Question: First step is to fill in the chart and then do the adjustmenst for October. If an expert can please do this as soon as

First step is to fill in the chart and then do the adjustmenst for October. If an expert can please do this as soon as possible I would really appreciate it. Please and thank you in advance.

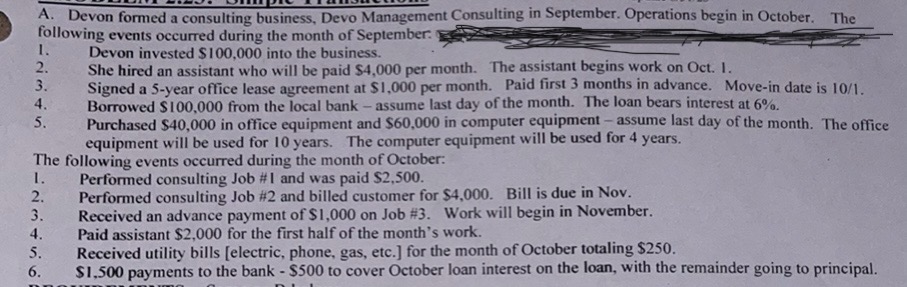

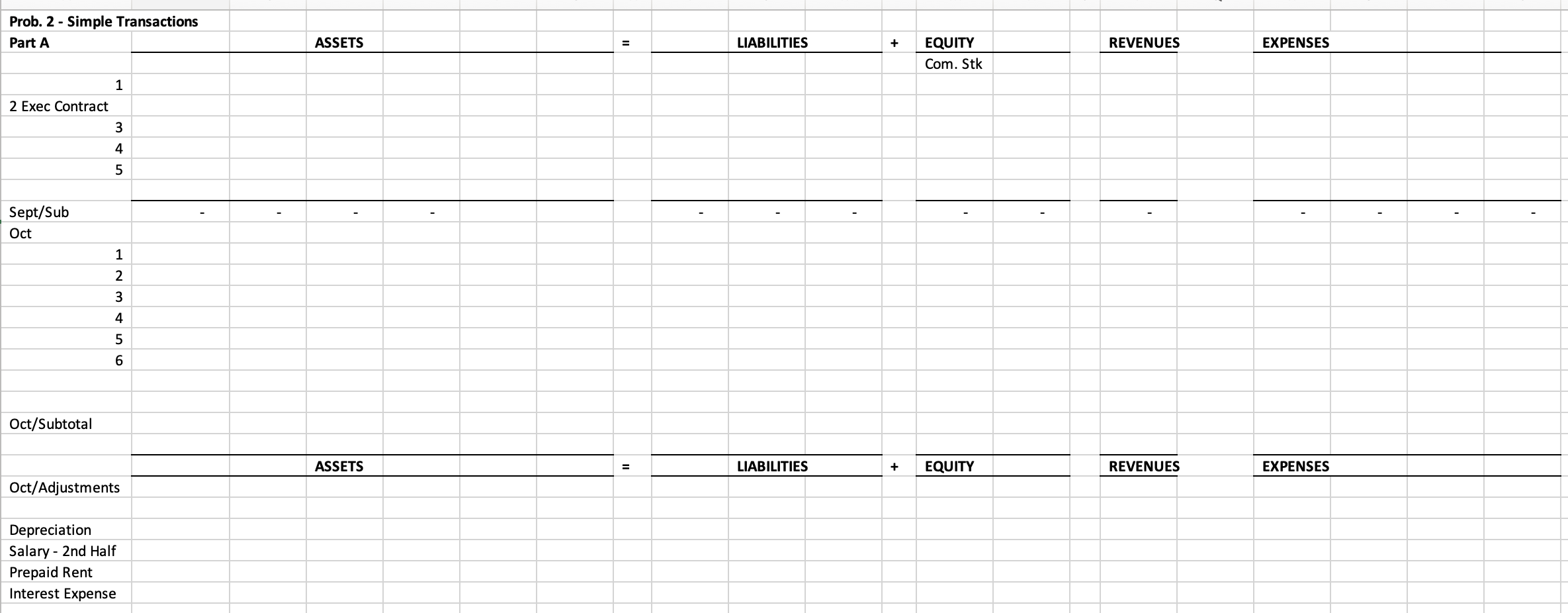

PROBLEM 2.23: Simple Transactions Part A Adjustments: - Depreciation - Salary - 2nd Half - Prepaid rent - Interest Expense - Record October Adjustments for both Part A A. Devon formed a consulting business, Devo Management Consulting in September. Operations begin in October. The following events occurred during the month of September 1. Devon invested $100,000 into the business. 2. She hired an assistant who will be paid $4,000 per month. The assistant begins work on Oct. 1 . 3. Signed a 5-year office lease agreement at $1,000 per month. Paid first 3 months in advance. Move-in date is 10/1. 4. Borrowed $100,000 from the local bank - assume last day of the month. The loan bears interest at 6%. 5. Purchased $40,000 in office equipment and $60,000 in computer equipment - assume last day of the month. The office equipment will be used for 10 years. The computer equipment will be used for 4 years. The following events occurred during the month of October: 1. Performed consulting Job \#I and was paid $2,500. 2. Performed consulting Job #2 and billed customer for $4,000. Bill is due in Nov. 3. Received an advance payment of $1,000 on Job #3. Work will begin in November. 4. Paid assistant $2,000 for the first half of the month's work. 5. Received utility bills [electric, phone, gas, etc.] for the month of October totaling $250. 6. $1,500 payments to the bank $500 to cover October loan interest on the loan, with the remainder going to principal. PROBLEM 2.23: Simple Transactions Part A Adjustments: - Depreciation - Salary - 2nd Half - Prepaid rent - Interest Expense - Record October Adjustments for both Part A A. Devon formed a consulting business, Devo Management Consulting in September. Operations begin in October. The following events occurred during the month of September 1. Devon invested $100,000 into the business. 2. She hired an assistant who will be paid $4,000 per month. The assistant begins work on Oct. 1 . 3. Signed a 5-year office lease agreement at $1,000 per month. Paid first 3 months in advance. Move-in date is 10/1. 4. Borrowed $100,000 from the local bank - assume last day of the month. The loan bears interest at 6%. 5. Purchased $40,000 in office equipment and $60,000 in computer equipment - assume last day of the month. The office equipment will be used for 10 years. The computer equipment will be used for 4 years. The following events occurred during the month of October: 1. Performed consulting Job \#I and was paid $2,500. 2. Performed consulting Job #2 and billed customer for $4,000. Bill is due in Nov. 3. Received an advance payment of $1,000 on Job #3. Work will begin in November. 4. Paid assistant $2,000 for the first half of the month's work. 5. Received utility bills [electric, phone, gas, etc.] for the month of October totaling $250. 6. $1,500 payments to the bank $500 to cover October loan interest on the loan, with the remainder going to principal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts