Question: Fiscal Years Ended January 29, 2021 January 31, 2020 Current Earnings Net sales Amount % Sales Amount % Sales February 1, 2019 Amount %

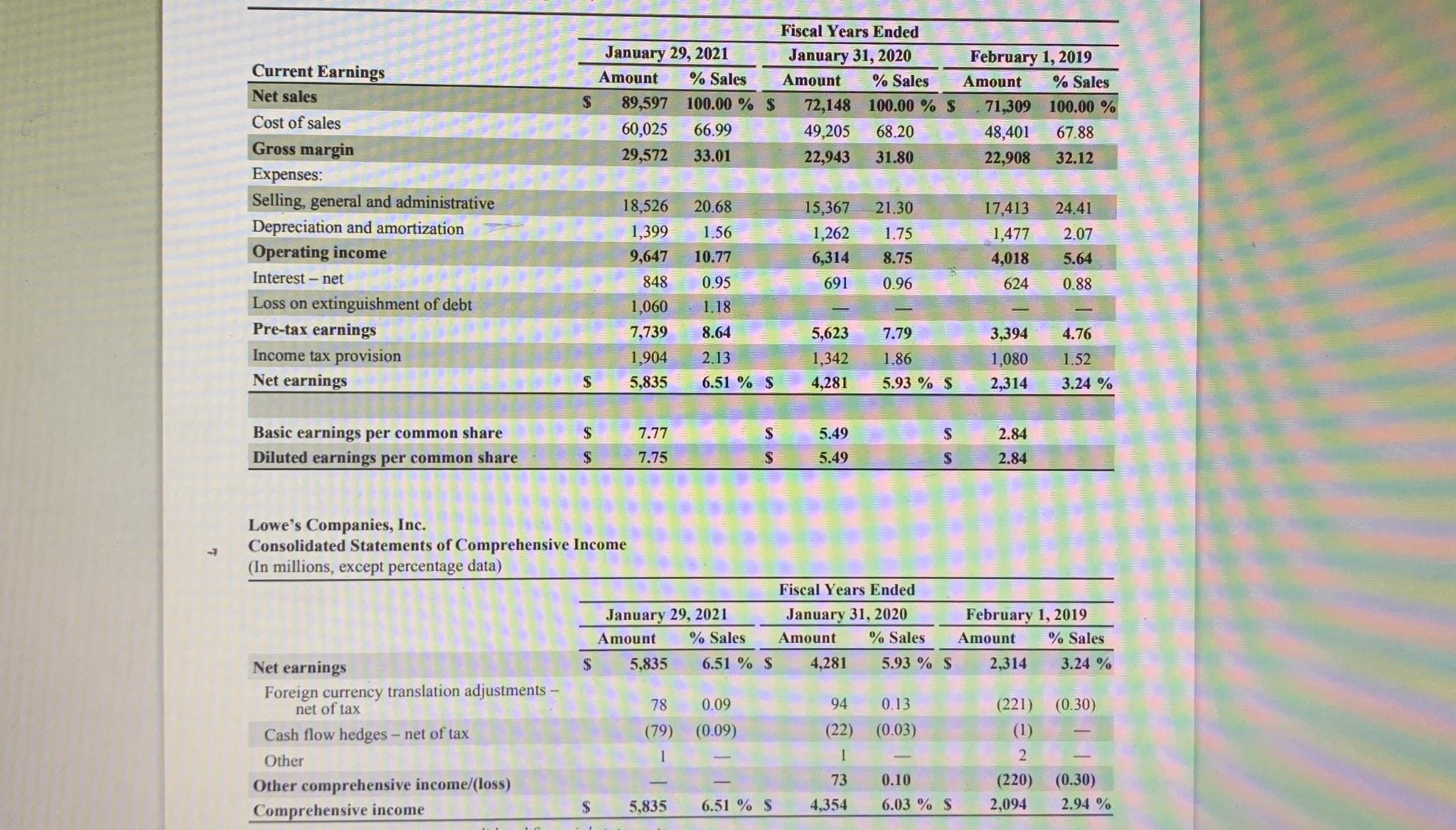

Fiscal Years Ended January 29, 2021 January 31, 2020 Current Earnings Net sales Amount % Sales Amount % Sales February 1, 2019 Amount % Sales $ 89,597 100.00% S 72,148 100.00 % $ 71,309 100.00% Cost of sales 60,025 66.99 49,205 68.20 48,401 67.88 Gross margin 29,572 33.01 22,943 31.80 22,908 32.12 Expenses: Selling, general and administrative 18,526 20.68 15,367 21.30 17,413 24.41 Depreciation and amortization 1,399 1.56 1,262 1.75 1,477 2.07 Operating income 9,647 10.77 6,314 8.75 4,018 5.64 Interest - net 848 0.95 691 0.96 624 0.88 Loss on extinguishment of debt 1,060 1.18 Pre-tax earnings 7,739 8.64 5,623 7.79 3,394 4.76 Income tax provision 1,904 2.13 1,342 1.86 1,080 1.52 Net earnings 5,835 6.51 % $ 4,281 5.93 % $ 2,314 3.24 % Basic earnings per common share $ 7.77 $ 5.49 $ 2.84 Diluted earnings per common share $ 7.75 $ 5.49 $ 2.84 Lowe's Companies, Inc. Consolidated Statements of Comprehensive Income (In millions, except percentage data) Net earnings Foreign currency translation adjustments - net of tax Cash flow hedges - net of tax Other Other comprehensive income/(loss) Comprehensive income January 29, 2021 Fiscal Years Ended January 31, 2020 February 1, 2019 Amount % Sales Amount % Sales Amount % Sales $ 5,835 6.51 % $ 4,281 5.93 % $ 2,314 3.24 % 78 0.09 94 0.13 (221) (0.30) (79) (0.09) (22) (0.03) (1) 1 1 2 73 0.10 (220) (0.30) $ 5,835 6.51 % $ 4,354 6.03 % $ 2,094 2.94 %

Step by Step Solution

There are 3 Steps involved in it

Certainlylets analyze the provided image data on Depreciation and Amortization for Lowes CompaniesInc Depreciation and Amortization for Lowes Companies Inc Fiscal Year Ended Amount Millions of Sales J... View full answer

Get step-by-step solutions from verified subject matter experts