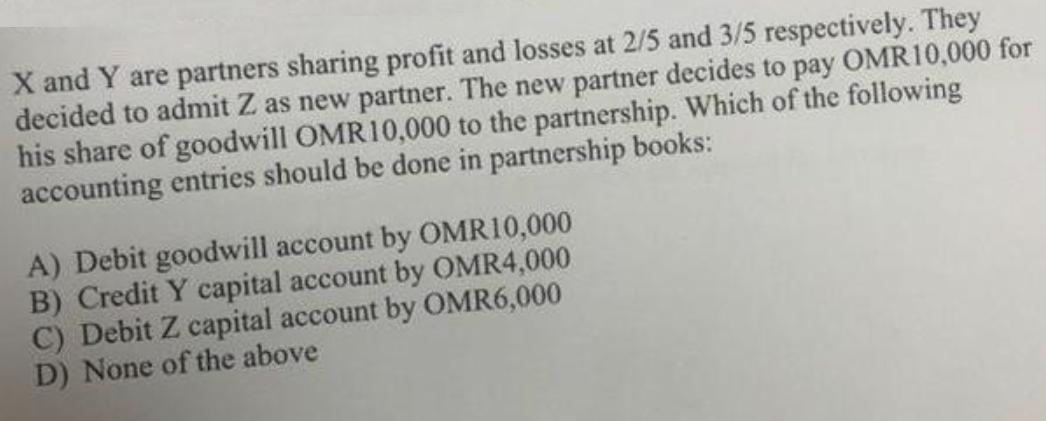

Question: X and Y are partners sharing profit and losses at 2/5 and 3/5 respectively. They decided to admit Z as new partner. The new

X and Y are partners sharing profit and losses at 2/5 and 3/5 respectively. They decided to admit Z as new partner. The new partner decides to pay OMR10,000 for his share of goodwill OMR10,000 to the partnership. Which of the following accounting entries should be done in partnership books: A) Debit goodwill account by OMR10,000 B) Credit Y capital account by OMR4,000 C) Debit Z capital account by OMR6,000 D) None of the above

Step by Step Solution

There are 3 Steps involved in it

2s Share Goodwill og e Sacrificing ratio 21 not z ... View full answer

Get step-by-step solutions from verified subject matter experts