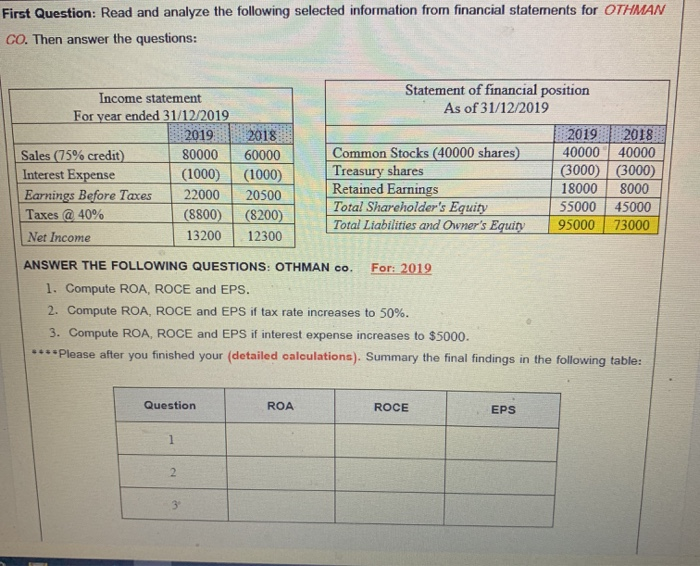

Question: First Question: Read and analyze the following selected information from financial statements for OTHMAN CO. Then answer the questions: Income statement For year ended 31/12/2019

First Question: Read and analyze the following selected information from financial statements for OTHMAN CO. Then answer the questions: Income statement For year ended 31/12/2019 2019 2018 Sales (75% credit) 80000 60000 Interest Expense (1000) (1000) Earnings Before Taces 2200020500 Taxes @ 40% (8800) (8200) Net Income 1320012300 Statement of financial position As of 31/12/2019 2019 Common Stocks (40000 shares) 40000 Treasury shares (3000) Retained Earnings 18000 Total Shareholder's Equity 55000 Total Liabilities and Owner's Equity 95000 2018 40000 (3000) 8000 45000 73000 ANSWER THE FOLLOWING QUESTIONS: OTHMAN CO. For: 2019 1. Compute ROA, ROCE and EPS. 2. Compute ROA, ROCE and EPS if tax rate increases to 50%. 3. Compute ROA, ROCE and EPS if interest expense increases to $5000. ***Please after you finished your detailed calculations). Summary the final findings in the following table: Question ROA ROCE EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts