Question: FIRST SECTION: COMPULSORY QUESTIONS Question One: (14 Points) (B1, C1, and D4) IBM Corporation, a U.S. Company, formed a subsidiary with a new company in

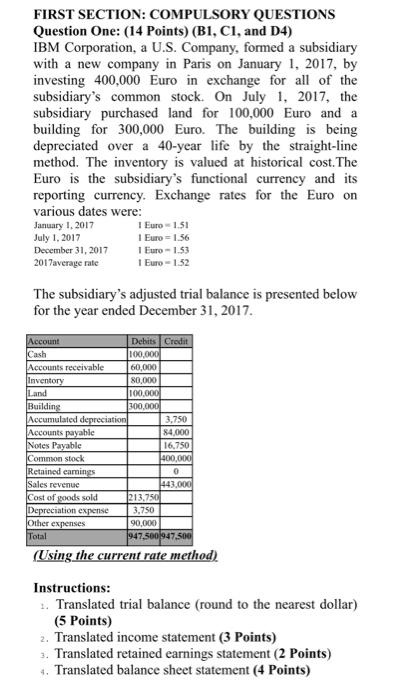

FIRST SECTION: COMPULSORY QUESTIONS Question One: (14 Points) (B1, C1, and D4) IBM Corporation, a U.S. Company, formed a subsidiary with a new company in Paris on January 1,2017, by investing 400,000 Euro in exchange for all of the subsidiary's common stock. On July 1, 2017, the subsidiary purchased land for 100,000 Euro and a building for 300,000 Euro. The building is being depreciated over a 40 -year life by the straight-line method. The inventory is valued at historical cost. The Euro is the subsidiary's functional currency and its reporting currency. Exchange rates for the Euro on various dates were: The subsidiary's adjusted trial balance is presented below for the year ended December 31,2017. (Using the current rate method) Instructions: 1. Translated trial balance (round to the nearest dollar) (5 Points) 2. Translated income statement (3 Points) 3. Translated retained earnings statement (2 Points) 4. Translated balance sheet statement (4 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts