Question: first page is done, only need second page Problem 2 - 40 points Name Vincenze Lebare The management of XYZ Manufacturing Company prepared the following

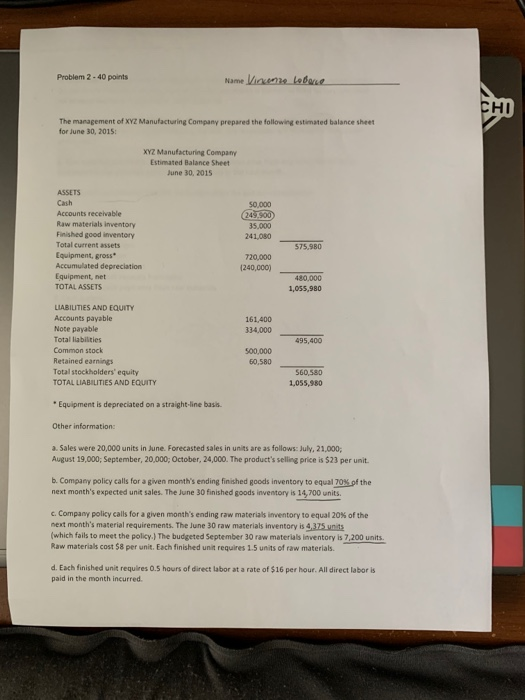

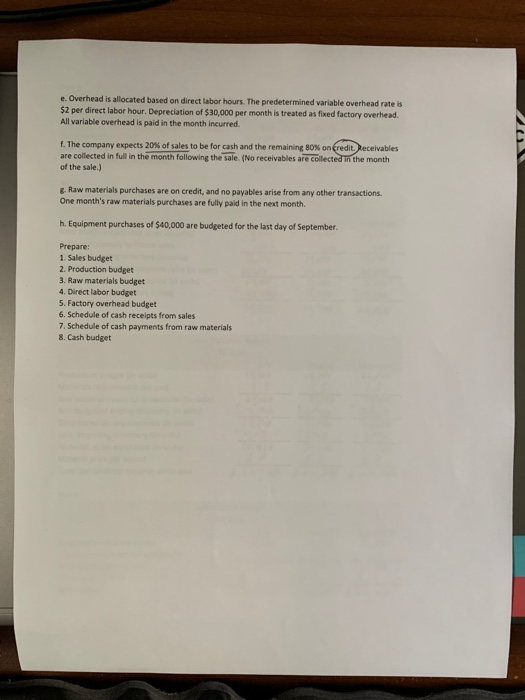

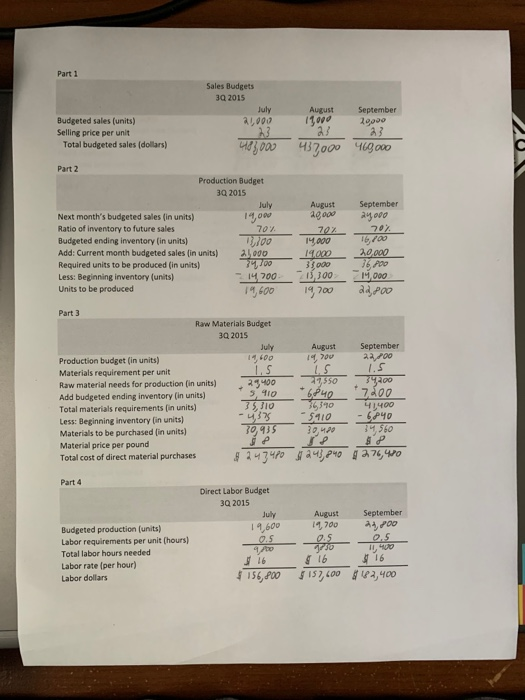

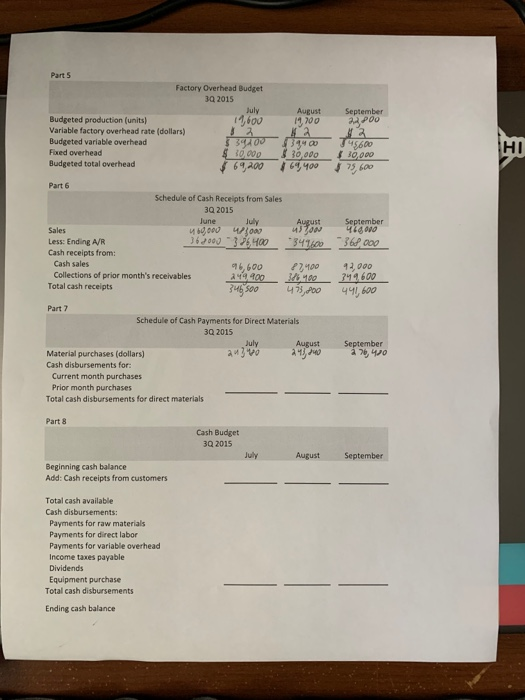

Problem 2 - 40 points Name Vincenze Lebare The management of XYZ Manufacturing Company prepared the following estimated balance sheet for June 30, 2015: XYZ Manufacturing Company Estimated Balance Sheet June 30, 2015 ASSETS Cash Accounts receivable Raw materials inventory Finished good inventory Total current assets Equipment, gross Accumulated depreciation Equipment, net TOTAL ASSETS 50.000 2400) 35.000 241.080 575.900 720,000 (240,000) 480,000 1,055,980 161,400 334,000 495,400 LIABILITIES AND EQUITY Accounts payable Note payable Total liabilities Common stock Retained earnings Total stockholders' equity TOTAL LIABILITIES AND EQUITY 500.000 60.580 560,580 1,055,980 * Equipment is depreciated on a straight-line basis Other information a. Sales were 20,000 units in June. Forecasted sales in units are as follows: July 21,000; August 19,000; September, 20,000; October, 24,000. The product's selling price is $23 per unit. b. Company policy calls for a given month's ending finished goods inventory to equal 70% of the next month's expected unit sales. The June 30 finished goods inventory is 14,700 units. c. Company policy calls for a given month's ending raw materials inventory to equal 20% of the next month's material requirements. The June 30 raw materials inventory is 4,375 units (which fails to meet the policy.) The budgeted September 30 raw materials inventory is 7,200 units Raw materials cost $8 per unit. Each finished unit requires 1.5 units of raw materials d. Each finished unit requires 0.5 hours of direct laborat a rate of $16 per hour. All direct laboris paid in the month incurred e. Overhead is allocated based on direct labor hours. The predetermined variable overhead rate is $2 per direct labor hour. Depreciation of $30,000 per month is treated as fixed factory overhead. All variable overhead is paid in the month incurred. 1. The company expects 20% of sales to be for cash and the remaining Box on credit.Receivables are collected in full in the month following the sale. (No receivables are collected in the month of the sale.) Raw materials purchases are on credit, and no payables arise from any other transactions. One month's raw materials purchases are fully paid in the next month. h. Equipment purchases of $40,000 are budgeted for the last day of September Prepare 1. Sales budget 2. Production budget 3. Raw materials budget 4. Direct labor budget 5. Factory overhead budget 6. Schedule of cash receipts from sales 7. Schedule of cash payments from raw materials 8. Cash budget Sales Budgets 30 2015 July 21000 Budgeted sales (units) Selling price per unit Total budgeted sales (dollars) August September 10. 2000 22 23 437,000 460000 17 4183,000 14,000 Part 2 Production Budget 3Q 2015 July Next month's budgeted sales in units) Ratio of inventory to future sales 70%. Budgeted ending Inventory (in units) do Add: Current month budgeted sales in units) 2000 Required units to be produced in units) 7700 Less: Beginning inventory (units) - 14.700 Units to be produced 19,600 August 480p 70% 14000 19.000 33.000 215,300 19,700 September Ayo 70% 700 20.000 76 PE 14000 2,200 August 1970 Part 3 Raw Materials Budget 3Q 2015 July Production budget (in units) 14.00 Materials requirement per unit 1.5 Raw material needs for production (in units) 29400 Add budgeted ending inventory (in units) 5,910 Total materials requirements (in units) 35,310 Less: Beginning inventory (in units) -4375 Materials to be purchased in units) 30,935 Material price per pound je Total cost of direct material purchases # 247470 IS 297550 6840 September 22 700 1.S 33400 +7,500 41,400 - 5240 34,560 HP 376, - 5910 241, P4 Part 4 Direct Labor Budget 3Q 2015 July 19,600 August 14,700 0.5 1730 Budgeted production (units) Labor requirements per unit (hours) Total labor hours needed Labor rate (per hour) Labor dollars September 44,00 0.5 ,00 16 2,400 & 16 156,200 $157,400 July September 22 200 2 45600 30,000 75,600 HT Factory Overhead Budget 3Q 2015 August Budgeted production (units) 11,600 19,700 Variable factory overhead rate (dollars) Budgeted variable overhead $ 394003940 Fixed overhead $000 $30,000 Budgeted total overhead 69200 164,400 Part 6 Schedule of Cash Receipts from Sales 3Q 2015 June Sales Less: Ending A/R 362000 " 35 HOO #349600 Cash receipts from: Cash sales 96.600 27400 Collections of prior month's receivables 249.400 3400 Total cash receipts 346 500 4 ,00 w oa September Mond 368000 42,000 249.600 441,600 Part 7 Schedule of Cash Payments for Direct Materials 3Q 2015 August September 24,40 7400 Material purchases (dollars) Cash disbursements for: Current month purchases Prior month purchases Total cash disbursements for direct materials Part 8 Cash Budget 3Q 2015 July August September Beginning cash balance Add: Cash receipts from customers Total cash available Cash disbursements: Payments for raw materials Payments for direct labor Payments for variable overhead Income taxes payable Dividends Equipment purchase Total cash disbursements Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts