Question: First picture is the problem . 2nd picture where u do work. Part 2 (30 pts) payroll all Villanova Drug Store has four employees who

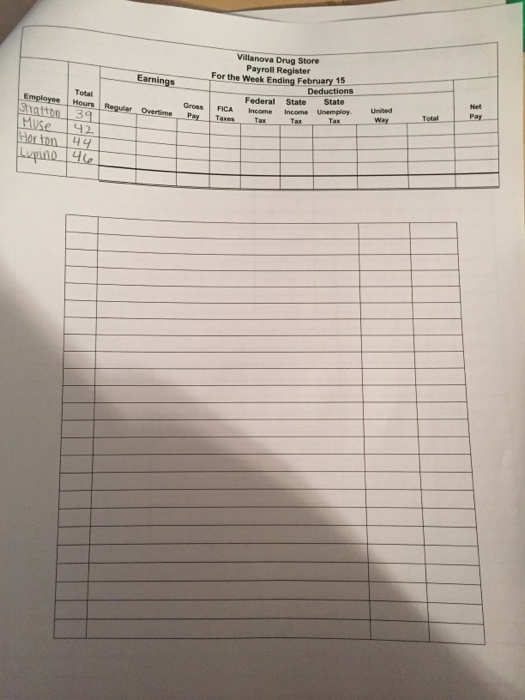

First picture is the problem . 2nd picture where u do work.

First picture is the problem . 2nd picture where u do work.

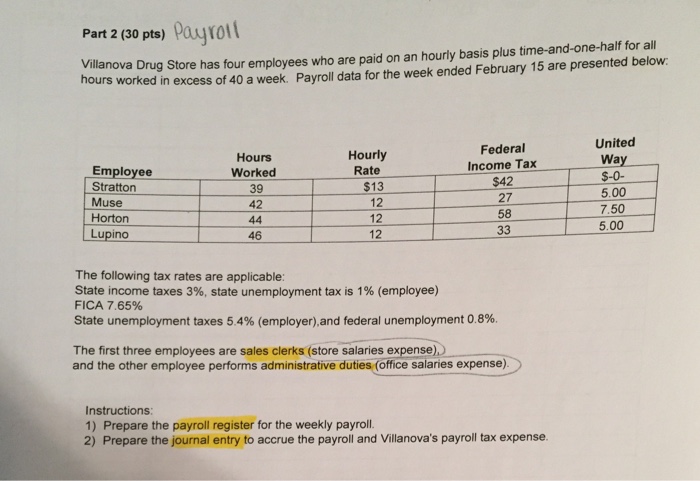

Part 2 (30 pts) payroll all Villanova Drug Store has four employees who are paid on an hourly basis plus time-and-one-half for hours worked in excess of 40 a week. Payroll data for the week ended February 15 below: United Federal Hourly Hours Employee Worked Rate Income Tax Wat Stratton 39 $13 $42 $-0- Muse 12 27 5.00 Horton 42 58 7.50 Lupino 46 12 33 5.00 The following tax rates are applicable: State income taxes 3%, state unemployment tax is 1% (employee) FICA 7.65% State unemployment taxes 5.4% (employer.and federal unemployment 0.8%. The first three employees are sales clerks (store salaries expense and the other employee performs administrative duties (office salaries expense) Instructions 1) Prepare the payroll register for the weekly payroll 2) Prepare the journal entry to accrue the payroll and Villanova's payroll tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts