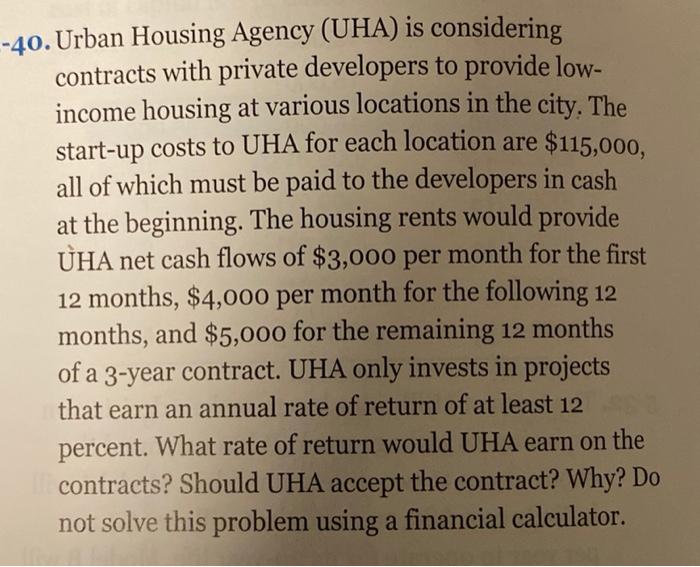

Question: first the problem and then solve the IRR , monthly return, simple annualized return, and compound annual return. -40. Urban Housing Agency (UHA) is considering

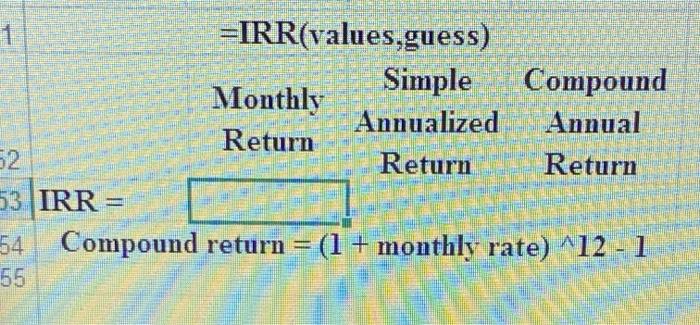

-40. Urban Housing Agency (UHA) is considering contracts with private developers to provide low- income housing at various locations in the city. The start-up costs to UHA for each location are $115,000, all of which must be paid to the developers in cash at the beginning. The housing rents would provide UHA net cash flows of $3,000 per month for the first 12 months, $4,000 per month for the following 12 months, and $5,000 for the remaining 12 months of a 3-year contract. UHA only invests in projects that earn an annual rate of return of at least 12 percent. What rate of return would UHA earn on the contracts? Should UHA accept the contract? Why? Do not solve this problem using a financial calculator. a 1 =IRR(values,guess) Simple Compound Monthly Annualized Annual Return 52 Return Return 53 IRR = 54 Compound return = (1 + monthly rate) ^12 - 1 55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts