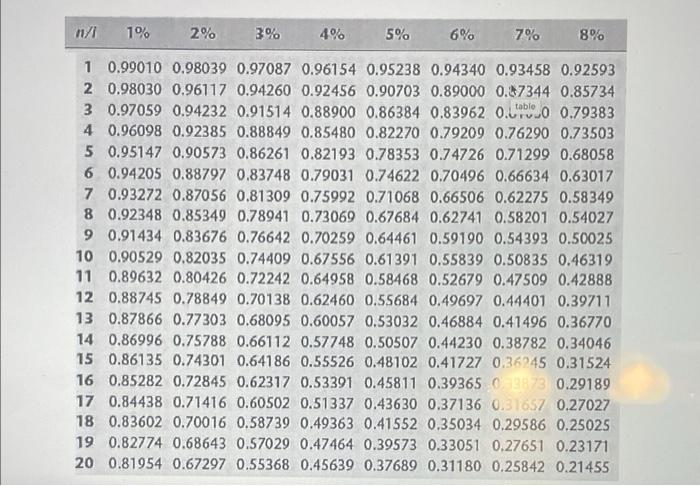

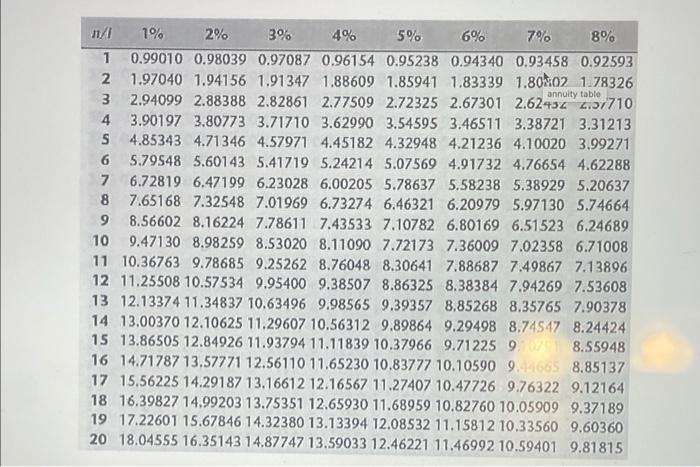

Question: first pic is present value of a single amount sec pic is present value of an annuity begin{tabular}{rccccccccc} n/1 & 1% & 2% & 3%

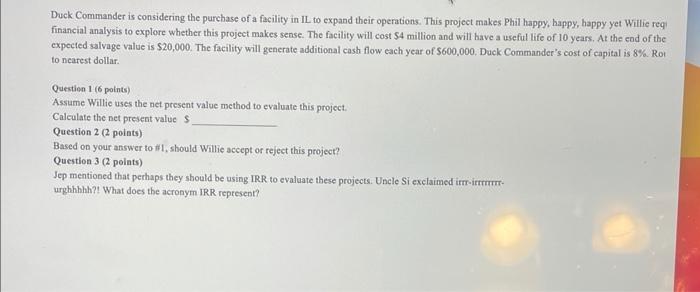

\begin{tabular}{rccccccccc} n/1 & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% \\ \hline 1 & 0.99010 & 0.98039 & 0.97087 & 0.96154 & 0.95238 & 0.94340 & 0.93458 & 0.92593 \\ 2 & 1.97040 & 1.94156 & 1.91347 & 1.88609 & 1.85941 & 1.83339 & 1.80 \& 02 & 1.78326 \\ 3 & 2.94099 & 2.88388 & 2.82861 & 2.77509 & 2.72325 & 2.67301 & 2.62434 & 2.502710 \\ 4 & 3.90197 & 3.80773 & 3.71710 & 3.62990 & 3.54595 & 3.46511 & 3.38721 & 3.31213 \\ 5 & 4.85343 & 4.71346 & 4.57971 & 4.45182 & 4.32948 & 4.21236 & 4.10020 & 3.99271 \\ 6 & 5.79548 & 5.60143 & 5.41719 & 5.24214 & 5.07569 & 4.91732 & 4.76654 & 4.62288 \\ 7 & 6.72819 & 6.47199 & 6.23028 & 6.00205 & 5.78637 & 5.58238 & 5.38929 & 5.20637 \\ 8 & 7.65168 & 7.32548 & 7.01969 & 6.73274 & 6.46321 & 6.20979 & 5.97130 & 5.74664 \\ 9 & 8.56602 & 8.16224 & 7.78611 & 7.43533 & 7.10782 & 6.80169 & 6.51523 & 6.24689 \\ 10 & 9.47130 & 8.98259 & 8.53020 & 8.11090 & 7.72173 & 7.36009 & 7.02358 & 6.71008 \\ 11 & 10.36763 & 9.78685 & 9.25262 & 8.76048 & 8.30641 & 7.88687 & 7.49867 & 7.13896 \\ 12 & 11.25508 & 10.57534 & 9.95400 & 9.38507 & 8.86325 & 8.38384 & 7.94269 & 7.53608 \\ 13 & 12.13374 & 11.34837 & 10.63496 & 9.98565 & 9.39357 & 8.85268 & 8.35765 & 7.90378 \\ 14 & 13.00370 & 12.10625 & 11.29607 & 10.56312 & 9.89864 & 9.29498 & 8.74547 & 8.24424 \\ 15 & 13.86505 & 12.84926 & 11.93794 & 11.11839 & 10.37966 & 9.71225 & 9 & 8.55948 \\ 16 & 14.71787 & 13.57771 & 12.56110 & 11.65230 & 10.83777 & 10.10590 & 9.9605 & 8.85137 \\ 17 & 15.56225 & 14.29187 & 13.16612 & 12.16567 & 11.27407 & 10.47726 & 9.76322 & 9.12164 \\ 18 & 16.39827 & 14.99203 & 13.75351 & 12.65930 & 11.68959 & 10.82760 & 10.05909 & 9.37189 \\ 19 & 17.22601 & 15.67846 & 14.32380 & 13.13394 & 12.08532 & 11.15812 & 10.33560 & 9.60360 \\ 20 & 18.04555 & 16.35143 & 14.87747 & 13.59033 & 12.46221 & 11.46992 & 10.59401 & 9.81815 \end{tabular} Duck Commander is considering the purchase of a facility in IL to expand their operations. This project makes Phil happy, happy, happy yet Willie reqi financial analysis to explore whether this project makes sense. The facility will cost $4 million and will have a useful life of 10 years. At the end of the expected salvage value is $20,000. The facility will gencrate additional cash flow each year of $600,000. Duck Commander's cost of capital is 8%. Rot to nearest dollar. Question 1 ( 6 points) Assume Willie uses the net present value method to evaluate this project. Calculate the net present value $ Question 2 (2 points) Based on your answer to # 1 , should Willie accept of reject this project? Question 3 (2 polnts) Jep mentioned that perhaps they should be using IRR to evaluate these projects. Uncle Si exelaimed itrroitrrrrr- urghhhhh?! What does the acronym IRR reptesent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts