Question: First two pitcures are information needed for 21-23 Really only need 22&23 but would like to compare answers on 21 if possible! Use the following

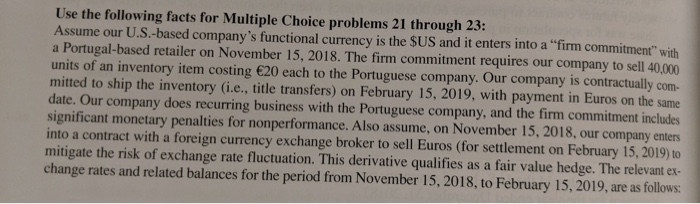

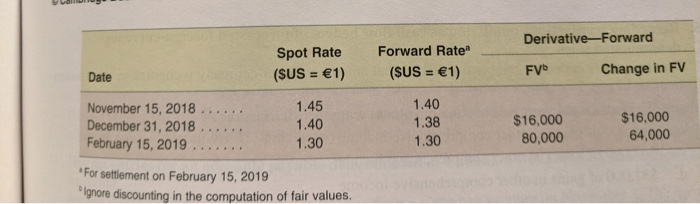

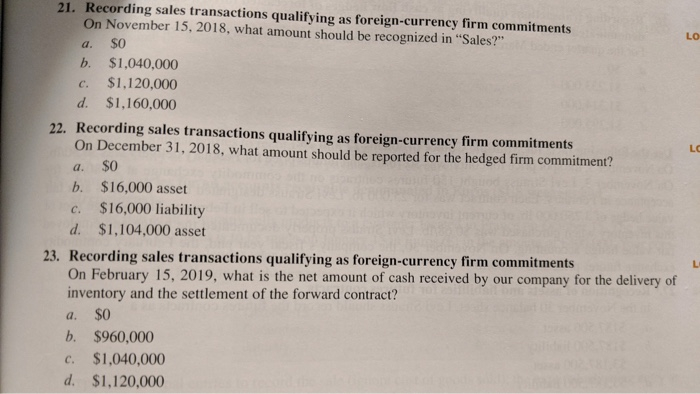

Use the following facts for Multiple Choice problems 21 through 23: Assume our U.S.-based company's functional currency is the $US and it enters into a "firm commitment" with a Portugal-based retailer on November 15, 2018. The firm commitment requires our company to sell 40.000 units of an inventory item costing 20 each to the Portuguese company. Our company is contractually com- mitted to ship the inventory (i.e., title transfers) on February 15, 2019, with payment in Euros on the same date. Our company does recurring business with the Portuguese company, and the firm commitment includes significant monetary penalties for nonperformance. Also assume, on November 15, 2018, our company enters into a contract with a foreign currency exchange broker to sell Euros (for settlement on February 15, 2019) to mitigate the risk of exchange rate fluctuation. This derivative qualifies as a fair value hedge. The relevant ex- change rates and related balances for the period from November 15, 2018, to February 15, 2019, are as follows: Derivative-Forward Spot Rate (SUS = 1) Forward Rate (SUS = 1) Date FVD Change in FV November 15, 2018 ...... December 31, 2018 February 15, 2019 ....... 1.45 1.40 1.30 1.40 1.38 1.30 $16,000 80,000 $16,000 64,000 "For settlement on February 15, 2019 "Ignore discounting in the computation of fair values. LC 21. Recording sales transactions qualifying as foreign-currency firm commitments On November 15, 2018, what amount should be recognized in "Sales?" a. $0 b. $1,040,000 c. $1,120,000 d. $1,160,000 22. Recording sales transactions qualifying as foreign-currency firm commitments On December 31, 2018, what amount should be reported for the hedged firm commitment? a. $0 b. $16,000 asset c. $16,000 liability d. $1,104,000 asset 23. Recording sales transactions qualifying as foreign-currency firm commitments On February 15, 2019, what is the net amount of cash received by our company for the delivery of inventory and the settlement of the forward contract? a. $0 b. $960,000 c. $1,040,000 d. $1,120,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts