Question: First options: make deposits, accept deposits Second options: make loans, purchase stocks and bonds Third options: loans, deposits What Are the Differences Between Depository and

First options: make deposits, accept deposits

Second options: make loans, purchase stocks and bonds

Third options: loans, deposits

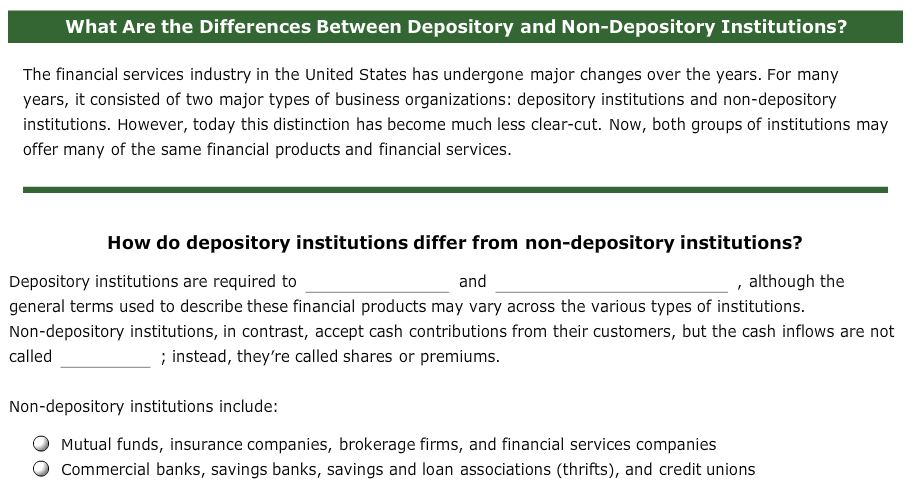

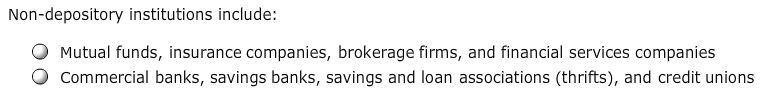

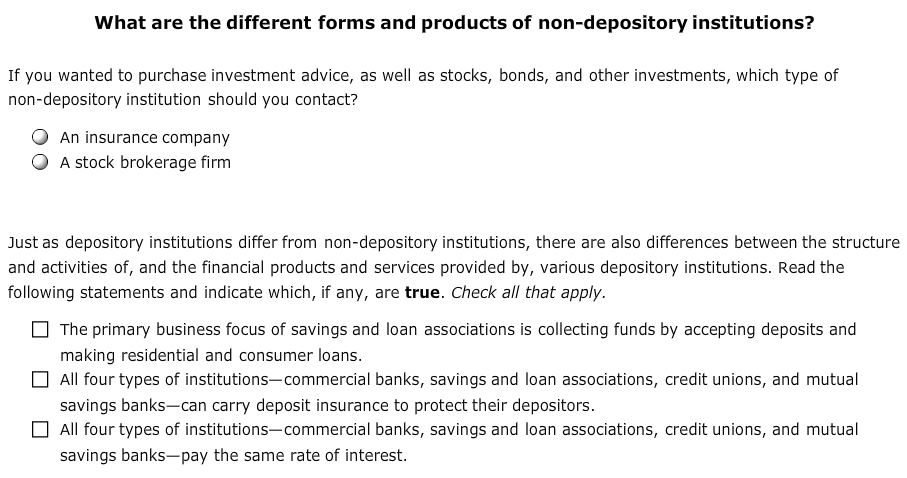

What Are the Differences Between Depository and Non-Depository Institutions? The financial services industry in the United States has undergone major changes over the years. For many years, it consisted of two major types of business organizations: depository institutions and non-depository institutions. However, today this distinction has become much less clear-cut. Now, both groups of institutions may offer many of the same financial products and financial services. How do depository institutions differ from non-depository institutions? although the Depository institutions are required to general terms used to describe these financial products may vary across the various types of institutions. Non-depository institutions, in contrast, accept cash contributions from their customers, but the cash inflows are not called and ; instead, they're called shares or premiums. Non-depository institutions include: O Mutual funds, insurance companies, brokerage firms, and financial services companies O Commercial banks, savings banks, savings and loan associations (thrifts), and credit unions Non-depository institutions include: O Mutual funds, insurance companies, brokerage firms, and financial services companies O Commercial banks, savings banks, savings and loan associations (thrifts), and credit unions What are the different forms and products of non-depository institutions? If you wanted to purchase investment advice, as well as stocks, bonds, and other investments, which type of non-depository institution should you contact? O An insurance company O A stock brokerage firm Just as depository institutions differ from non-depository institutions, there are also differences between the structure and activities of, and the financial products and services provided by, various depository institutions. Read the following statements and indicate which, if any, are true. Check all that apply. The primary business focus of savings and loan associations is collecting funds by accepting deposits and making residential and consumer loans. All four types of institutions-commercial banks, savings and loan associations, credit unions, and mutual savings banks-can carry deposit insurance to protect their depositors All four types of institutions-commercial banks, savings and loan associations, credit unions, and mutual savings banks-pay the same rate of interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts