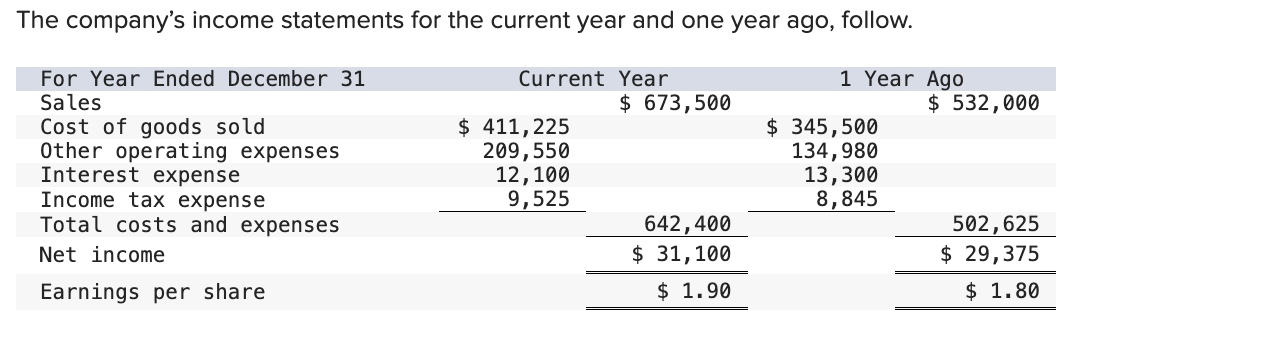

Question: First part: 1 ) Debt and equity ratios. ( 2 - a ) Compute debt - to - equity ratio for the current year and

First part:

Debt and equity ratios.

a Compute debttoequity ratio for the current year and one year ago.

b Based on debttoequity ratio, does the company have more or less debt in the current year versus one year ago?

a Times interest earned.

b Based on times interest earned, is the company more or less risky for creditors in the Current Year versus Year Ago?

Second Part:

a Profit margin ratio.

b Did profit margin improve or worsen in the Current Year versus Year Ago?

Total asset turnover.

a Return on total assets.

b Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus Year Ago?

Third Part:

Return on equity.

Dividend yield.

a Priceearnings ratio on December

b Assuming Simon's competitor has a priceearnings ratio of which company has higher market expectations for future growth?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock