Question: first one pleaseee Maxwell Feed & Seed is considering a project that has an initial cash outflow of $7.400. Expected cash inflows are $2.000 in

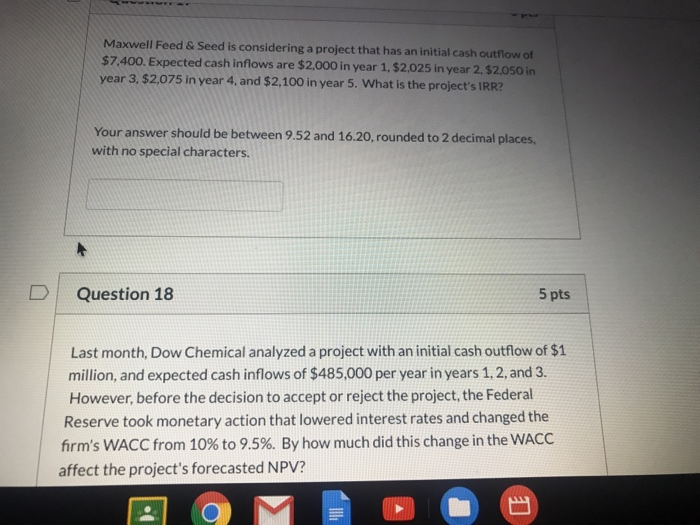

Maxwell Feed & Seed is considering a project that has an initial cash outflow of $7.400. Expected cash inflows are $2.000 in year 1, $2,025 in year 2.52.050 in year 3. $2,075 in year 4. and $2,100 in year 5. What is the project's IRR Your answer should be between 9.52 and 16.20 rounded to 2 decimal places. with no special characters. D Question 18 5 pts Last month, Dow Chemical analyzed a project with an initial cash outflow of $1 million, and expected cash inflows of $485,000 per year in years 1, 2, and 3. However, before the decision to accept or reject the project, the Federal Reserve took monetary action that lowered interest rates and changed the firm's WACC from 10% to 9.5%. By how much did this change in the WACC affect the project's forecasted NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts