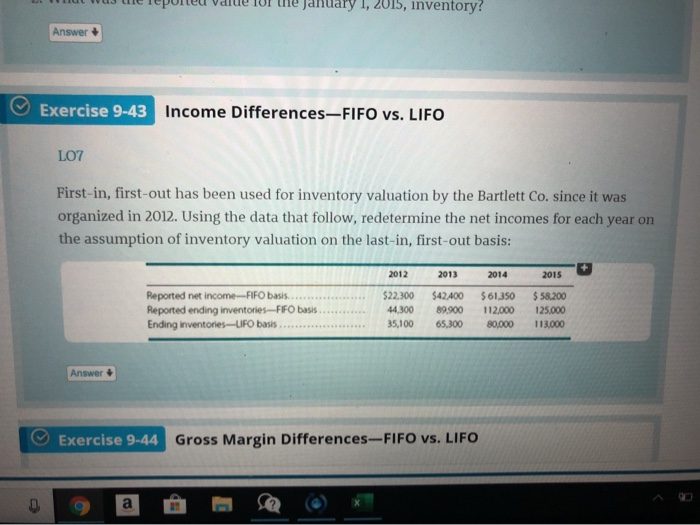

Question: First in , first-out has been used for inventory valuation by the Bartlett Co. since it was organized in 2012. Using the data that follow,

uary 1, 2015, inventory? Answer Exercise 9-43 Income Differences-Fl FO vs. LIFO LO7 First-in, first-out has been used for inventory valuation by the Bartlett Co. since it was organized in 2012. Using the data that follow, redetermine the net incomes for each year on the assumption of inventory valuation on the last-in, first-out basis: 2012 2013 2014 2015 Reported net income-FIFO basis. Reported ending inventories-FIFO basis Ending inventories-LIFO basis $22,300 $42400 $61,350 $58.200 44,300 89900 112,000 125.000 35,100 65,300 80,000 113,000 Answer Exercise 9-44 Gross Margin Differences-FIFO vs. LIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts