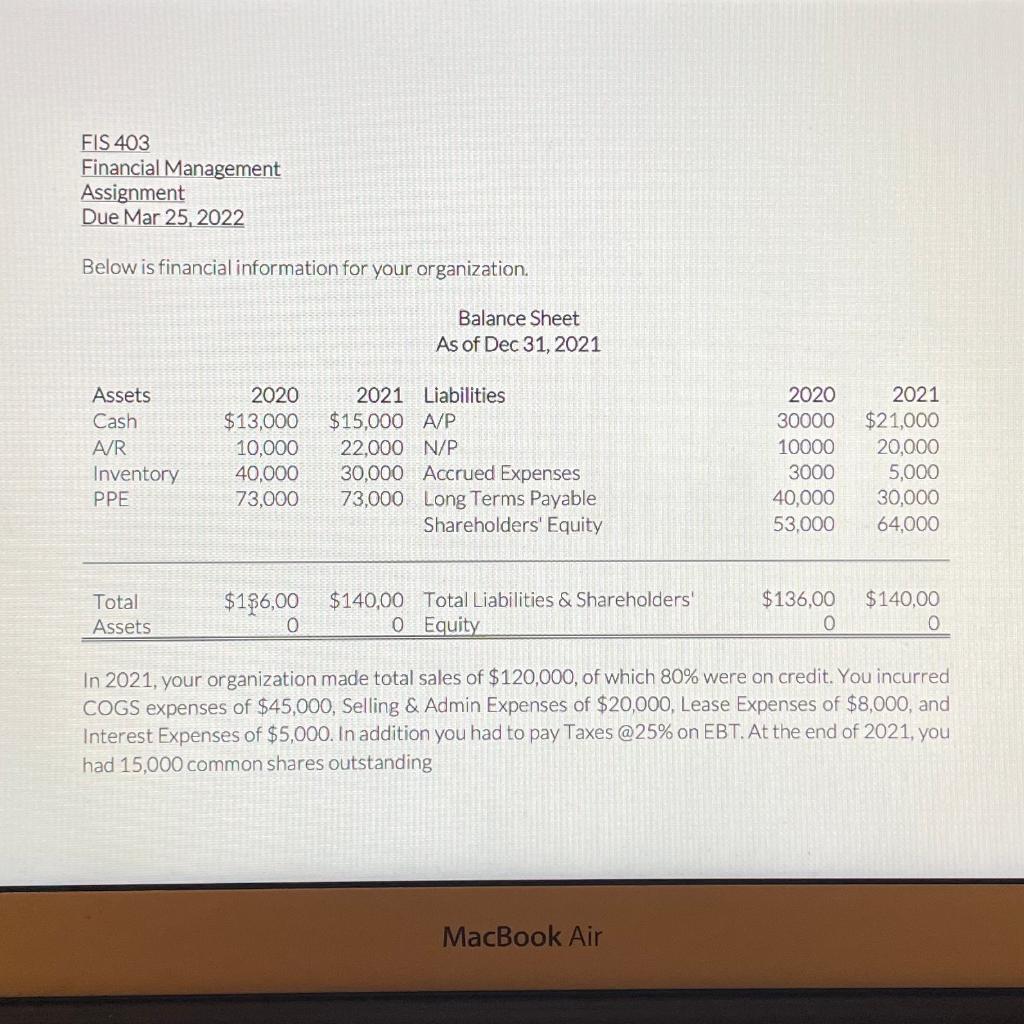

Question: FIS 403 Financial Management Assignment Due Mar 25, 2022 Below is financial information for your organization. Balance Sheet As of Dec 31, 2021 Assets Cash

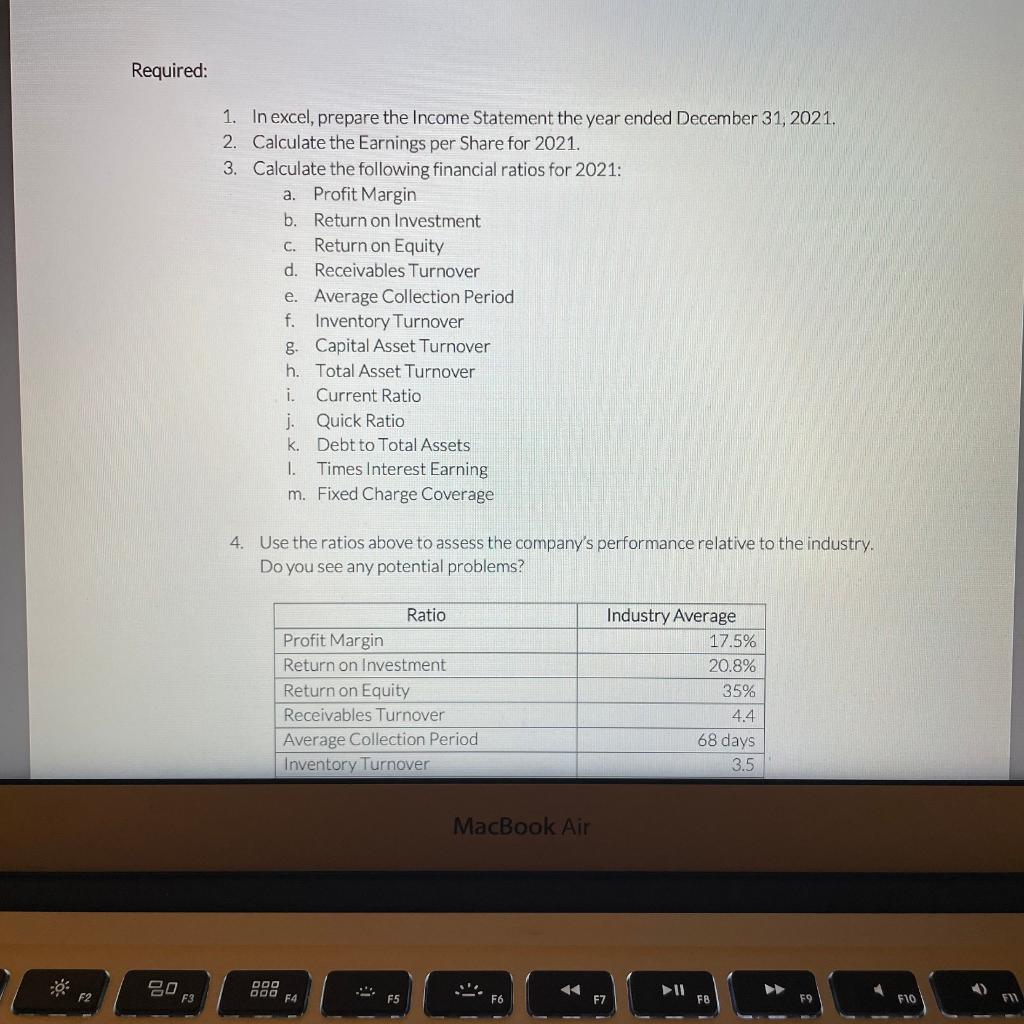

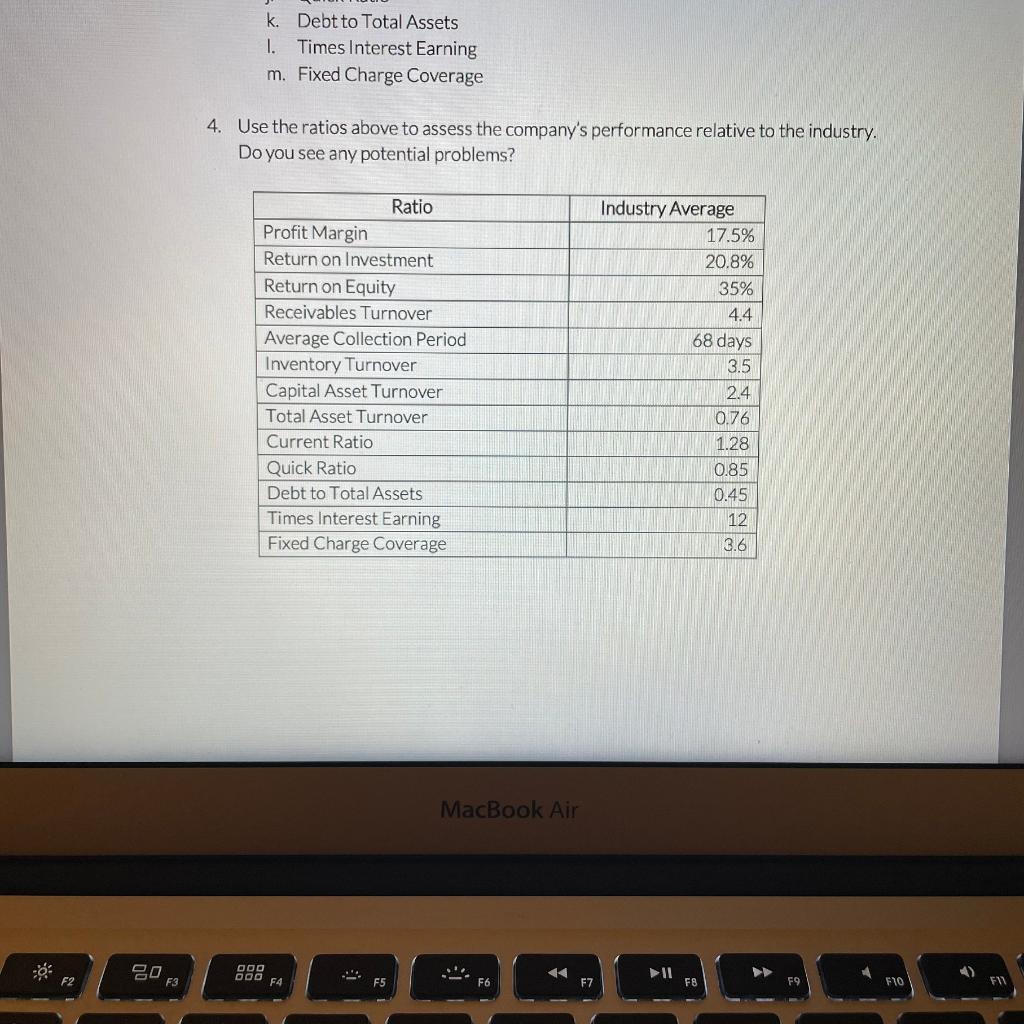

FIS 403 Financial Management Assignment Due Mar 25, 2022 Below is financial information for your organization. Balance Sheet As of Dec 31, 2021 Assets Cash AR Inventory PPE 2020 $13,000 10,000 40,000 73,000 2021 Liabilities $15,000 A/P 22,000 N/P 30,000 Accrued Expenses 73,000 Long Terms Payable Shareholders' Equity 2020 30000 10000 3000 40,000 53,000 2021 $21,000 20,000 5,000 30,000 64,000 Total Assets $1$6,00 $136,00 $140,00 Total Liabilities & Shareholders! 0 Equity $140,00 0 0 In 2021, your organization made total sales of $120,000, of which 80% were on credit. You incurred COGS expenses of $45,000, Selling & Admin Expenses of $20,000, Lease Expenses of $8,000, and Interest Expenses of $5,000. In addition you had to pay Taxes @25% on EBT. At the end of 2021, you had 15,000 common shares outstanding MacBook Air Required: 1. In excel, prepare the Income Statement the year ended December 31, 2021. 2. Calculate the Earnings per Share for 2021. 3. Calculate the following financial ratios for 2021: a. Profit Margin b. Return on Investment C. Return on Equity d. Receivables Turnover e. Average Collection Period f. Inventory Turnover g. Capital Asset Turnover h. Total Asset Turnover i. Current Ratio j. Quick Ratio k. Debt to Total Assets I. Times Interest Earning m. Fixed Charge Coverage 4. Use the ratios above to assess the company's performance relative to the industry. Do you see any potential problems? Ratio Profit Margin Return on Investment Return on Equity Receivables Turnover Average Collection Period Inventory Turnover Industry Average 17.5% 20.8% 35% 4.4 68 days 3.5 MacBook Air 20 Dog 000 F4 ** ** F3 FS F7 FIO k. Debt to Total Assets I. Times Interest Earning m. Fixed Charge Coverage 4. Use the ratios above to assess the company's performance relative to the industry. Do you see any potential problems? Industry Average 17.5% 20.8% 35% 4.4 68 days 3.5 Ratio Profit Margin Return on Investment Return on Equity Receivables Turnover Average Collection Period Inventory Turnover Capital Asset Turnover Total Asset Turnover Current Ratio Quick Ratio Debt to Total Assets Times Interest Earning Fixed Charge Coverage 2.4 0.76 1.28 0.85 0.45 12 3.6 MacBook Air 20 '. IN F3 F4 F5 F6 F8 F9 FO FLY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts